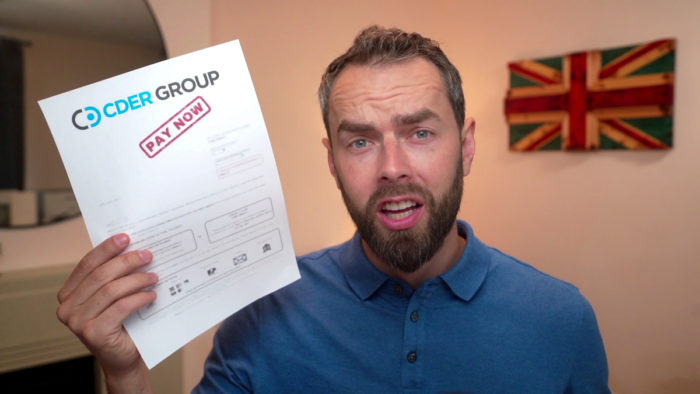

CDER Group Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter from CDER Group about a debt? Are you wondering whether you should pay, or even if the letter is real?

Don’t worry, you’re not alone. Every month, over 170,000 people come to our website for help with debt issues.

In this article, we’ll explain:

- What CDER Group debt is.

- How to check if the debt is really yours.

- What to do if you can’t afford to pay.

- How to stop CDER Group from chasing you.

- Ways to write off your debt, if possible.

We understand how scary it feels to get letters from debt collectors. In fact, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1. Many of us have been in your shoes, so, we’ll share our experiences and knowledge to help you.

Let’s dive in and learn about how to deal with CDER Group debt.

Should you pay CDER Group Debt Collection?

Yes, you need to pay CDER Group after receiving a Notice of Enforcement.

Resolving debt with CDER Group quickly will get them off your back with as few problems as possible. Make sure you establish early communication – you can’t ignore them!

Sadly, Stepchange reports a 25% year-on-year rise in average unsecured debt, reaching £13,941 in 20222, so debt collection agencies aren’t going anywhere any time soon.

If you cannot pay back your debt in one go, a CDER Group payment plan may be available to you. Just make sure that you can afford to pay what you agree to as the consequences of not paying CDER Group are very serious.

What happens if you don’t pay CDER?

If you don’t pay they will come to your home, which will trigger a fee.

If you still don’t pay, they may come to your home for asset seizure. This means that they will take away your goods to sell them at auction to pay off your debt which will be another fee added to your bill. Keep in mind that there are some limitations to what they can seize from your home.

The implications of not paying CDER Group are severe. Failure to pay will be noted on your credit file and you will significantly and negatively affect your credit score. This will make it notably harder for you to secure credit in the future if you can secure any at all.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you have to let bailiffs in?

You don’t always have to let bailiffs into your home.

If you want to communicate with them securely, it’s best to do so from a letterbox with the door locked or from an upstairs window when possible.

Our financial expert, Janine, says on debt collectors: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

If they do force entry into your home because they have a court order, remember that they can only use reasonable force.

Make sure you do your research if you suspect that you will have bailiffs at your door! Knowing your rights will help make the situation less stressful for you, and help make sure that they don’t overstep their professional boundaries.

CDER group reviews

CDER Group Limited have a lot of online reviews, unfortunately for them, not a lot of people have nice things to say about the business. Take a read for yourself:

“Very rude and unprofessional, do not follow good practise or industry guidance relying instead on intimidation and threats. I asked my agent for a breakdown of costs and he refused to provide one. […]”

- Baz T (Google review)

“Had outstanding charges on my car for not paying the dart crossing charge on time. Crossings happened in July 2021 and they only started reaching out the beginning of Jan 2022. Ended up paying over £600. What a load of rubbish.”

- Lorenzo C (Google review)

What power do bailiffs have?

Dealing with bailiffs can be scary. This is why we think understanding bailiffs’ authority and limitations is so important.

Bailiffs have the power to enforce court orders and writs. In terms of debt collection, they can come to your home to ask for payment or repossess your belongings to an equal value of the debt.

They can enter your home if the doors are open or unlocked, but they cannot force entry into your home by breaking locks or physically handling you. They can’t climb through windows, but it’s still advisable to keep them shut and locked. They also cannot bring a locksmith with them to unlock your doors.

The only time a bailiff can force entry into your property is if you have defaulted on a payment plan with them and had signed a Controlled Goods Agreement (CGA).

This is an agreement that the bailiff can take certain assets if you miss payment plans.

Thus, they can force entry to seize assets on the CGA after a payment default, but they must use a locksmith rather than breaking down a locked door.

Keep in mind that the CEDR Group have to follow the Financial Conduct Authority (FCA) Guidelines. If you think that they have broken these rules, you may be able to make a complaint against them, possibly even with the Financial Ombudsman Service.

