Is a Trust Deed an IVA? All You Need to Know, FAQs & More

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if a trust deed is the same as an IVA? Want to know more about trust deeds? This is the right place for you. Over 170,000 people visit our website each month seeking advice on debt.

A trust deed is not the same as an IVA, but they have some things in common. Trust deeds can help you manage your debt.

In this article, we’ll:

- Explain what a trust deed is, and how it works.

- Look at how a trust deed compares to an IVA.

- Answer some common questions about trust deeds.

We know that having debt can be worrying; some of us have been there too. With our experience, we’ll help you understand trust deeds and IVAs.

What is the difference between a Trust Deed and an IVA?

The main difference between an IVA and a Trust Deed is that an IVA is only available for English, Welsh, and people from Northern Ireland, whereas Trust Deeds are only available for Scottish residents.

Secondly, in a trust deed, you require a minimum debt level of £5,000. However, in an IVA, you are expected to have at least £6,000 of unsecured debts.

Additionally, the estimated duration for an IVA is sixty months or 5 years. However, a trust deed could last up to forty-eight months/4 years.

In the case that you have been living in Scotland for at least 12 months, there aren’t too many criteria, so it can be simple to get a trust deed.

If you aren’t sure which debt arrangement is most suitable for you, your insolvency practitioners could help you understand which agreement is best.

What are the similarities between an IVA and a trust deed?

There are a number of similarities between an IVA and a Trust Deed, including:

- Both of them are debt relief agreements designed to help people in the UK pay off their unwanted debts.

- In both cases, you should owe money to one or more creditors.

- Your monthly payments are based on your ability to pay. This is an amount decided after:

- Evaluating your financial situation.

- Deducting your disposable income.

- Only unsecured debts can be a part of your debt relief agreement.

- Once you get into the agreement, interest and charges will be frozen.

- After your payments are complete, in both cases, your remaining unpaid debts will be written off.

- IVAs and Trust Deeds are an alternative to sequestration.

- Neither of the agreements can have an impact on your ability to be a part of a public office or own a company.

- In case of a windfall, the amount of money must be declared. Your trustee must be informed about it.

- Both debt solutions will be recorded in the Public Register of Insolvency. Credit reference agencies can make this information available to anyone.

- Your insolvency information is recorded by authorized and regulated organizations.

- Your credit card can be included in the debt arrangement scheme.

- Both solutions may have an effect on your credit rating. This may further impact your ability to complete mortgage applications, renting applications, or even future loan applications

- Your trust deed will appear in your credit file.

- You will be expected to visit a licensed insolvency practitioner to make the agreement.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How much monthly income do I need to have for an IVA and a Trust Deed?

For both cases, the agreement is made on your ability to make payments easily. However, you are expected to have a monthly income of more than £150.

I would advise you to speak to your trustee, since it could be different for each debt solution.

» TAKE ACTION NOW: Fill out the short debt form

Will the IVA/Trust Deed records be published publicly?

Regardless of which agreement you choose, your records could be published in the Public Register of Insolvencies. This means your creditors could easily get your information.

An IVA is mostly listed in the London or Belfast Gazette. However, a Trust Deed is listed in the Edinburgh Gazette.

Are there any other options?

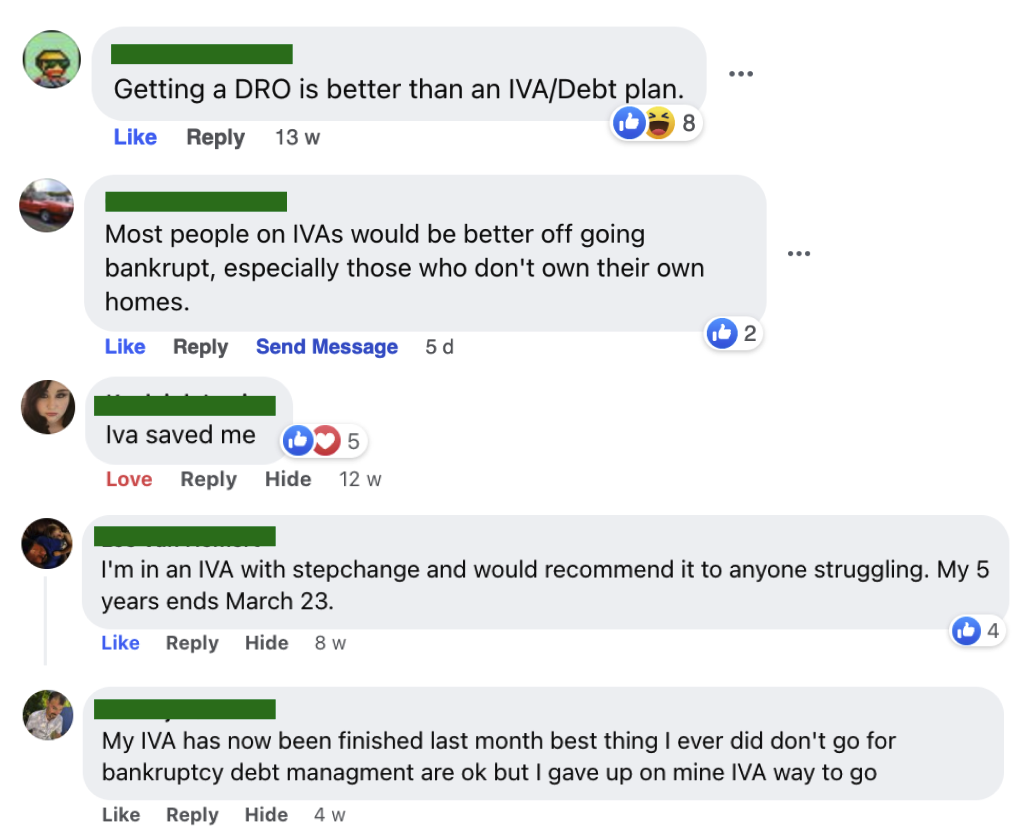

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do I need to transfer my assets in an IVA agreement?

Once an IVA is agreed upon, you have to transfer your assets to your trustee. Since your trustee will be managing your money, you will be protected from any legal action and pursuit from your creditors.