How to Get a Second Mortgage During or After Divorce & Separation

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

In this article, we’ll explain:

- What happens to your home equity after a divorce/formal separation.

- How to transfer partial ownership of your property.

- How to buy out your ex-partner.

- Whether you can get a second mortgage after your divorce.

Did you know that in May 2022, over 2,800 homeowners took out second charge mortgages, marking a significant 43% increase from May 2021?1

Making such a decision is crucial, and we’re here to provide you with the necessary information. Let’s dive in!

What happens to home equity after a divorce?

A joint mortgage means that both partners have an equal share in a property. Both you and your partner have a 50% share in the property you own jointly.

As such, even after a divorce, mortgage repayments fall to both parties even if one moves out. The fact you divorced doesn’t have a bearing on mortgage liability in the eyes of the lender.

So, what are your options?

You could:

- Transfer ownership into your sole name, or

- Buy out your ex-partner

How do I transfer part ownership of a property?

One option is to transfer part ownership of the property into your name. It often happens when couples divorce or separate.

You should contact a licensed conveyancer who could help you complete all the necessary paperwork associated with the transfer process.

They can help you to fill out the ‘Transfer of Whole of Registered Title’ form which must be sent to HM Land Registry together with:

- The transfer fee

- Verified identity forms

If there’s an outstanding mortgage on the property, it would need to be transferred into your sole name too.

Moreover, you must show the lender that you can afford the mortgage repayments for them to agree to the transfer.

Plus, you should speak to a solicitor who has the necessary experience to offer expert legal advice.

How to transfer a property into your name

I’ve included a list of forms that need to be completed when you transfer a property into your sole name in the table below.

| AP1 form | https://www.gov.uk/government/publications/change-the-register-ap1 |

| ID1 identity form | https://www.gov.uk/government/publications/verify-identity-citizen-id1 |

| Transfer deed (TR1) form | https://www.gov.uk/government/publications/registered-titles-whole-transfer-tr1 |

You also need to make sure you transfer all or part of the property in question and have enough money to pay the required fee.

Once completed, all forms and the fee must be sent to the Land Registry Office after you sign the transfer deed form.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Buy Out Your Ex-Partner

You could opt to buy out your ex-partner and various options could facilitate this route which I’ve outlined below.

Reach an amicable settlement with your ex-partner

This could work if your property is mortgage-free and you want to stay in the home.

It would involve paying your ex-partner a lump sum which would be based on the equity they have in the property.

Once your ex-partner receives their payout, their names can be removed from the title deeds

Mortgage the property in your name only

In this instance, I suggest you contact your lender and discuss whether or not they would agree to remortgaging your property to buy out your partner.

You must prove to the lender you can afford the mortgage repayments on your own. As such, it could involve the lender doing an income and expenditure test.

If all goes well and the lender agrees to the remortgage, once finalised your ex-partner’s name can be removed from the title deed.

Apply for a guarantor mortgage

One option if you can’t meet the mortgage repayments on your own is to seek a guarantor mortgage.

You may find that your mortgage provider might agree if you can provide a guarantor who would agree to make the payments if you can’t.

That said, this type of mortgage is not so easily come by which is why I suggest you discuss your situation with a broker.

Plus, you may want to consider a joint borrower sole proprietor arrangement which could be a suitable alternative.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Getting a second mortgage after divorce

Getting a second mortgage after a divorce when you are both on a joint mortgage can be challenging.

But it’s not impossible.

Some mortgage providers and lenders won’t entertain an application for a second mortgage when you are already committed to one.

If this happens, you should discuss things with a mortgage broker who may be able to find a suitable lender based on your circumstances.

However, a second mortgage is separate from an original mortgage on a property. As such, you would be liable for two different monthly mortgage repayments.

It could also mean you’d have different lenders for each mortgage even if the second loan is for a current property.

Plus, it’s worth bearing in mind that many lenders see second mortgages as high risk.

So the long and short of their approach is to charge higher interest rates.

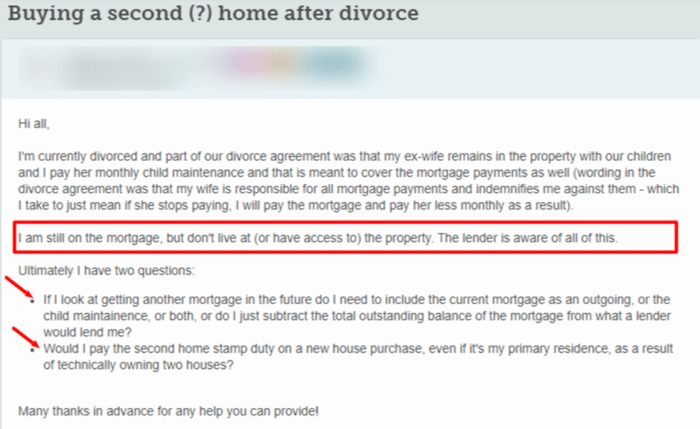

A lot of people seek advice about getting a second mortgage after a divorce as demonstrated by this message.

Source: Moneysavingexpert

Can I get a second mortgage during divorce?

You could apply for a second mortgage during a divorce but it’s wiser to wait until a final settlement is reached.

If you jump the gun, your ex-partner could claim a share in the value of a new property as part of their final settlement.

In short, applying and taking out a second mortgage during a divorce may not be such a good move.

What happens to a joint mortgage after separation?

A divorce or separation can be stressful and could lead to missed mortgage payments.

However, you must keep up with your mortgage repayments even during this difficult time.

If you fall behind with mortgage repayments, it could impact the credit scores of both parties because you’d still be financially linked.

If you feel you may not be in a position to keep up with your mortgage payments during a divorce or separation, I suggest you contact your lender as soon as possible.

Second charge mortgage for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What is a clean break order?

You can apply for a clean break order at any point in time once a Condition Order for divorce is issued.

That said, you must have agreed how matrimonial assets are divided.

Plus the court must approve the terms of a financial separation before issuing a clean break order.

Getting a 2nd mortgage after divorce

You could apply for a second mortgage after a divorce and once a final settlement is reached and a ‘clean break’ from an ex-partner is reached.

That way, you have peace of mind that your ex-partner can’t lay claim to anything you now own.

It’s always a good idea to seek legal advice when you divorce or separate from a partner.

An adviser has the necessary experience in handling confusing paperwork that needs to be completed when dissolving a partnership or marriage.

As such, both parties should seek financial and tax advice from an independent adviser to achieve the best outcome. More especially when it comes to dividing home equity and other assets during a divorce or separation.