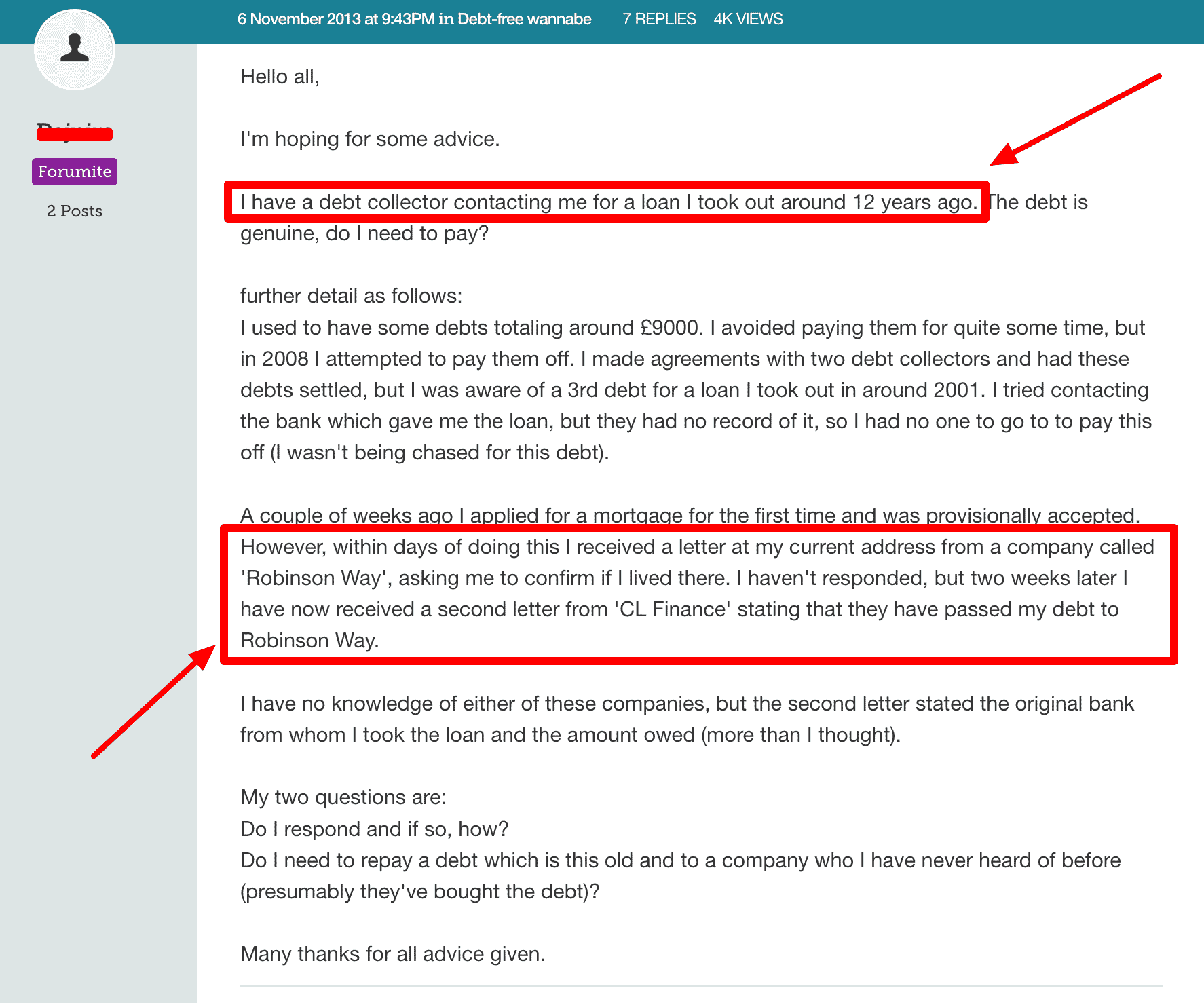

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

CDER Group Contact Details

| Address: | 9th Floor, Peninsular House, 30-36 Monument Street, London, EC3R 8LJ |

| Phone: | 0330 460 5295 |

| Email: | [email protected] |

| LinkedIn: | cder-group |

| Twitter: | @CDERGroup |

| Website: | https://www.cdergroup.co.uk/ |

Who can help?

If you are struggling with your debts, there are several debt charities in the UK that can help.

- StepChange and National Debtline offer free debt advice

- Citizens Advice offer a wide range of free and confidential advice

- The government has a comprehensive list of free services, including regional help.

To prevent other debts from escalating to court action and bailiffs, read our top guides and tips on staying out of debt. Our debt help page will also help you deal with new debts quickly.