Can HMRC Debt Be Included in an IVA? Answer (2024 Rules)

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you unsure if HMRC debt can be included in an Individual Voluntary Agreement (IVA)? You’re in the right place to find answers. Every month, over 170,000 people visit our website seeking advice on debt matters.

In this article, we’ll help you understand:

- If HMRC debt can be part of an IVA

- The types of debt that cannot be included in an IVA

- How far HMRC can go back

Our team is made up of people who have gone through debt troubles themselves. We know that understanding the IVA process can be confusing, and paying off debt can feel overwhelming.

But don’t worry; we’re here to help make things clearer and easier for you. So, let’s delve into the 2023 rules and find out if HMRC debt can be included in an IVA.

Does an IVA write off debt?

Potentially yes – at the end of the IVA, any debt that has not been repaid will be written off.

Learn more about writing off debt with MoneyNerd.

Can HMRC debt be included in an IVA?

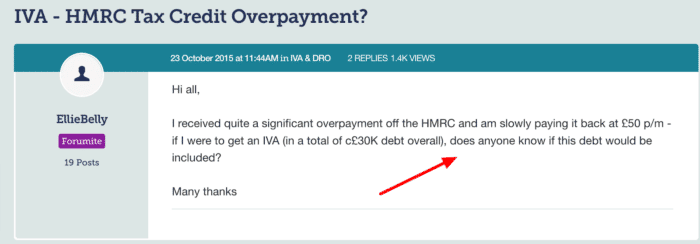

Can HMRC debt be included in an IVA? This is a common question among debtors considering an IVA with outstanding debts owed to HMRC, just like EllieBelly asks here:

Source: https://forums.moneysavingexpert.com/discussion/5346514/iva-hmrc-tax-credit-overpayment

Yes, it’s possible to include HM Revenue & Customs (HMRC) debt in your IVA, especially if your HMRC debt isn’t the majority of what you owe.

If most or all of your debt is owed to HMRC then an IVA might not be the best option for you. In this situation, you should discuss alternative debt solutions with a trained debt adviser.

What is included in an IVA?

An IVA can include lots of different debts. The most common debts included in an IVA are:

- Energy bill and water bill arrears

- Council Tax arrears

- Payday or personal loans

- Store cards and catalogue debt

- Credit cards debts

- Bank account overdrafts

- Debt owed to family and friends

- Outstanding invoices (e.g vet bills)

You can even include debts owed to companies in the EU.

How far can HMRC go back?

Innocent and careless mistakes can be investigated from the previous four to six years. If HMRC suspects there has been a purposeful and deliberate effort to avoid tax and other payments, they can investigate over the last 20 years.

What cannot be included in an IVA?

Although you can include HMRC debt in an IVA, there are some debts that cannot be included. The most common debts that people want to include but cannot are:

- Child support arrears

- Child maintenance arrears ordered to be paid by a court

- Magistrate Court fines

- Student loan debt

- Social Fund Loan arrears

- TV licence arrears

- Secured loan debt, including mortgages (they technically could be included but the lender would never agree)

All of the above need to be dealt with separately from the IVA.

Joint debts can pose different problems. Although a qualifying joint debt can be included in your IVA, the other person owing the debt is still responsible for 100% of the debt unless they also take out an interlocking IVA. You cannot have a joint IVA, only an interlocking one.