Sky Bill Debt – Can You Get it Wiped?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Has a surprise letter from a debt collector left you puzzled and worried? Maybe you’re wondering about your Sky bill debt and if it can be wiped?

We’re here to help. Every month, over 170,000 people visit our site for guidance on debt matters.

In this easy-to-understand guide, we’ll explore:

- Unravelling the mystery of Sky bill debt.

- How Sky handles bills and debt.

- The impact of not paying your Sky bill.

- Options if you can’t afford Sky but are still in a contract.

- How to manage your Sky account better to avoid debt .

We know it’s tough to face debt issues, as research shows 64% of UK adults find interactions with current debt collectors stressful1. Many of us have been there. We also know it’s possible to come out the other side.

We’re going to share some handy tips and tricks that might help you clear your Sky Bill debt.

How Sky manages billing & debt

Implications of a restricted Sky account

The average unsecured debt amount has increased by 27% year-on-year (to £16,174)2, and a large chunk of that debt is pursued by third-party debt collectors.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Consequences of not paying Sky bill?

Sky bill non-payment consequences and ignoring payment reminders and demands can earn you a CCJ.

CCJs remain on your credit report for six years. You’d have trouble getting credit during that time!

However, it’s a long process to getting to the court stage and receiving a County Court Judgement for non-payment of a Sky bill.

What are my options if I can’t afford Sky but I’m still in contract?

I always recommend responding to debt collectors – even just to question the debt’s validity or to negotiate. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Benefits of Proactively Managing Your Sky Account

Sky debt – write off

In short, I find that it might be better to check the Sky policy first.

New direct debit to sky clear outstanding balance

Navigating a Sky Price Hike

Sky must give you 30 days warning before they implement a price hike. You have the right to cancel your Sky contract in those 30 days and you shouldn’t have to pay a fee.

» TAKE ACTION NOW: Fill out the short debt form

Dealing with Sky Payment Errors

Renegotiating Your Sky Plan: An Alternative Solution

Consider renegotiating your current plan if you can’t afford to pay your current one. Sky should consider your circumstances and offer you one of their more affordable Sky subscriptions.

However, you’d need to work out a repayment plan for any money you owe Sky first. Again, Sky customer service should offer advice on how to settle what you owe. The key to a successful outcome is to stay in touch with Sky support before they pass your details to a debt collector.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

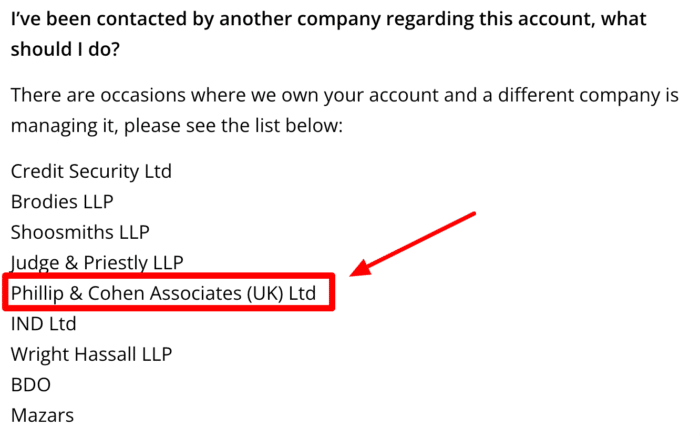

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Tips to Avoid Falling into Sky Debt

Contact Sky support if you’re struggling with your finances and struggling to settle your monthly bill. They will take into account your circumstances and should attempt to set up an affordable way to get your account back on track. I have found it’s one of the best ways of staying debt-free with Sky.