Black Horse Finance Bad Credit – Is It Possible?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if you can get car finance with bad credit from Black Horse Finance? You’ve come to the right place. Over 170,000 people visit our website each month seeking advice on debt solutions.

In this easy-to-understand guide, we’ll explain:

- What Black Horse Finance is

- What to do if you’re worried about your car finance

- How Black Horse Finance works

- If it’s possible to write off some Black Horse Finance debt

- If Black Horse Finance is part of Lloyds

Dealing with car finance payments can be tough, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’re here to help you know your choices.

Is Black Horse Finance Lloyds?

Yes, Black Horse is part of the Lloyds Banking Group.

You might have clocked on that Black Horse is owned by Lloyds due to its name and similar logo. Lloyds uses the same black horse image in their logo.

Black Horse is part of the Lloyds Banking Group but is entirely dedicated to vehicle financing agreements.

Can you get accepted for finance with bad credit?

It’s possible to be approved for car finance when you have a bad credit rating.

However, it will be harder to get an HP Agreement compared to someone with an excellent credit score. The important thing to remember is that your credit score isn’t the only consideration taken into account by vehicle finance companies.

If you do manage to get approved for finance with bad credit, you must take into consideration the impact of late payments will have on your credit score.

While you may rectify your mistake and pay your bill, the probability of being approved for more credit in the near future is reduced.

Even if you don’t get accepted for finance with bad credit there are options out there. I recommend looking into bad credit loans and what your options are.

Budget Advice

If you’re struggling with a bad credit score, it’s crucial to change certain habits to lower your expenses and manage your finances effectively.

Here are ten simple budgeting tips:

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you get Black Horse Finance with bad credit?

Black Horse Finance may still accept your car financing application if you have a poor credit score. However, it all comes down to your complete personal situation.

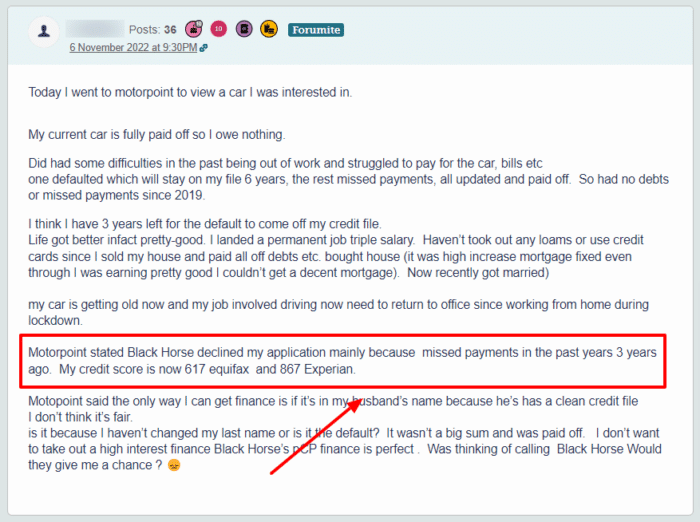

There is evidence of this on online forums:

“I’ve been with Black Horse for over a year now and I’ve had no problems at all. They accepted me and I had a couple of defaults and 1 CCJ.”

- Blue 2_3 (Money Saving Expert Forum)

Although this forum user doesn’t state they had a poor score, having defaults and a CCJ will have significantly damaged their score. Yet, they were still accepted.

There are other stories online of people getting rejected with good credit scores but a high level of debt.

This forum user had turned things around and their credit score was above average, but they were still declined. This shows that your credit score is just one consideration for Black Horse.

» TAKE ACTION NOW: Fill out the short debt form

Can you get a Black Horse finance payment holiday?

Black Horse may consider a payment holiday if it will help you get back on track over the long term.

You should go to your online account and then go to the Help Centre. From here you can click a Money Worries tab and answer some questions about your situation.

Your answers should reveal the ways in which Black Horse and prepared to help, one of which might be a payment holiday.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you change your Black Horse finance payment date?

You can change your payment date to Black Horse Finance through your online account. On the menu, there is a “change payment date” option.

Black Horse Finance reviews

Black Horse has over 225 reviews on Trustpilot with a poor rating of 1.9 out of 5 stars. Many reviewers complain about the company’s lacking customer service. Here is a negative and positive review for balance:

“Worse customer service ever and they lie to you all the time talk so much rubbish try to delay ur problems and staff member extremely rude pathetic ppl!! Will never ever use their service again or recommend anyone!”

- Lal Hussain (Trustpilot)

“I haven’t had any issues with them. My payment has been taken on time every month. It’s been easy on my online account to make extra payments and settle my balance early, with immediate email confirmation.”

- R Billington (Trustpilot)

Black Horse Finance Contact Details

| Website: | https://www.blackhorse.co.uk/ |

| Phone number: | 0344 824 8888 |

| Hours of operation: | Monday to Friday 8:30am – 6:00pm Saturday: 9:00am – 1:00pm |

| Contact by mail: | Black Horse Finance Customer Services St William House, Cardiff, CF10 5BH |

Want to get out of a car financing agreement?

You can get out of a Black Horse financing agreement when you have paid at least 50% of the agreement off.

This is called voluntary termination. You will have to give back the vehicle to Black Horse.

Black Horse Finance bad credit (Quick recap!)

You might be able to get a Black Horse HP Agreement when you have a bad credit history.

Black Horse will make their decision based on your complete circumstances and finances, including existing debts.