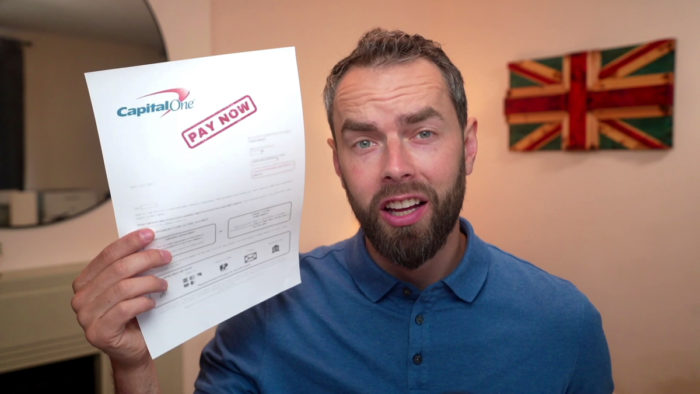

Capital One Default – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried about your Capital One credit card debt? We’re here to help. Every month, over 170,000 people visit our site seeking help with their debt problems. We’re experts at explaining debt and how to manage it.

In this article, we’ll explain:

- What Capital One is and what it means when you owe them money.

- How a Capital One default can affect your credit score.

- What happens if you can’t pay your Capital One debt.

- If you can write off some of your debt, and how to do this.

- How to contact Capital One about your debt.

We understand how hard it can be to deal with debt. But you’re not alone. We’ll walk you through your options and help you find a solution that works for you.

What happens if you owe Capital One?

If you miss a credit card payment to Capital One they will write to you or get in touch in another way. They will ask you to make the payment immediately or call them to discuss any financial difficulty stopping you from paying.

Their website states that they are open to personalised payment plans to help you pay off your credit card arrears in an affordable way. So it’s worth getting in touch with Capital One even if you know you can’t make the payment.

But if you don’t get in touch, Capital One will send you more letters and apply more fees for the missed payment(s). Your account could then eventually be closed and recorded as a default.

What is a Capital One default?

A Capital One default can refer to a missed payment or when Capital One closes your account because you have failed to pay off the debt. A default is a serious situation and shouldn’t be taken lightly.

Getting chased for Capital One debt

Once the Capital One debt has been sold to a debt purchasing company, they will contact you to make a payment or ask you to commit to a payment plan if needed. They’re likely to threaten court action if you don’t cooperate. This is known as a Letter Before Action because it gives you an opportunity to pay before potentially being taken to court.

Sometimes legal threats can be used as a scare tactic to get you to pay, but when the company has already purchased your debt it’s less likely to be an empty threat – but not always! Unfortunately, there’s no way of being sure that the legal threat is real or just a scare tactic.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay your Capital One debt?

You should aim to clear your Capital One debt, but only commit to a payment plan that won’t cause further financial pressure or cause other debts to arise elsewhere.

By ignoring the debt collection company, you run the risk of being taken to court. If you lose in court, you’ll be legally obligated to pay, and if you don’t, you could face bailiffs or have money taken from your wages.

If you think there has been a mistake, you should instead ask the debt collection company to prove you owe the debt. They must provide a copy of the signed credit card agreement from Capital One. if they cannot do this you don’t have to pay. And you can tell a judge that they didn’t prove the debt if taken to court.

» TAKE ACTION NOW: Fill out the short debt form

When you DON’T have to pay Capital One

Read more about statute barred debts to see if you are off the hook!

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Capital One and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

Will Capital One take a settlement?

Capital One might agree on a settlement figure for your arrears. The only way to know for sure is to ask. But if they have already sold your debt to a debt purchasing company, you’ll need to try and settle with them. The company may or may not agree to settle, depending on how much you offer.

Will Capital One remove a default?

Capital One may remove the Capital One default from your credit file if you pay the debt or settle the debt with them (or the debt purchasing company). Otherwise, the default will be automatically removed from your credit report after six years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What is the Debt Breathing Space Scheme?

You might be worried about debt collectors or legal action while you try to find a solution to your financial problems. It might be time to look into the Debt Respite Scheme (Breathing Space) from the government.

The Breathing Space scheme gives you a moment to get some advice or even start a debt solution. It started in May 2021 and gives you 60 days of no added fees, added interest, or enforcement action once you have passed the eligibility checks.

There are two types of breathing space that you can apply for:

- A standard breathing space: available for anyone with debt problems. It lasts for 60 days.

- A mental health crisis breathing space: available to those who are receiving mental health crisis treatment. It lasts for however long treatment takes, plus 30 days.

This scheme is not available in Scotland. Instead, you will need to apply for a Statutory Moratorium.

Capital One Contact Details

| Website: | https://www.capitalone.co.uk/ |

| Phone number: | 03444 812 812 (General Account) +44 115 993 8002 [General Account (outside of the UK) 0344 481 4814 (Additional Support) 18001 0344 481 8852 (deaf or hard of hearing) |

| Opening hours: | Monday to Friday 7am – 9pm Saturday & Sunday 8am – 5pm |

| Mail: | Capital One Card Services, P.O. Box 5283, Nottingham, NG2 9HD |

| Email: | [email protected] |