What Can Debt Collectors Do UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

In the UK, debt collectors have the right to chase you for the money you owe. If you’ve received a letter from a debt collector, you might be feeling concerned and unsure about what to do next.

Don’t worry – we’re here to help. Each month, over 170,000 people visit our website for advice on dealing with debt.

This article will explain:

- What UK debt collectors can do under the 2023 laws.

- The process of debt collection.

- The impact of debt on your credit score.

- Your rights when dealing with debt collectors.

We understand how stressful it can be to deal with debt collectors, especially considering that nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. Some of us have been in your shoes. With our expertise, we’ll help you figure things out.

Let’s get started!

What are Debt Collectors and Creditors Allowed to Do?

Remember, all debt collection agencies must respect UK debt recovery laws.

In short, there are creditors rights UK too. Here’s a table summarizing the key aspects.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

They can Chase You Regarding Your Debts

They Can Show Up at Your Home

But they should let you know when they are coming which is good practice.

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

» TAKE ACTION NOW: Fill out the short debt form

They Can Add Interest and/or Additional Charges on Your Debt

If the debt collection agency has purchased the debt, they can add fees and interest to the debt if a clause is included in the purchase note from the original creditor.

Research suggests that the average unsecured debt has increased by 25% year-on-year, rising to £13,9412, and a big chunk of that number comes from interest.

They must respect your request.

They Can Take Money from Your Accounts

Your Creditors can Apply for a Court Order or a County Court Judgement (CCJ)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Your Creditors Can Issue a Default Notice

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.

What are Debt Collectors UK and Creditors Not Allowed to Do?

They are Not Allowed to Harass You

There are UK debt recovery laws that debt collectors must follow.

They are Not Allowed to Contact You at Your Workplace

They Cannot Threaten You with Legal Powers That They Don’t Have

This type of action is unlawful and deemed a criminal act.

They Cannot Breach Data Protection Laws

They are Not Allowed to Increase Interest Because You Missed Payments

They Cannot Lie to You

If the debt collection agency’s response is unsatisfactory, you can report them to the Financial Conduct Authority and the Financial Ombudsman Service complaints.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Should I Do if a Debt Collector Violates FCA Guidelines?

There are many debt collection agencies in the UK and not all of them behave according to the law.

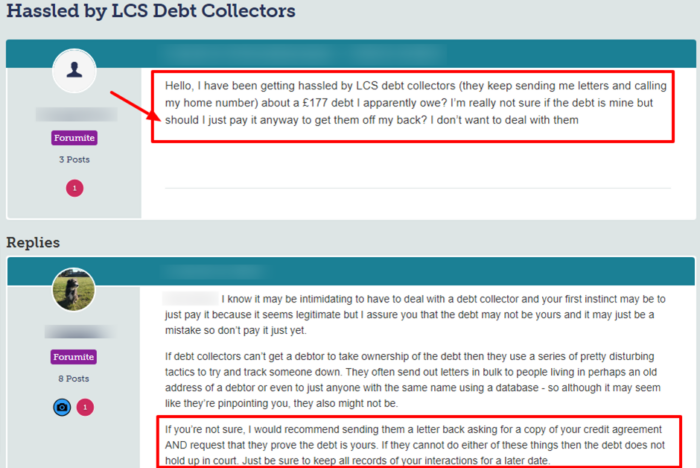

See what one person posted on a popular forum and the reply that was posted.

Source: Moneysavingexpert

The impact of debt on your credit score

If you get a County Court Judgement (CCJ) on your credit file, it will make borrowing money harder for six years.

In short, you won’t easily obtain a credit card, bank loan or a mortgage until the CCJ expires.

Your Creditors can Issue a Statutory Demand

What if I can’t pay my debts?

If you owe a lot of money to several creditors and struggling to keep on top of payments, consider other debt solutions which I’ve listed below.

Debt Management Plan (DMP)

This is an agreement you enter into with your creditors. A debt management plan (DMP) allows you to pay smaller amounts every month.

You can set a DMP up directly with creditors or you could opt to go through a leading UK charity or a debt management company.

Individual Voluntary Arrangement (IVA)

An IVA is an arrangement you make with creditors to pay off part of your debts or all of them.

You’d have to make the payment through an insolvency practitioner who then shares the money between the creditors you owe money to.

Administration Order

If you have a County Court claim or a High Court Judgement levied against you, an administration order could be the better option.

You make monthly payments directly to the court which is then divided between creditors.

However, you must meet specific criteria to be eligible.

Debt Relief Order (DRO)

If the money you owe is less than £30,000, you could consider a debt relief order (DRO).

However, there are specific criteria attached to DROs which shouldn’t be overlooked.

Bankruptcy Order

If you cannot pay off your debts, a bankruptcy order could be the only option open to you.

You’d need to make an application which an adjudicator assesses. They decide whether or not you can go down this route to be debt-free.

For 12 months of bankruptcy, any non-essential assets you own could be used to pay off creditors.

Declaring bankruptcy no longer has a stigma. But you should be aware that it will have a long-term impact on your credit rating.

As such, it’s a debt solution that needs careful consideration and expert advice should be sought first.