Can My Personal Debt Affect My Limited Company? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your personal debt? Are you wondering if it can affect your limited company? This article is for you.

Every month, more than 170,000 people visit our website looking for guidance on money and debt issues. So, you’re not alone.

In this article, we’ll explore:

- The difference between a Limited Company and a Sole Trader.

- How personal debt might affect your Limited Company.

- What to do if you’re worried about debt.

- How to deal with personal and company debt.

- What to do if someone is trying to collect your personal debt.

We understand your worries; many of us have also faced struggles with debt. It can feel scary, but remember, there are always ways to make things better.

Can My Personal Debt Affect My Limited Company?

If you are asking this from a financial perspective, the answer is no. A limited company is regarded as a separate legal entity, and any debt you personally owe is not connected with your limited company.

Think of it like this. You are employed by your limited company, usually as a director of the company. The same is true of an employee of McDonald’s.

If McDonald’s went bust and into debt, would their employees be responsible for paying the debt? The answer is, of course, no.

However, this is not the same as if you were running a business as a sole trader or if you transferred your personal debt to your business. We’ll get to this shortly.

» TAKE ACTION NOW: Fill out the short debt form

Are There Any Exceptions to The Rule?

Those eagle-eyed readers will have noticed that we answered the above question with ‘predominantly no’.

That is because there are some very rare situations when your personal debt may be affected by debt that your limited company needs to repay.

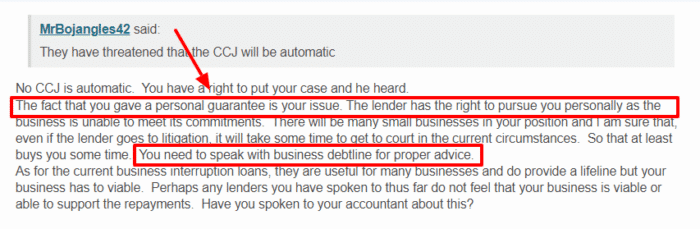

This is when credit was given to your company on the basis of you signing a Personal Guarantee. This type of document will make you personally responsible for any debt that the company has in regard to the credit issued.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can My Personal Debt Affect My Sole Trader Business?

In short, Yes it can.

If you have personal debts that you cannot repay, any assets you have in your sole trader business (such as tools, equipment or a laptop) could be repossessed as part of other personal belongings to pay off the debt.

However, having items repossessed to pay off personal debt only happens at a very late stage of debt collection. There are ways to avoid this happening, even if you can’t afford to pay off all your debt at once.

What About Partnerships and Personal Debt?

Personal debt may or may not be the responsibility of your partnership, depending on how it is set up.

Some partnerships operate like sole trader businesses and are, therefore, the same entity, whereas others are Limited Liability Partnerships (LLP) and are separate legal entities.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What to Do If Bailiffs Try to Collect Personal Debt?

If you have already been to court and had a CCJ issued for your debt, there is a chance that your creditors could chase the debt with bailiffs.

Also known as court enforcement officers, they have the right to repossess your items and sell them at an auction to pay off your debt. This is when your sole trader assets become fair game if they want them.

However, you can prevent bailiffs from repossessing any assets in the name of your company.

You might have bought a car in the company name or a new computer. Bailiffs cannot take these to pay off the debt.

What If I Need to Get Out of Company Debt?

The previously mentioned debt solutions are available for personal debt only. Another range of options is needed to get out of limited company debt.

For example, there is an equivalent of an Individual Voluntary Arrangement for companies called a Company Voluntary Arrangement.

You will need to speak with insolvency practitioners (debt charities have their contacts) to arrange company debt solutions.