Average Mortgage Length UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Curious about the average mortgage length in the UK? You’re not alone. In fact, over 170,000 people visit our website seeking advice on debt solutions.

In this simple guide, we’ll discuss:

- The current average length of a mortgage in the UK

- How global economic conditions may impact mortgages

- Useful facts and stats on UK mortgages

- The pros and cons of a longer mortgage term

- How to deal with unaffordable debt

We know that managing your finances and understanding mortgages can be tricky. But don’t worry, we’re here to help.

Some key statistics on UK mortgages

- The average UK mortgage is 30 years

- In total, 41% of mortgages now have a term of more than 25 years, up from just 14% prior to the financial crisis.

- The average monthly mortgage spend is £733

- The average deposit for first-time buyers is £58,986, up £11,677 since March 2020.

- In the past ten years, the cost of a monthly mortgage has climbed by 31%.

- ACCORDING TO THE ONS, the UK’s average home price reached £283,000 in May 2022.

The typical term of a mortgage

A typical mortgage is repaid over 25, 30, or 35 years. The most common length has historically been 25, but 30 years is now the UK average, and even 35-year mortgages are beginning to gain traction.

Mortgages may be the longest and most expensive loans you may take out in your lifetime.

Longer mortgage terms are desirable since they result in lower monthly payments. As a result, it is simpler for people to meet the requirements for a mortgage, allowing them to advance in the housing market. But because of this, they will have to pay much more throughout the longer mortgage.

In total, 41% of mortgages now have a term of more than 25 years, up from just 14% prior to the financial crisis.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The advantages and disadvantages of a longer mortgage

Not everyone is a good candidate for mortgages with longer terms. Let us take a look at some of the advantages and disadvantages.

Advantages

Smaller monthly repayments

This is so you can spread the payments over a longer period.

Let us take the case of a first-time buyer with a mortgage of £180,000 at a 2% interest rate. With a 25-year term, monthly payments would be £763 instead of £545 with a 40-year term.

The average monthly mortgage spend is £733

The mortgage lender must determine how much you can afford to borrow and how well you can repay monthly when applying for a mortgage. Additionally, they must ensure that you can pay if interest rates increase.

Particularly for first-time purchasers, it may be simpler to pass these affordability requirements because monthly repayments are smaller with a longer term. This is not always the case, though. For instance, if the duration extends over your state’s retirement age or the source of your income is not seen as consistent throughout that time.

As you can see, this MoneySavingExpert forum user chose a 30-year term. Despite the longer mortgage, they have the flexibility of lower payments and are confident that their property will be paid off within ten years.

Disadvantages

Overall, you will pay higher interest.

A longer mortgage costs more overall, even though your payments are lower. This means that you should carefully consider that factor before taking out a long mortgage.

For instance, in the case above, a 25-year term would result in interest costs of under £49,000 per year. You would pay a staggering £33,000 more in interest with a 40-year term, or nearly £82,000 in total.

You have accumulated more debt.

Remember that it will take 40 years if you have a 40-year mortgage before you purchase your house outright. This means that if you took out a mortgage at age 25, which is a young age for a first-time buyer, you would not have paid it off until you were 65 (the current state pension age).

Being so young and making such a big commitment is difficult because so much can happen in 40 years.

» TAKE ACTION NOW: Fill out the short debt form

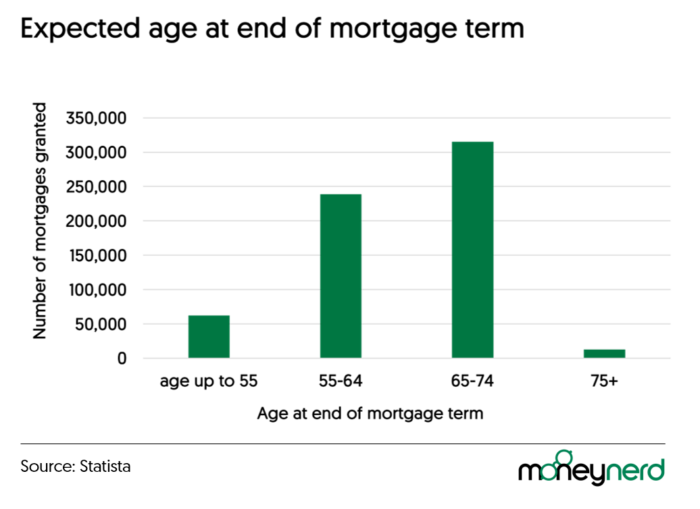

How old will you be when you finish the mortgage?

The older you are when you make the final mortgage payment, the longer the mortgage term.

Although some mortgage lenders have raised the age restriction to 80, you are less likely to be working and earning as much money each month as before.

Source: Statista showing the average age at the end of the mortgage term and the number of mortgages granted.

Of course, you need to prepare for more than just long-term mortgages. Affordability checks will be performed on any mortgage loan you apply for to ensure you can afford the monthly payments, even if your circumstances change.

The graph above shows that 12,680 new mortgages will last through the borrower’s 75th birthday, whereas 313,000 new mortgages will cease when the borrower is between 65 and 74.