The Cheapest Car Insurance with SP40 Conviction?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about finding affordable car insurance after an SP40 conviction? This worry is quite common. In fact, more than 9,300 people come to our website each month for advice on this very issue. It may seem hard to find cheap car insurance after a driving conviction, but it’s certainly not impossible.

In this article, we aim to give you clear and useful information on:

- Understanding what an SP40 offence is.

- The difference between SP30 and SP40.

- The impact of an SP40 conviction on your car insurance.

- Finding affordable car insurance even with an SP40 conviction.

- The importance of declaring your SP40 conviction to your insurance company.

We know that the thought of not being able to afford car insurance can be scary. The idea of not being able to get insurance at all is even scarier. But don’t worry; we’re here to help you through this tough situation and understand your concerns.

Let’s get started.

What is an SP40 offence?

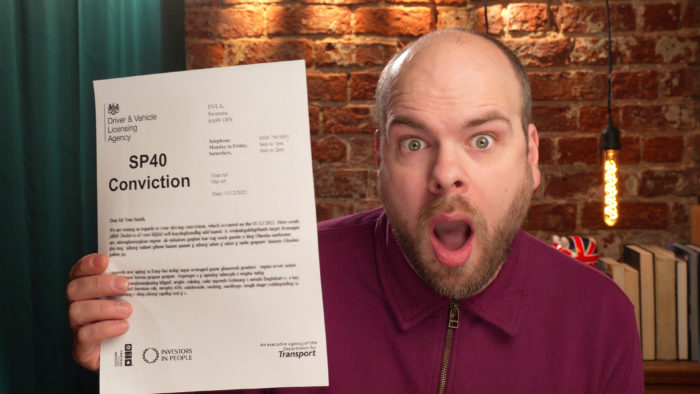

SP driving convictions relate to speeding offences and an SP40 offence is when a driver exceeds the speed limit in a passenger vehicle, such as driving above the speed limit in a car.

What is the penalty for an SP40 conviction?

The penalty for an SP40 conviction is summarised in the table below.

| Conviction code | Offence | Number of penalty points | Fine amount |

| SP40 | Exceeding passenger vehicle speed limit | Between three and six penalty points | Means-tested but up to £1,000 |

How long does SP40 stay on licence?

The points will remain on your licence for four years from the date of the offence – not the date of conviction. If the penalty points take your total points to 12 or more within the last three years, you will be banned from driving for at least six months.

How much does an SP40 affect insurance?

An SP40 driving conviction can affect insurance in two ways:

- It can make some companies not want to insure you, meaning you have fewer options. Although this would be quite rare for an SP40 conviction on its own.

- It can cause insurance companies to offer insurance at a higher cost, so your insurance premiums will be higher than they otherwise would be without the conviction

How big of an impact the conviction will have on the cost of your insurance depends on the type of offence and how many penalty points you receive.

Admiral states that the increase to your car insurance premiums will be 23% or 46% for an SP conviction on average, depending on whether you get three or six points, respectively.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do you have to declare SP40 to insurance?

Yes, you must declare an SP40 driving conviction when you renew or apply for car insurance if the offence occurred within the last five years.

This is because insurance companies use this information to determine how big of a risk it is to insure you.

People who have been convicted of a driving offence are considered more likely to be involved in other road incidents and therefore more likely to make claims on insurance. Consequently, it costs more to get insured with convictions.

What happens if you hide convictions from insurance?

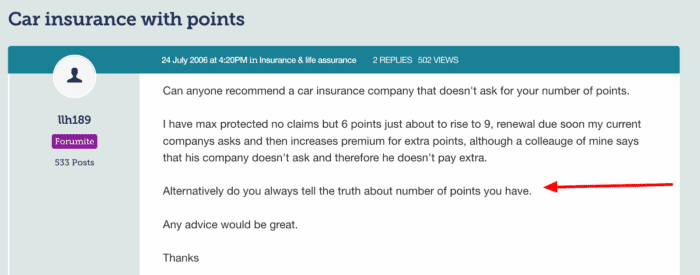

When you have convictions that you know will bump up the price of your insurance, it’s common to want to find insurance companies that don’t ask about convictions.

This is one of the most common insurance-related queries asked on forums. Just like this example shows:

Source: https://forums.moneysavingexpert.com/discussion/232675/car-insurance-with-points

Unfortunately, it’s highly unlikely that an insurance provider will not ask about criminal convictions or driving convictions. They use this information to assess your risk, somewhat like a loan company uses your credit score to assess your risk of not repaying.

The forum user above asks if they can just not tell the truth. This is not recommended. By not disclosing convictions when you should, it is likely to invalidate your insurance for all named drivers. This could leave you with a big bill should you need to make a claim.

How to get cheaper car insurance with an SP40 conviction

Despite the unavoidable hike in your premiums, there are still ways to find affordable and cheaper insurance with an SP40 conviction.

You could search for insurance policies specifically marketed to people with previous convictions, which may be advertised as convicted driver insurance, high-risk insurance or something similar.

Another top tip is to use the services of a car insurance broker. It’s best to find a broker who specialises in helping convicted drivers or drivers with an SP40 to get affordable insurance.

Some brokers may have access to policies not usually found on the market and they may get exclusive deals from the insurance company.

Last but not least, consider the car you’re trying to insure. You might be able to reduce your premiums as a convicted driver with a vehicle that doesn’t have higher performance, especially with a previous speeding conviction.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What’s the cheapest car insurance with an SP40 conviction?

The cost of car insurance depends on several factors and can be time-sensitive to limited offers and deals. Thus, there isn’t just one specialist insurance company that offers the cheapest insurance for convicted drivers. You should do your research and use a car insurance broker to help find the cheapest option for you.

What is the difference between SP30 and SP40?

An SP30 offence is exceeding the speed limit on a public road, whereas an SP40 offence is exceeding the speed limit in a passenger vehicle.

In some cases, there may be no distinction between the two. However, they both carry the same penalty.

Check out the MoneyNerd convicted driver insurance hub!

Discover more about convicted driver insurance and get more answers to the most asked insurance and convicted driver questions now. We have a dedicated page on this topic with plenty more posts covering important topics.