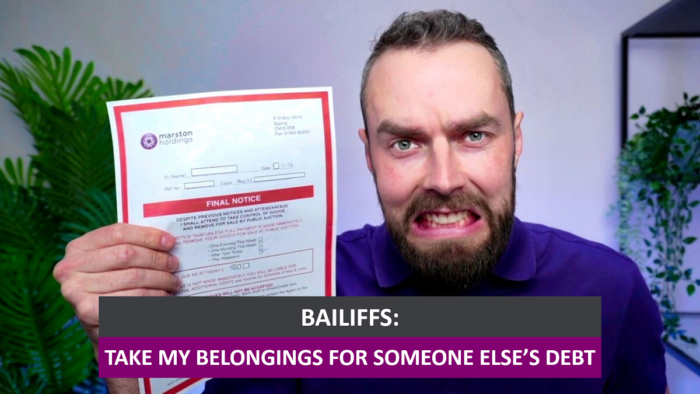

Can Bailiffs Take My Belongings for Someone Else’s Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried because bailiffs are at your door for someone else’s debt? We understand your fears. Many people are also scared that their things may be taken away. But we’re here to help you out. Each month, over 170,000 people visit our website for information on such debt issues.

In this article, we will guide you on:

- Understanding if the debt is yours or not.

- How to prove to the bailiffs that it’s not your debt.

- What to do if the debt belongs to someone else.

- What bailiffs can take if you live with your parents.

- How to complain about a bailiff.

Our team members have been in similar situations, so we understand how stressful it can be. We’re here to help you find the best way out of this tricky situation. Let’s take a look at how you can deal with bailiffs at your door for someone else’s debt.

Can Bailiffs Take My Belongings for Someone Else’s Debt?

How Do I Prove to Bailiffs That It’s Not My Debt?

» TAKE ACTION NOW: Fill out the short debt form

What Should I Do if It’s Someone Else’s Debt Entirely?

What can Bailiffs Take if I Live with Parents?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Complain About a Bailiff?

If you think that your bailiff has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to the bailiff’s company so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the bailiff agency may be fined. You could even be owed compensation.

If the bailiff’s company is not registered with the FCA, you can make a secondary complaint to the Civil Enforcement Authority (CIVEA) instead.