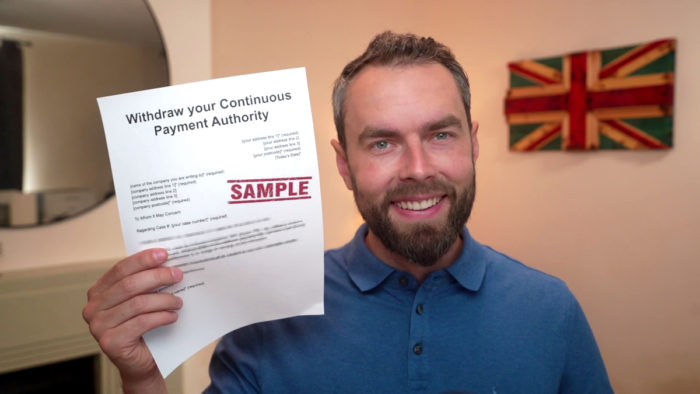

Withdraw your Continuous Payment Authority – Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Introduction

This free letter template can be used to tell your payday loan provider that they no longer have your approval to take regular payments from your debit card. Withdraw a Continuous Payment Authority (CPA) from payday loan providers easily and without stress by sending this letter.

We’ve made a letter template for people with sole or joint debts, so everyone can put a stop to these types of payments. Download our templates, add your account details and send it off. It couldn’t be any easier!

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

With immediate effect, I withdraw my authority for all future payments to be debited from card number [enter your card number here]* (required) in respect of the above loan.

Please confirm in writing that you have received and actioned this instruction.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

How do I stop payments on a payday loan?

You might want to stop payments to a payday loan provider for different reasons. You could be having difficulty keeping up with payments and are withholding money until you can agree to a lower repayment plan. Or you may be using a different debt solution and no longer need the payday loan provider to charge your bank account.

The way to stop payday loan providers from taking money will depend on the method they are using to collect the payments. A small group of creditors might use a direct debit instruction. In this case, you will need to cancel the direct debit with your bank. However, a greater number of loan providers will be using a Continuous Payment Authority (CPA), which you should aim to cancel with the payday loan provider as well as your bank.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a Continuous Payment Authority (CPA)?

A Continuous Payment Authority is a method of payment collection where the vendor charges a debit card rather than takes the money from your bank account. It occurs automatically each month without you having to do anything. It can be a convenient way for the loan company to collect the payments.

Interestingly, loan providers can only use a CPA to take all of the money. If you cannot pay the full amount, they cannot take anything. This prevents them from taking a lower amount and cleaning out your bank account, thus, preventing them from leaving you with no money.

How do I cancel my Continuous Payment Authority?

You can cancel a Continuous Payment Authority by withdrawing your permission for the loan provider to take payments. Without permission, they are not allowed to take these payments.

Writing to your creditor remains the best way to do this. Don’t worry if you don’t know what to say. We have already written an effective letter template you can use to withdraw your CPA permission from a payday loan company.

Download and use it for free, now!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens after I stop payments?

If you are withdrawing your CPA permission because of financial difficulty, you should communicate with your loan provider to explain the situation. Stopping payments will not make your debts go away, but speaking with creditors might result in more affordable repayment plans.

Where to get debt help for payday loans?

For further help dealing with payday loan providers and financial difficulty, read the Money Nerd guides online, or speak with a UK debt charity. You don’t have to face debt alone!