Assignment of Debt UK – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debt that has been passed to a third party? Don’t worry, you’ve found the right place to learn about it. Every month, over 170,000 people visit our website seeking advice on debt problems.

This article will help you understand:

- What ‘Assignment of Debt’ means

- The difference between Legal and Equitable Assignment

- How to tell if you can write off some of your debt

- The meaning of ‘Absolute Assignments’ and ‘Assignment of Receivables’

- How to seek help with problem debt

Our team understands your worry because some of us have been in the same situation. With our experience, we’re here to help you learn about ‘Assignment of Debt’ in the UK and what you can do about it.

What Does ‘Assignment of Debt’ Mean?

Simply put, assignment of debt means that your original creditor (assignor) has decided to assign your debt to a third party, usually called the “assignee”.

The assignee now has the right to proceed with court action, if they deem it necessary, to recover money from you.

There are two commonly known types, as you’ll find out in the next few sections.

Legal Assignment vs Equitable Assignment

Legal assignment means that another company takes over both the benefit of a debt from a creditor as well as the right to enforce it, namely, the right to pursue court action over the loan.

In contrast, equitable assignment only transfers the benefit of a loan to a third party, but not the right to pursue court action over the loan.

So, if the assignee wants to take the debtor to court, they may only actively collaborate with the original creditor once the original creditor decides to take the borrower to court. So, they do not hold the power to initiate court action themselves.

Remember, for the assignment to be effective, the debtor must be given notice of the assignment. Only once they have received notice is the debtor obligated to make payment to the assignee.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Assignment vs Novation

For assignments, the party that assigns still keeps performing the obligations associated with the loan, but the assignee is now entitled to the benefits of the loan.

To put this in perspective, let’s say you assign an amount a debtor owes you to another organisation. In this frame of reference, you still hold some rights and obligations over the loan, most notably the right to pursue legal action in court.

On the other hand, novation entails a full transfer of both rights and obligations.

For instance, in our original scenario, this would mean that a creditor gives the assignee company full power over both the rights and obligations associated with the loan.

Assignment vs Selling

As discussed, assignment of debt means the right to collect a debt has been legally transferred from the original creditor (assignor) to a third party (assignee).

The debtor is notified of this assignment, and they must then make payments to the assignee. However, the original contract’s terms and conditions remain unchanged.

As for the selling of debt, this typically refers to a financial transaction where a lender sells its loans to a third party, often for a fraction of the original amount.

The buyer (often a debt collection agency) then attempts to collect the full amount from the debtor.

Does an Assignment Need to be a Deed?

No, it doesn’t need to be a deed.

Even if it is just an agreement, that is usually fine. Deeds were utilised commonly quite a while ago, and today’s court operations hardly require a deed as part of most assignments.

As for exceptions, there are a few cases where assignments might need to be deeds. For instance, when the original loan contract was signed as a deed, you do need a deed to assign it or to novate it.

Otherwise, a deed is not usually needed as assignments have three parties by default, and it is highly unlikely that any of them tampered with the agreement, since all of them have separate interests.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Frequently Asked Questions About Debt Assignment

How long before debt is written off in the UK?

Under UK law, the limitation period is six years, after which debt collectors won’t likely hound you for payment. For mortgage loans, however, this period is twelve years.

So, if your creditor has not contacted you for six years (or twelve years if you owe a mortgage loan), you can take the matter to court and attempt to have your loan written off.

This includes payday loans, personal loans, credit cards, and some other types of loans.

What happens when a mortgage is assigned?

When a mortgage is assigned, the new lender takes on the obligations and rights of the mortgage loan.

In specific situations, even borrowers may assign their mortgage to another party, but this happens far less frequently than creditor assignments.

Lastly, when mortgage assignments happen, they are recorded with the county recorder’s office, which is the office responsible for storing and maintaining records of titles that affect deeds.

How does it affect my credit report?

When it comes to the specifics, your credit report will be updated to reflect the new company and the new terms of the loan, if any.

For one, you will see a new name on your credit record in place of an old one. The name of your previous company will be replaced, and the new company’s name will be entered.

Also, when you’ve started making repayments and default on a payment, your new creditors will inform the Credit Reference Agencies of this circumstance.

All in all, it entails an update of information on your credit report.

You can check your credit score on Equifax or Experian.

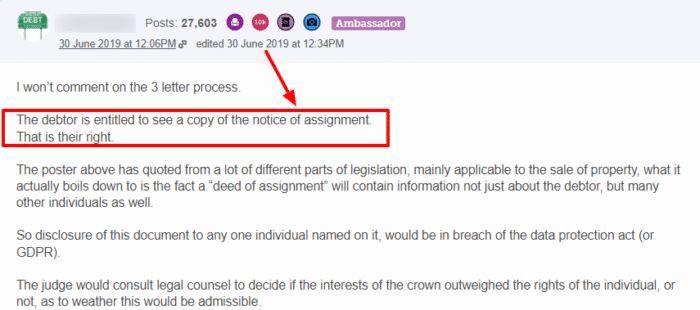

What is a notice of assignment?

Under the Property Act 1925, this is a notice that is used to formally inform a borrower that another company has bought or acquired their debts from their original creditor.

Creditors are required to formally inform borrowers through a notice if it’s a legal assignment.

What happens after a notice is issued?

Once a notice is issued, the due process for legal assignments dictates that the benefits and obligations of the lender are transferred to the company that purchases the debt.

After this, the usual debt collection procedures ensue, with the new creditor having the choice of hiring a collection agency, adopting in-house collection procedures, or other means.

Their aim likely is to recover the amount from you and avoid court action as much as possible since it can end up costing them a pretty penny as well.

Why do people assign their debt?

People may assign their debts when they don’t want to go through the trouble of collecting them themselves.

Another reason is they don’t have the resources to pursue court action against a debtor themselves or both. Debt collection can be quite a hassle at times.

In general, if a third party, such as a debt collection agency, can do the job of repayment collection more efficiently than a creditor can themselves, it’s probably a good idea to let them do it.