Transcom Student Loan & eBay Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled about a letter you’ve got from Transcom about student loans or eBay debt? Wondering if you should pay it?

This is the right place to help you understand it all. Every month, over 170,000 people visit our website for advice on dealing with debt.

In this article, we will explain:

- Who Transcom Worldwide are.

- What to do if they claim you owe money.

- Understanding what a Statute-Barred Debt is.

- Ways to possibly write off some Transcom debt.

- What happens if you genuinely can’t afford to repay the debt.

Dealing with unexpected debt can be worrying. In fact, research shows that 64% of UK adults find interactions with current debt collectors stressful1.

We’ve been there, we understand, and are here to help you through this. Let’s get started on finding the best solution for you.

They Claim I Owe Money. What Should I Do?

The first thing you should do is to check that you actually owe Transcom the money that they are claiming that you owe. Transcom debt verification is important – you don’t want to pay for a debt that you don’t have to!

There are a number of reasons that you might not owe the money.

First, debts cannot be legally enforced after a certain amount of time has elapsed. If you have not acknowledged the debt for a while, it’s quite possible that the debt has been statute barred.

Second, the debt could be owed by someone else. If that’s the case, Transcom should be chasing that person for repayment rather than you.

Third, you may have already repaid the debt. If you’ve paid back part of the money, the money that Transcom is claiming that you owe could be the wrong amount.

If you aren’t sure that you owe the money being claimed you should ask Transcom to prove to you in writing that you are liable. If they cannot provide this proof, they have to mark the debt as settled.

When you write to them asking for proof that you owe the money, you should not sign the letter. Some debt collection agencies have been known to use signatures to create documents that “prove” that the money is owed even though it isn’t.

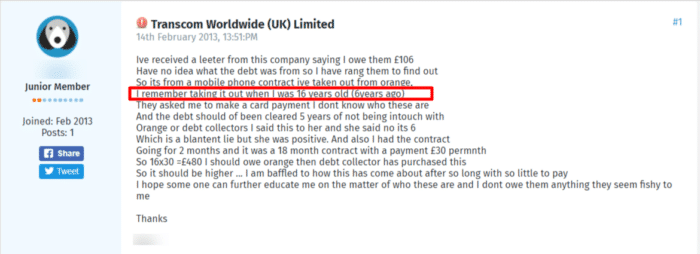

Unfortunately, just being unsure about the debt isn’t enough to not pay it, especially if you are provided proof or get your facts wrong! Take a look at this example.

If you get a letter from any debt collection company and aren’t sure if your debt is enforceable, we recommend speaking to a debt charity. They will look at your situation in detail and they can help correct any misunderstandings you may have!

We will go through the details of statute-barred debts below, but it is 6 years in England and Wales and 5 in Scotland.

» TAKE ACTION NOW: Fill out the short debt form

I Cannot Afford to Repay It. What Are My Options?

The average unsecured debt amount has increased by 27% year-on-year (to £16,174)2. So, it’s common for people to struggle with debt.

If that’s your case, and you cannot afford to repay the full amount, don’t worry. Most debt collection agencies will agree to a repayment plan.

You may need to supply details of your monthly income and expenditure to show how much you can afford to repay each month. Once you have agreed to a monthly figure, you will pay that amount each month until the debt has been cleared or there is another repayment plan negotiation.

Make sure that you get confirmation of any repayment agreement in writing so there are no misunderstandings at a later date.

As an alternative to a repayment plan, if you have several debts or cannot agree a repayment figure with Transcom, you might want to consider setting up a Debt Management Plan.

Debt Management Plans are usually managed by a licensed debt management company. That company will agree to reduced monthly payments with your creditors. You then make one payment to the debt management company, and they distribute that payment accordingly.

If you are considering a Debt Management Plan, it is important to check the terms and conditions. Some debt management companies charge a fee for providing the service.

What Can They Do if I Do Not Pay?

If you do not repay the debt, either in full or via instalments, Transcom will continue to try and get hold of you. This can quickly feel like harassment by writing to you, phoning you and sending text messages to you. They may even decide to visit your home.

If they visit you, they are not allowed to enter your home unless you invite them in. In fact, you aren’t even obliged to answer the door.

Our financial expert, Janine, says: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

You should not, under any circumstances, agree to anything when they are on your doorstep. If you do speak to them, get them to put any repayment plan that they offer in writing so you have a chance to consider their proposal properly. Do not pay them anything on the day.

Debt collection agencies often attempt to pressure vulnerable people into agreeing on things that they later regret. They rely on the fact that most people will want them to go away and, as a result, they’ll agree to anything that will make that happen. Remember that you don’t actually need to talk to them on your doorstep.

Although you’ll have to deal with the debt at some point, you’re well within your rights to tell them that you’re not prepared to talk to them.

Your Rights With Debt Collectors

We’ve prepared this table to help you better understand your rights when dealing with debt collectors. If you want to learn more about what they can and can’t do, please read our complete guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Remember that if debt collectors visit you, they are not allowed to take any of your property. Only a court-appointed bailiff can do that.

Transcom is allowed to contact you, but they are not allowed to harass you or threaten you.

If you feel that you have been the victim of these behaviours or unfair debt collection agency tactics, you can make a complaint.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Make A Complaint?

If you think that Transom has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Transcom so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and if your complaint is upheld, Transcom may be fined. You could even be owed compensation.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Transcom WorldWide Contact Details

| Company Name: | Transcom Worldwide (UK) Limited |

| Website: | https://www.transcom.com/global/ |

| Address: | Limewood House, Limewood Way, Seacroft, Leeds, LS14 1AB |

| Phone: | +44 113 273 5400 |