Will a Trust Deed Affect My Partner?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to get your head around trust deeds? Or maybe you’re wondering if your partner will be affected? You’re in the right place.

Each month, over 170,000 people visit our website looking for guidance on debt solutions. We understand your worries about debt and its effect on your life.

In this simple guide, we’ll talk about:

- What trust deeds are and how they work

- If your partner can be affected by your trust deed

- What happens if you and your partner have a trust deed together

- The impact of a trust deed on your job

- How to deal with debt in a trust deed

We know the stress of money problems, but you’re not alone. We’re here to help you understand your options.

Can my trust deed affect my partner?

If you enter a trust deed, it will not affect your partner or spouse. However, if you have joint debts, you could both be equally responsible for your payments.

Is it necessary to inform my spouse about my debt agreement?

It is possible to complete a trust agreement within a period of four years without your spouse finding out.

However, you could be advised to be transparent about your financial difficulties to prevent future disturbances.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can my spouse be forced into paying my trust deed?

Your credit agreement is signed in your personal name. This means you are responsible for making your debt payments yourself.

Your partner or spouse can not be forced into making your monthly payments.

Moreover, your creditors are forbidden from revealing the details of your trust to your spouse, unless you consent to it.

What will happen to the equity of a joint-owned home?

If you are a homeowner who is starting a trust deed, you will be expected to release all equity from your property.

However, if your property is jointly owned, then equity will be equally shared between you and your partner.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What will happen in the case of a joint-applied trust deed?

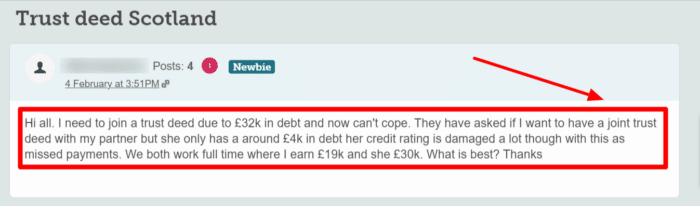

It is common to wonder how joint trust deeds work with a partner, as this forum user is also exploring:

If you have joint debts with your partner, you both will be expected to pay an estimated amount of share towards your debts. This is mutually agreed between you and your trustee.

In case the relationship is broken, each individual will be responsible for their own share of liability.