Can I Ask My Creditors to Freeze Credit Interest? Cards & Loans

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Facing debt can be a tough road, but you’re in the right place to find help. Every month, over 170,000 people come to our website for guidance on debt solutions, so you’re not the only one seeking answers.

In this article, we’ll explore:

- How freezing your credit interest can help when you’re in a financial pinch.

- The process of asking your creditors to freeze the interest on your card or loan.

- The meaning of ‘freezing interest’.

- If creditors have to freeze interests when you ask them to.

- Ways to write off some of your debt.

Many on our team have personally faced debt issues, so we understand how worrisome it can be. This is especially true if you’re unsure about the fairness of the added interest and charges to your debt or if you’re struggling to afford your debt.

Stay with us to learn how you can manage your debt better and possibly freeze your credit interests. Our goal is to help you better understand your options and make informed decisions.

Let’s get started.

Does a Creditor Have to Freeze Interests If I Request?

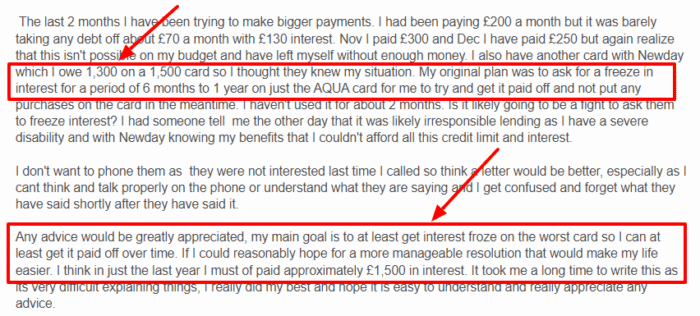

Remember that your creditors don’t necessarily have to freeze your interest and charges just because you asked. You can request them to do so by writing them a letter, but that is the extent of your power.

If they reject your loan interest freeze request, however, you can write them again.

For them to approve your interest suspension request on your debt, you need to really have a compelling reason – and what’s better than presenting your struggling financial situation?

Another way to convince your creditor is by adopting a debt management plan. A DMP increases the likelihood of your debt suspension request being approved.

In some cases, the creditors might reject your request to have your interests frozen. But at the same time, they might offer you a significantly lower interest than the interest and charges you were paying before.

Most creditors do freeze interest if you provide a reasonable Income and Expenditure Statement. This is because they are required by the FCA to show leniency for customers experiencing financial difficulties. If you do this in writing, the lender is more likely to accept your request.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Freeze Interest on Credit Cards?

Yes, freezing credit card interest is possible.

If you have worsening financial conditions, you can ask your credit card company to freeze interest on your credit card.

They might reject the initial request or lower the interest, but you can write them a letter of appeal again to freeze credit card interest, as it is allowed under the FCA’s regulations for credit card debt management.

» TAKE ACTION NOW: Fill out the short debt form

Are Interest and Charges Added to My Debt Fair?

The interest and charges added to debts are completely fair to the debtor unless the credit takes certain actions – which might be false, and so on.

Let’s put it this way:

When you sign up for a loan, there are certain terms and conditions set by the creditor and the Financial Conduct Authority (FCA). As long as the creditor charges you extra fees and interest based on these terms, it is fair to you, and you cannot call them out for it.

However, if your creditor goes on to increase your interest and charges later for no specified reason, then it is unfair to you.

Similarly, if they make you pay high interest whilst knowing that you are going through extreme monetary struggles, you can complain to the FCA, as it might seem unfair.

If you feel your creditor is charging you unreasonable interest rates, seek independent advice from organisations like the MoneyHelper or Citizens Advice Bureau.

Your creditor may also add interest and other charges for certain legal actions they have taken for the debts (e.g. using bailiffs). If they ask for a fair amount, then it should be fine with you.

However, if they ask you to pay more than the actual costs or fees for actions they never took, then you should complain to the Financial Conduct Authority.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

Freezing Interests With a Debt Management Plan

Debt management is actually a form of debt advice and solutions to help reduce financial pressures on you by helping you get rid of your debts.

Such plans and solutions don’t cancel your debt or request your creditor to write it off your credit. They, however, provide you with a well-formulated plan to help you keep track of your instalments as you strive towards becoming debt-free.

For instance, a debt management plan can help convince your creditor to accept lower instalments from you. It can also help get your interests frozen or at least lowered. Something similar happens when switching energy suppliers while in debt, as you can do it as long as you come to an understanding with your current supplier about a payment plan.

While you can apply to suspend interests, it’s better to reach out with a debt management plan, as the chance of getting request approval is slightly higher.

But it is easier to pay back the debt because of the longer and smaller instalments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.