Never Paid Council Tax – Consequences If You Don’t Pay!

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Facing council tax debt can be a worry, but luckily; you’ve come to the right place for answers. Each month, more than 170,000 people visit our website for guidance on debt solutions.

In this article, we will explain in simple words:

- Steps to take if you find it hard to pay your council tax.

- What council tax bands mean.

- How to ask the council to clear some of your council tax debt.

- How not paying council tax may change your credit score.

- The legal problems that can happen if you don’t pay your council tax.

StepChange reports that over half of their clients contacted by bailiffs were struggling with council tax arrears, and many of them expressed feeling unfairly treated.1

We know this can be concerning, but we are here to guide you through all you need to know about council tax and debt.

Let’s dive right in and discuss your options.

If You Don’t Pay Your Council Tax, What Will Happen?

Council Tax Debt Solutions

Dealing with council tax arrears can be concerning and scary. But don’t worry, there are different debt strategies that can help you. These are:

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

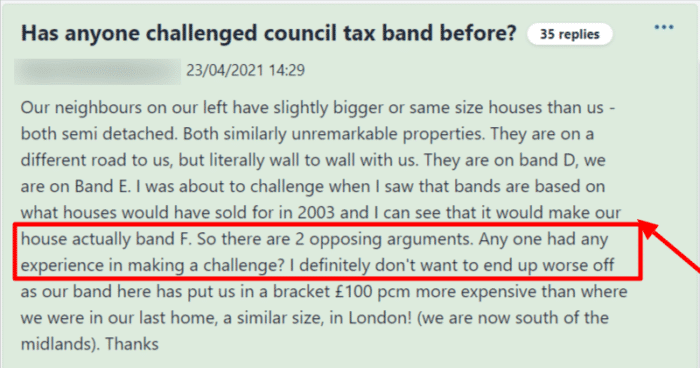

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Who Has To Pay?

If you think that there has been an error, you might be able to challenge your tax band.

You can challenge your council tax band online but you will need to have supporting evidence that proves there has been a mistake.

What if You Miss a Payment?

What if You Cannot Afford It?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I appeal my bill?

If you think that your council tax bill is wrong, you need to write to your council and tell them why you think that your bill is incorrect. You can find out who your local council is here.

Your council will then reply to you within 2 months.

This reply will either:

- Tell you you are correct, your bill is wrong, and a new bill will be sent.

- Tell you that the bill is right and explain why.

If the council replies and says that your bill is wrong, you must carry on paying the amount on your old bill until a new one comes.

If you wish to appeal your council’s decision, or you don’t get a reply within 2 months, you can appeal to the Valuation Tribunal. This is a free services but you need to pay for your own costs.

For your appeal to be valid, you need to:

- 2 months of the council telling you their decision

- 4 months after you first wrote to the council about your council tax bill.

If the Valuation Tribunal agrees with you and says that the council was wrong, your new bill will be sent along with your monthly adjustments.

» TAKE ACTION NOW: Fill out the short debt form

Will Arrears Affect My Credit Score?

Yes, council tax arrears can affect your credit score because it can lead to legal action.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ for any debt, including council tax, you have had such trouble paying back your debt that someone had to go to court about it.

If you have an earnings arrestment as well, you:

- Haven’t paid off your debts according to your original credit agreement

- Got taken to court over your lack of repayment

- Got a CCJ against you

- Didn’t pay according to the terms of the CCJ

- Forced your creditor to go back to court for an earnings arrestment.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.