Lost My Job, Need Money to Pay Bills – In-depth Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

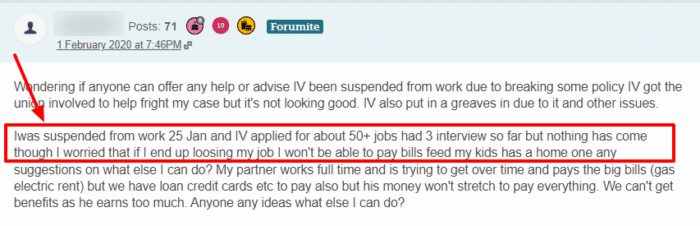

Lost your job and not sure how to pay your bills? You’re in the right place to get help. Our guide is here to answer your questions and ease your worries.

Each month, over 170,000 people come to our website for advice on money troubles, so you’re not alone in this tough time. Our team understands how hard it can be some of us have been in the same place as you.

In this guide we’ll cover:

- How to apply for Universal Credit right away.

- Ways to get a council tax reduction or a mortgage break.

- Steps to possibly write off some debt.

- Paying bills when you’re out of work.

- What to do about credit card debt after losing a job.

We know it’s scary when you can’t pay your bills and we want to help you find a way through this. Let’s dive in and learn more about the options available to you.

What happens if you lose your job and can’t pay bills?

Many individuals and families in the UK are living from payday to payday without significant savings. This means if they are made redundant, they will not be able to pay their next set of household bills.

You may be able to claim Universal Credit to access benefit payments quickly and stay afloat. There is also Jobseeker’s Allowance, which is available for those who are actively seeking employment.

Still, even these payments may not stretch far enough to cover all monthly payments for rent, energy, groceries, etc.

If you suddenly stop paying your bills in full or on time, the creditor or company will send you a reminder to pay. They can also ask you to get in touch to negotiate a more affordable payment plan on any arrears.

It is worth discussing a monthly payment to avoid the company taking further action, including taking you to court.

Alternatively, it could be advantageous to use formal debt solutions, such as a Debt Relief Order or Individual Voluntary Arrangement.

If you qualify for a debt solution, you could write off all or some of your debts.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you pay your bills if you lose your job?

When you have lost your job and need money to keep paying bills, you should apply for Universal Credit straight away. This is a benefit payment for many situations, including if you are looking for new employment.

However, if you are locked into long-term contracts, such as rent or mortgage payments, TV packages and others, the money you receive from benefits is not likely enough.

So, what can you do about this?

Here’s a list of things to consider doing to make any benefits payments stretch further and reduce your immediate household expenses:

1. Council Tax

You should update your household situation with the local council. Households with only one or no working adults may be due a council tax reduction and be able to instantly reduce monthly payments.

If you’ve forgotten to do this already, you’ll be allowed to backdate your overpayment and get a refund.

2. Mortgage Payment

You might be able to get help from your mortgage provider. Many banks and mortgage providers can offer a repayment holiday when you file for unemployment. This will give you a break from paying your mortgage debt (possibly not the loan interest!) for three to six months.

These were guaranteed during the coronavirus pandemic, but now you will have to ask your lender and qualify. The aim should be to find another job while you receive the payments holiday.

3. Water bills

Great news – your water can never be turned off, even when you cannot afford to make payments. That’s not a free pass to never pay again, as other issues can materialise, and it will damage your credit score.

You should communicate the situation with your water provider. They’ll probably point you in the direction of certain schemes designed to help people pay their water bill while temporarily unemployed.

For more information about water debts, consult this in-depth guide!

4. Electricity and gas bills

You should also communicate with any energy suppliers to explain your financial situation. They could offer to stop payments for some time, or they may offer an alternative arrangement over the short term.

Use this downloadable letter template to ask your supplier to agree to a more affordable arrangement. All you have to do is include some personal information or account data and shoot it off in the post!

If you have a prepay meter because of poor credit history, you should ask for emergency credit when you need it.

Avoiding their letters and ignoring calls is what can lead to significant debts and legal action being taken against you. For further support and advice, contact a debt advice charity.

5. Miscellaneous subscriptions

Make a list of all the other services and subscriptions you have. For most households, this will revolve around entertainment streaming sites, such as Netflix. You should seek to cancel as many of these as possible to prioritise essential expenses instead.

You may have miscellaneous outgoings that are not needed while you are not in work. For example, you may want to consider cancelling your car insurance when you do not need it to drive to a workplace.

If you’re a student, consider applying for university hardship funds, which is available for students who lose their job and are struggling to keep up with their education expenses

» TAKE ACTION NOW: Fill out the short debt form

What to do about credit card debt if you lost your job?

If you have lost your job with existing debts, such as credit cards or loans, you may be worried about meeting your minimum repayments on each debt.

The first thing you should do in this situation is to contact each lender to explain your new financial circumstances.

Your lenders may be able to adjust the amount you owe each month to make minimum repayments more affordable and tailored to your personal finances. They are encouraged to do this by various bodies and groups.

Or you may want to ask for a complete repayment freeze, including stopping interest. We have made it easier for everyday people to ask their card companies and loan providers for a payment freeze.

If you have credit cards and an unpaid credit card debt, you may want to consider your options.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Some people in this situation can benefit from a credit card balance transfer. This is essentially opening up a new credit card with a lower rate of interest than your current one and using it to pay off your existing credit card arrears. Thus, you still have the credit card debt, but the debt is not growing as much because of the lower interest rate.

For more information on these types of debts, read our credit card debt guide!

For now, you can use my free interest calculator to see how interest affects your monthly bills. You might need to write to your creditors and explain your employment situation if interest rates are going to be a problem. I do have a free letter template for you to use if need be!

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

It’s time to start a budget!

Another productive task you can complete when you have entered unemployment with bills and maybe debts is to start a budget to monitor your finances.

By creating a budget, you can take control of your spending. You’ll create a complete picture of your financial situation in minutes.

A budget is simply a complete list of monthly income – such as benefits – and all of your expenses. You can then divide your spending into essentials and desirable to identify which costs you are able to get rid of while you search for new employment.

You can then adjust your spending, and therefore your budget, to help you save money.

We’ve created a dedicated guide on how to cut your spending to help clear your existing debts. Read it here now!

A popular method some people use is to only spend cash so they can easily keep track of their budget.