Together Energy Debt Collection – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying your Together Energy bills? You’re not alone. We’re here to help you understand and manage your energy debt. With over 170,000 people turning to us for advice each month, we’re experienced in offering support.

In this article, we’ll explain:

- What happens if you cannot pay Together Energy.

- Who Together Energy is and what they do.

- How to deal with letters from debt collectors.

- How to possibly reduce some of your Together Energy debt.

- How to find help if you’re struggling with unaffordable debt.

Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1

We know it’s tough when bills pile up and payments seem impossible. Yet, there are ways to handle it, and we’ll guide you through them. It’s important to remember you’re not alone in this and with the right steps, it can get better.

Let’s get started and figure out your next steps.

Who are They?

Together Energy provided power to people throughout the UK. However, the company went into administration at the beginning of this year. On 4th February to be exact. The appointed Joint Administrators are FRP Advisory Trading Limited.

British Gas was appointed the new supplier to existing customers of Together Energy by Ofgem. You can get support and advice on the Ofgem website if you’re worried about things such as the impact of energy provider bankruptcy.

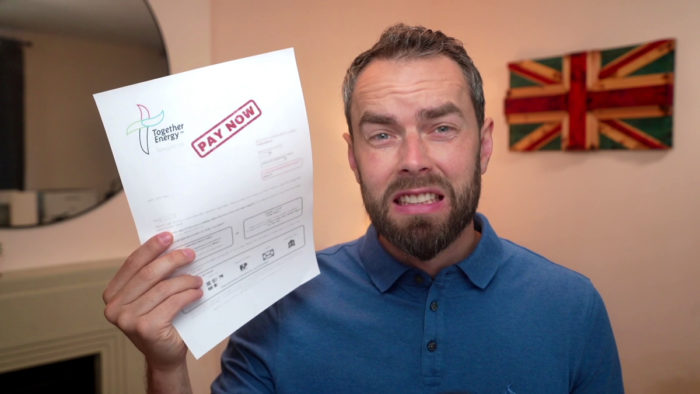

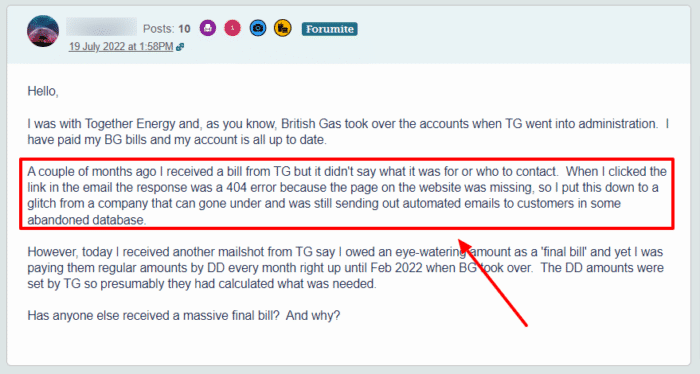

As you can see here, this forum user was part of the transition from Together Energy to British Gas and has found that they’re still being contacted by Together Energy. If you are a part of or have been a part of this transition, make sure to find out from British Gas what to do if this happens to you.

Are they going bust?

Together Energy was the first energy supplier to go bust in 2022. Over 2.3 million households in the UK have seen their suppliers go bankrupt!

» TAKE ACTION NOW: Fill out the short debt form

I’ve received letters. What should I do?

Suppose you fell behind with your payments and did not remain in contact with Together Energy. In that case, they’ll have passed your details to a debt collection agency.

My advice? Don’t ignore letters and other correspondence you get from a debt collector. If you’re confused and unsure what to do, contact British Gas and request ‘Breathing Space’. This gives you time to decide if and how you can pay and learn more about dealing with debt collectors.

The new supplier (British Gas) should put everything on hold until the matter is resolved. You should stop getting letters, phone calls or emails from the debt collection agency.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is Breathing Space?

You can request ‘Breathing Space‘ (The Debt Respite Scheme) if you have a debt problem. This provides legal protection from your creditors for up to 60 days.

The protection means:

- Pausing any enforcement actions

- Stopping contact from creditors

- Freezing interest and charges on the debt

You can only apply for ‘breathing space’ when you seek advice from an FCA-approved debt adviser. When you know you can’t repay the amount you owe, I strongly recommend you seek advice from a debt adviser.

The debt adviser will apply for a ‘breathing space’ for you. However, not all applications are accepted as it depends on whether this route is suitable or not.

Examples, when breathing space may not be applicable, include:

- You have assets you can sell to clear the debt

- You may be able to access funds to repay the debt through budgeting

- There is a more suitable solution which does not involve protections

What if I still get letters?

If the debt collection agency continues the debt collection process even when you requested a ‘Breathing Space’, file a complaint with British Gas.

Also, there have been many errors made by Together Energy before they went into administration. For example, customers were sent messages saying they owed a lot of money to the supplier. However, when customers queried the debts, the amounts owed shrank considerably.

My advice? Don’t automatically assume the debt is correct. Always question the amount!

Make sure the collectors are legit

Always check with the supplier (in this case British Gas) that the debt collection agency is legitimate. That they are acting on behalf of the supplier.

My advice is to stay in touch with the debt collection agency once you’re happy they are legitimate. You can ask them to ‘prove the debt’. Then, once you’ve written the letter, send it to their registered office address.

Always stay on top of things which means replying to emails, letters and phone calls. Do NOT ignore debt collectors because things can quickly get out of control. Plus, when you stay in touch, you might find the amount you owe could be reduced!

A debt collection agency must remain polite and offer you a realistic repayment schedule. One you can afford. If you are unhappy with how you’re treated, you can file a complaint against them with the Financial Ombudsman Service.

Also, make sure you complain to the supplier about the actions of a debt collector if they don’t act lawfully.

You can also speak to the Energy Ombudsman at Ofgem to take further action against your energy supplier.

Hold on to all correspondence

Hold on to all the correspondence you’re sent by the debt collection agency. Also, note down who you spoke to and the dates you talked to them. The best way to do this is to keep a diary which you can refer to when needed.

Can they force their way into my home?

No, they cannot force entry into your home. But, if you ignore them when they contact you, they could come and visit you at home. However, they must let you know in writing beforehand. It’s worth looking into debt collectors’ rights and limitations so that if you do have a debt collector show up, you understand what they can and can’t do.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should I pay?

If you owe the money and have the funds to pay a Together Energy debt, my advice is to pay it. This way, no further action will be taken. However, if you’re struggling to pay, there are other options.

First, contact a debt adviser and seek help and support. You may qualify for a breathing space under the Debt Relief Scheme. This will stop the debt collectors from contacting you for 60 days until you can sort things out. If that option doesn’t seem right for you, there are many more energy debt solutions at your disposal.

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Remember that your energy bill is considered a priority debt, and failing to pay may result in you being disconnected, being put on a pre-payment meter, or even money being taken directly from your wages or benefits.

Together Energy Contact Details

| Address: | Together Energy Ltd In Administration, Erskine House, North Avenue, Clydebank G81 2DR |

| Email: | [email protected] |

| Website: | https://togetherenergy.co.uk/ |

Is there any debt help out there?

Yes, some organisations and charities help people who’ve fallen into debt. This includes:

My advice? Don’t ignore the situation or the debt collectors. It’s best to stay on top of the situation and to remain in contact at all times. The problem will not go away until it’s resolved.

Thanks for reading this post on Together Energy debt collection and whether you should pay. If you have the funds to pay the debt, I recommend you do. Then, you won’t have to deal with debt collectors knocking on your door.