Unpaid Court Fines Arrest Warrant – What You Can Expect

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about an unpaid court fine and a bailiff coming to your door, we are here to help. This article will guide you through what to expect and how to manage it.

You’re not alone in this situation – in fact, over 170,000 people visit this site each month for advice on similar issues.

Let’s go through:

- What a court fine is and why you get one.

- How to pay a court fine.

- What happens if you don’t pay the court fine.

- The meaning of a financial arrest warrant.

- How court fines can be written off.

Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. As a result, it’s understandable that many people are worried about debt and the impact it can have.

So, we understand your worries about your things being taken away or having to deal with bailiffs. We’re here to help you learn how to handle the situation.

Why do you get one?

Does it mean a criminal record?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to pay a fine

» TAKE ACTION NOW: Fill out the short debt form

What if I don’t pay it?

If you can’t afford to pay for a court fine, seek legal advice immediately. There are several charities that offer free advice for debt-related issues. I have linked a few at the bottom of this page.

Typical Bailiff Fees and Charges

As mentioned above, if you don’t pay the court fine, bailiffs may visit your home and seize items considered ‘luxury.’ If this occurs, there are certain fees you need to consider.

Here’s a quick table explaining the typical bailiff fees and charges. For more information on how bailiffs operate, be sure to read our specialized guide.

It’s important to consider the associated costs of dealing with bailiffs.

You see, StepChange found that over half of their respondents say dealing with bailiffs made paying off their debt more difficult. Many say that they had to take out more credit to pay the bailiffs.4 To prevent this stressful situation, you can explore alternative debt management solutions.

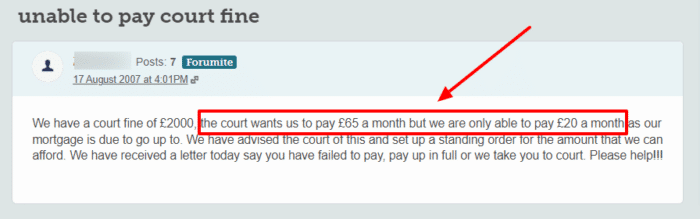

Court summons

This forum user would benefit from speaking to a debt charity. The advisors will either be able to give some legal advice on how to request an amendment to the fine, or help them go through their finances to find a way to prioritise this fine over other non-priority debts or payments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you go to prison?

| £200 or less | 7 days |

| More than £200 but less than £500 | 14 days |

| More than £500 but less than £1,000 | 28 days |

| More than £1,000 but less than £2,500 | 45 days |

| More than £2,500 but less than £5,000 | 3 months |

| More than £5,000 but less than £10,000 | 6 months |

| More than £10,000 but less than £20,000 | 12 months |

| More than £20,000 but less than £50,000 | 18 months |

| More than £50,000 but less than £100,000 | 2 years |

| More than £100,000 but less than £250,000 | 3 years |

| More than £250,000 but less than £1 million | 5 years |

| More than £1 million | 10 years |

What is a HMCTS warrant?

Can it be written off?

» TAKE ACTION NOW: Fill out the short debt form