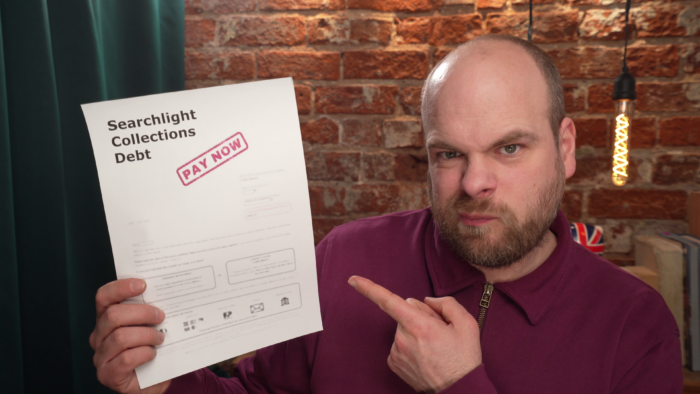

Searchlight Collections Debt – Should I Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Searchlight Collections, and are you puzzled about what to do next? Don’t worry; you are at the right place to find answers.

Each month, over 170,000 people visit our website for advice on matters just like this, so you are not alone. Our goal is to help you understand your options.

This article will help you:

- Understand who Searchlight Collections are.

- Find out what to do if you can’t pay.

- Learn how to question the debt if you are not sure it’s yours.

- Discover if it’s possible to write off some of the debt.

- Know what might happen if Searchlight Collections take you to court.

We know it can be worrying to get a letter from a debt collector; some of us have been in your shoes. That’s why we’ve prepared this guide to help you learn more about your options.

I’m not sure I owe this amount, what can I do?

If you are not sure that the debt or part of the debt is yours, for instance, if you had moved during the period that the bills cover then you will need to prove this to Searchlight Collections and they will then investigate it with Bristol Water PLC.

Depending on the outcome your bill will be adjusted and you will need to come to an arrangement for the remaining debt.

» TAKE ACTION NOW: Fill out the short debt form

What if I cannot pay?

If you cannot pay in full then you will need to come to a payment arrangement with Searchlight Collections.

They will send you an income and expenditure form to fill out and see what you can afford to pay.

You should seek advice from organisations such as StepChange, Citizens Advice Bureau, Financial Wellness Group, or Money Advice Service.

These charities will be able to help you work out your budget and suggest any additional help you may be able to get.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can my water get cut off?

No, if you are a domestic customer, then by law, your water cannot be disconnected or restricted.

Will they come to my home?

If you have ignored letters and phone calls from Searchlight Collections then they will have no alternative but to send an agent to your home.

Should this occur then you do not have to let them in, you do not even have to open the door if you don’t want to.

They will attempt to either collect the debt in full or come to an installment arrangement with you, if you offer a payment plan they can decide not to accept it.

Collection agencies are registered with the Financial Conduct Authority and are bound to a code of conduct.

For example, they cannot:

- Use aggressive or harassing tactics, such as constant phone calls, threats, or abusive language.

- Misrepresent themselves or the debt, making false claims about the amount owed or the consequences of non-payment.

- Use unfair methods to collect debt, such as seizing assets without proper legal procedures or pressuring debtors to pay more than they can reasonably afford.

- Contact you at unreasonable hours, such as late at night or early in the morning.

- Charge fees that are not clearly outlined in the original agreement or that are disproportionate to the debt.

- Contact third parties (like family members or employers) to disclose your debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can they take me to court?

If they are unable to come to an arrangement with you, or if you ignore the letters and home visit then they may commence court action which could result in a CCJ registered against you.

This will then go on your credit file where it will remain for 6 years and will affect your ability to get credit.

What if I am taken to court but still can’t pay?

If you are taken to court and still do not pay or keep up to an arranged payment plan then other action could be taken.

- An attachment of earnings could be sought, if this happens then the money is deducted from your earnings to pay your debt. This would mean your employer knows about your debt.

- Money can be deducted from any benefits that you receive and paid towards your debt.

- Bailiffs could be instructed to go to your home and seize your goods to pay off your debt.

- You could be required to appear in court to complete a financial statement.

- You could be made bankrupt.

Can I get any help to pay my water bill?

There are schemes available that could help you with your water bill.

- Low-income pensioner discount If you are in receipt of a pension credit or a state pension that is your only income then you will be entitled to a 20% discount.

- Watersure Plus Scheme If you are in receipt of certain benefits and meet other criteria then you can join the bill cap scheme which could lower your bills.

- Reduced Bill-Assist This is for people that are facing extreme hardship and have already sought advice from StepChange, Citizens Advice Bureau, Financial Wellness Group or Money Advice Service.

- Water Direct Scheme. If you are on certain benefits you can apply to have DWP deduct a certain amount from your benefit and pay that directly to the water company.

Searchlight Collections Contact Details

As Searchlight Collections are owned by Bristol Wessex Billing Services LTD You can contact them directly.

| [email protected] | |

| Telephone | 0345 600 3600 |