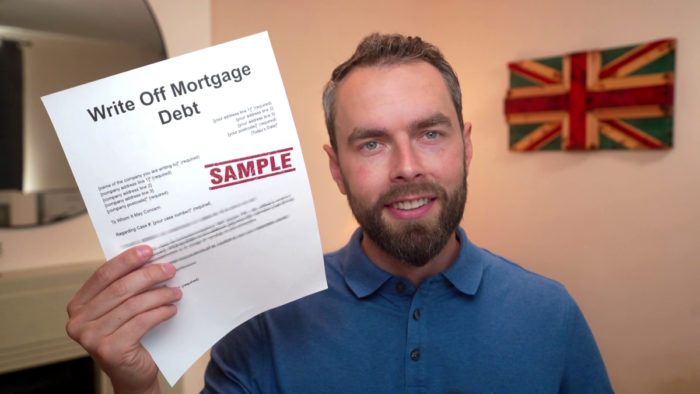

Write Off Mortgage Debt Sample Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you searching for ways to write off your mortgage debt? If so, this is the right place for you. Each month, over 170,000 people visit our website to find answers to their debt worries.

In this article, we’ll explain:

- What a mortgage shortfall debt is.

- If and how mortgage debt can be written off.

- How long it takes before a mortgage shortfall debt is written off.

- Why including a budget in your letter is important.

- How to legally write off debt.

We know that dealing with a debt problem can be tough, so we also have a free letter template for you to use.

Ready to learn how to write a letter to request your mortgage lender to write off your mortgage shortfall debt? Let’s get started.

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

Further to my recent [letters/telephone calls.]* (required) I enclose a copy of my budget sheet which gives details of my present financial circumstances.

As you can see, my outgoings are more than my income and I am experiencing extreme financial hardship.

Please would you consider writing off the outstanding debt owing? I have always taken my financial responsibilities very seriously, but unfortunately my circumstances are so bad that I cannot realistically maintain payments of any kind. I understand that under the ‘FCA Mortgages and Home Finance: Conduct of Business sourcebook (MCOB)’ a lender is not required to recover a mortgage shortfall debt where it is considered unviable to do so.

Please take the following special information into account when making your decision.

[include a paragraph outlining the special circumstances you have that you want the creditor to take into account.]* (required)

As you can see my situation is very unlikely to improve in the future. My continued high debt level may also have a serious effect on my physical and mental wellbeing.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a mortgage shortfall debt?

A mortgage shortfall is the difference between the value of a mortgage you have left to pay and the value of the property when it sells after a repossession. If your mortgage provider repossessed your home, they must sell it to clear the mortgage payments. If they sell the property for less than what is left to pay on the mortgage, the difference is known as the mortgage shortfall.

The amount of the mortgage shortfall can then be passed back to the initial buyer as a debt.

Can mortgage debt be written off?

You can ask your mortgage provider to write off any outstanding mortgage debts, including a mortgage shortfall debt. Realistically, they are not likely to wipe the debt without good reason to do so.

However, the FCA states that a mortgage lender should not chase mortgage shortfall debts if there is no ‘viable’ way for the person to pay it back. Thus, there may be a route to getting your mortgage debt wiped if you have extreme financial difficulty.

That’s why our letter template makes reference to this FCA code of conduct and how we can help you lobby for your mortgage shortfall to be wiped. Download it now to make your case effectively.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long before a mortgage shortfall debt is written off?

There is another way to not have to pay a mortgage shortfall debt. The Limitations Act states that mortgage shortfall capital payments cannot be collected after 12 years. And mortgage shortfall interest payments cannot be recovered after six years.

Although the debt is not technically wiped after this period, you still won’t be forced to pay it back.

You should also be aware that a mortgage lender must inform you of a mortgage shortfall within six years of the property benign sold. If they miss this window to inform you, you won’t need to pay the debt either. We have a specific letter template to tell a mortgage lender that it is too late to claim a mortgage shortfall debt.

Why include a budget in your letter

The only time a mortgage lender will actively write off a mortgage shortfall is when there is evidence of significant financial hardship, meaning they are highly unlikely to get the money back. For that reason, we recommend attaching your monthly budget to the letter when needing to prove financial hardship.