Can You Transfer Personal Debt to Business? Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you a business owner with personal debts? You may wonder, ‘Can I transfer a personal loan to my business?’

You’re not alone! Each month, over 170,000 people visit our website seeking advice on debt solutions. We understand your worries about the impact on your business if personal debt is transferred over.

In this guide, we’ll cover:

- The difference between personal and business debt

- The process of transferring personal debt to an LLC

- How to possibly write off some debt

- Transferring your personal credit card to a business

- Balance transfer on a personal loan

Our experienced team has dealt with similar debt situations. We know your concerns and aim to provide you with clear, helpful advice.

Let’s get started!

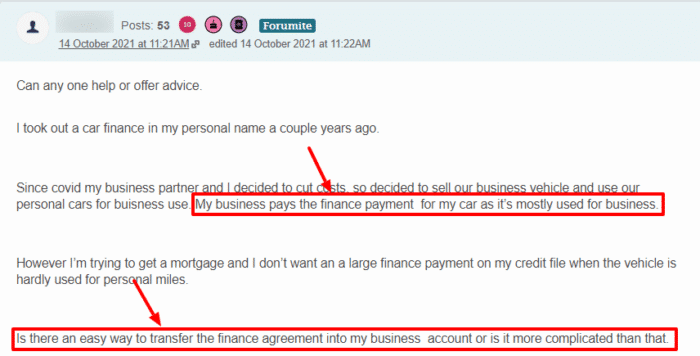

Can You Transfer Personal Debt to an LLC?

It’s not easy to transfer your consumer debt to an LLC. Even if you are able to do so, it’s also not the best idea.

If anyone would want to transfer their debt to their LLC, it would be an effort to dodge the debt.

And even if you transfer your debt, it will not only remain, but it will also increase through some fees, etc.

If you are looking to transfer your consumer debt just so you can ease down the process of payments, much won’t change again.

Is It a Good Idea?

If you are able to transfer your consumer debt to your LLC, it will not only become higher/larger due to some extra fees, tax, etc., but also won’t become any less of a burden.

Why? Because, even if you are transferring a debt off your consumer credit to some corporation, it will still be your responsibility.

You must also consider the potential tax implications. For example, interest on personal loans is not deductible in many cases, but business loan interest might be.

So, unless you have a solid reason for doing so, there’s no significant reason why you should transfer your consumer debts to your company debts.

» TAKE ACTION NOW: Fill out the short debt form

Can You Transfer Your Personal Credit Card to a Business?

Yes, you can transfer your consumer credit cards to company cards.

People might want to transfer their consumer credit to their business credit if they have used their consumer credit cards to make financial investments and funding for their, let’s say, new company.

However, in financial terms, there isn’t much that this transfer does for you – say, save you from debts, etc.

For instance, if you are transferring a bad credit history, dealing with it through your company credits won’t become easier.

The most it can do is help you keep better track of your new company’s financial history.

Similarly, if you are taking this step to protect your consumer credit from any financial mishap that your company might suffer, you will still be at minor harm.

This is because, for most credit card companies, a personal guarantee is an essential requirement when you apply for a loan from the company’s credit card.

I still advise that you always keep your company and consumer credit cards separate to keep better track of where your company is headed financially.

Also, because in the long term, its balance is beneficial in terms of lower interest rates in some cases, and no interest in rare cases.