The Cheapest Car Insurance with SP30 Conviction?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about the cost of car insurance after an SP30 conviction? This is a fear shared by many drivers. In fact, over 9,300 people seek advice from our website each month, all looking for guidance on this issue. Finding cheap car insurance after a driving conviction can be tough, but it’s not an impossible task.

In this article, we’ll offer clear advice and useful information on:

- Understanding what an SP30 conviction is.

- How it can affect your car insurance.

- The penalty for an SP30 conviction.

- Searching for affordable SP30 car insurance.

- The importance of informing your insurance company about your conviction.

We understand your worries about affording car insurance or even the fear of not being able to insure your car at all. But remember, we’re here to help. Our team is dedicated to helping you navigate this tricky journey.

Let’s dive in.

What is an SP conviction?

This is a group of five speeding convictions issued for exceeding the legal speed limit in various vehicles and situations.

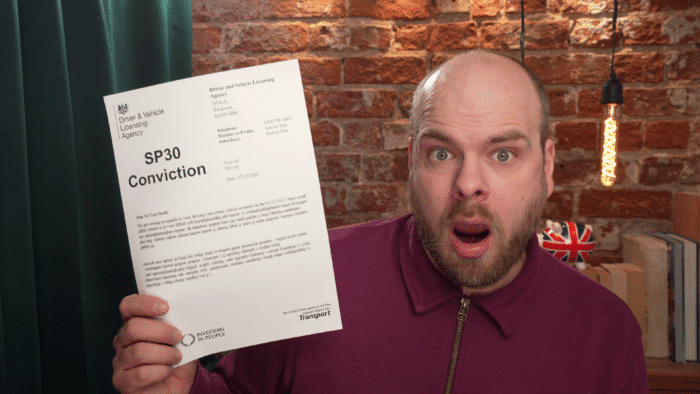

What is an SP30 conviction?

This code with its accompanying points is given to drivers who have been accused of speeding on a public road.

What is the penalty for an SP30 conviction?

The repercussions of an SP30 conviction are summarised in the table below:

| Conviction code | Nature of offence | Penalty points | Fine amount |

| SP30 | “Exceeding Statutory Speed Limit on Public Road” | Between 3 and 6 penalty points depending on the details of the Speeding Offence | Varying fines based on the details of the offence and a means test |

The repercussions are greater if convictions are combined with others, like drunk driving for example.

Will SP30 increase insurance?

Having an SP30 conviction will likely increase your premium payments to future car insurance companies. The more points you have, the more you can expect to pay.

As you can see, the points given range from 3 to 5 points. Some say that this could increase the premium by 5% to 25%. This is without taking all the other risk factors into account. The individuality of each premium makes it hard to guess what the exact figure will be. Until you apply that is.

You can apply without accepting the offer of course. This might be an opportunity to start gathering data on what the average premiums for your combination of risks are exactly.

Other risks might be the number of times you have claimed in the past. Even your age and where you live can have an impact. Both positive and negative, depending on the particulars.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How long does an SP30 stay on Insurance?

Insurance companies will need to be informed about this penalty for 4 years from the date the incident in question occurred.

Consider searching for SP30 insurance

Obtaining the cheapest deal available to you will likely come from insurance designed for disqualified drivers. These are also known as High-risk car insurance companies.

They charge more because they think people with these convictions are more likely to cause an accident.

And of course, this will mean the insurers will need to pay out more, so will seek compensation upfront.

They use controversial economic models that while accurate, are discriminatory – as some critics suggest. Increasing your premium based on where you live is out of your control, and many believe that it is unfair.

That is an argument for another time. The point is that if you have a conviction like drunk driving, even these specialist insurers will look at the above factor more in their decision-making process.

Just being aware of this allows you more choice around what you can, and can’t pursue to decrease your outgoings here.

» TAKE ACTION NOW: Find the best insurance for drivers with points

What is the cheapest car insurance with an SP30 conviction?

If there was one insurance company that offered everyone the cheapest deal, this would be a much shorter and more concise article. The problem is that there is no single cheapest car insurance provider.

The process involved is to search for:

- Who will and will not make an offer

- Out of the accepted applications, what are the average prices available?

- Out of the lowest-cost SP30 car insurers, which offers the most benefits for the price?

- Out of the lowest cost SP30 car insurers, which offers the least benefits for the price?

- Do any of the mid-range and higher-price offers have benefits that make them worthwhile?

If cost is the most important thing here, looking at the potential hidden costs in the terms and conditions might change your mind. Perhaps there are hidden penalties behind those initially attractive offers.

But then again, maybe not. Only research and comparing the winning results can tell you. For your personal situation.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

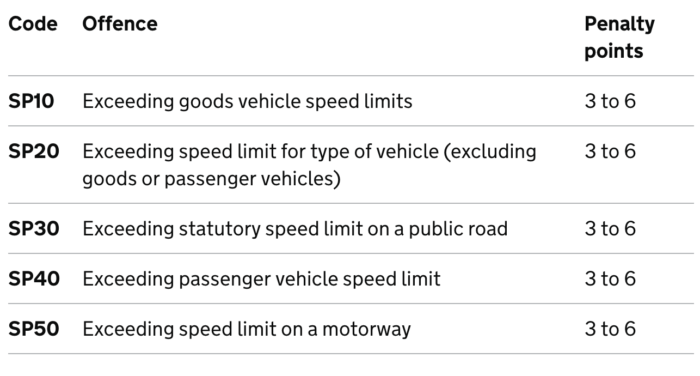

What is the sentence for speeding in the UK?

There are five codes that apply to speeding in various scenarios? These are the “SP” category of speeding offences. You may receive 3 to 6 penalty points. It must stay on record for 4 years from the date the conviction occurred.

Image src: https://www.gov.uk/penalty-points-endorsements/endorsement-codes-and-penalty-points

The image above taken from the gov.uk site shows the variations within this category of speeding offences/

There appear to be three broad differences between them:

- The type of vehicle. Cars are allowed to drive faster on certain roads than small goods vehicles.

- The type or road on which the incident took place.

- The people inside the vehicle and their location

All of them share one thing in common. That is the penalty point range. 6 points is an instant ban for drivers who have driven for less than two years. For a longer-term driver, this is likely to increase their insurance premium in many cases.

This issue that might have occurred on public roads might well have led to increased premium offers. Researching and comparing your personalised offers from a range of sources is one way to attempt to cut costs.