Can you get a CCJ for Council Tax?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Being in debt from council tax can make you feel lost and worried. But don’t fret; you’ve come to the right place for answers. Every month, over 170,000 people visit our website to find answers to their debt problems, so you’re not alone.

In this easy-to-read article, we will discuss:

- Steps to take if you can’t afford your council tax.

- What a Liability Order means and if it’s the same as a County Court Judgement (CCJ).

- How to deal with a Liability Order.

- The effect of council tax debt on your credit score.

- The legal results of not paying your council tax.

The average council tax debt among those seeking support from Citizens Advice has remained stable at £1,100 over the last year.1

We understand your worries about council tax debt. This article is here to guide you through it all. We will give clear and understandable advice, so you don’t need to feel overwhelmed.

Let’s get started.

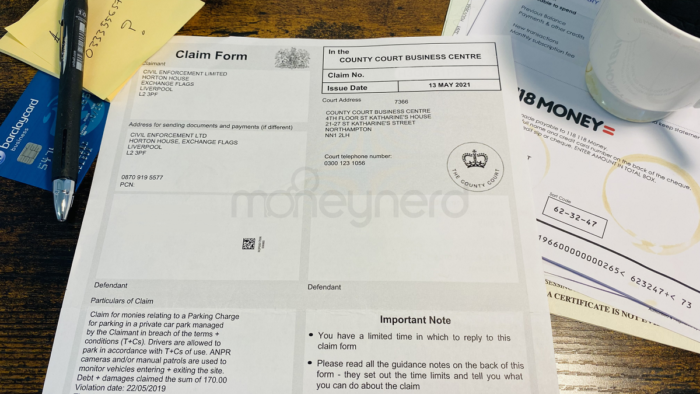

What is a county court judgement?

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your council, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgment will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

Note: Keep in mind that an N244 form is an application notice that can help you set aside a County Court judgement.

Can you get one for council tax?

What is a liability order?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Does it expire?

Can I ignore it?

No, you cannot ignore a liability order.

Failure to comply with a liability order can result in fines for you or for your employers. In extreme cases, you can even be imprisoned.

Dealing with arrears

How to get deductions

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

» TAKE ACTION NOW: Fill out the short debt form

How do I challenge it?

You have 14 days to inform the court that you disagree with the terms of your liability order.

You will need to write to the court and explain why you think the order that you have been given is wrong. From my experience, the most common examples include:

- You think that the court has set the instalments too high

- You want to request that the AEO is suspended while you explain to the court, in detail, why your employment might be affected.

A hearing will then be arranged. You must go to the hearing and take a detailed personal budget and information about any debt repayments or other outgoings that you have. You also need to take any other evidence that you have as to why you think that the liability order was wrongly given out.

You can then explain to the judge holding your hearing why you think that the liability order will cause serious problems or how your job will be affected.

Can bailiffs force entry?

Can They Take Everything?

There are strict rules on what bailiffs can’t remove from your property, even if they are collecting for priority debts like council tax. These items include:

- Anything that belongs to someone else – this includes things that belong to your children

- Pets or service animals

- Vehicles, tools, or equipment that you need for your job or to study up to £1,350

- A mobility vehicle or any vehicle with a valid Blue Badge

- Anything permanently fitted to your home – kitchen units, etc.

Bailiffs also can’t take things that you need to live. These items can be anything that you use for your ‘basic domestic needs.’ They can take some of these things, but must leave you with:

- A table with enough chairs for everyone in your home

- Beds and bedding for everyone in your home

- A phone or mobile phone

- Any medicine or medical equipment that you need to care for someone

- A washing machine

- A cooker or microwave, and a fridge.

If you think that a bailiff has taken something that they shouldn’t, you need to complain immediately.

You can also contact a debt charity for some advice. I have listed several charities that offer free advice at the bottom of this page.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What if I am a vulnerable person?

Before you start addressing the Notice of Enforcement from the bailiff about your council tax debt, you should know that if you:

- Are disabled in any way or extremely ill

- Suffer from any kind of mental illness

- Have children or are pregnant

- Are under the age of 18 or over the age of 65

- Are dealing with a stressful situation such as the death of a loved one or unemployment

- Don’t speak English very well

You are considered a vulnerable person. This means that any bailiffs will have to follow some additional rules to ensure their visit is as easy on you as possible.

Furthermore, if any of these conditions apply to you, you can get more time to deal with the Notice of Enforcement. You can also get more time if the Notice of Enforcement was not sent to you properly by the bailiffs or your council.

If you fall into any of the above categories, you need to either tell the bailiffs yourself or get a relative or carer to do it for you. You can then contact them by phone or by post. I have a free letter template that you can use to explain your situation.

When you speak to the bailiffs, you need to:

- Tell them that you’re vulnerable

- Explain why you would find dealing with bailiffs more difficult than other people in the same situation

- Ask them to stop any visits in the future because it will cause harm and distress to you

- Tell them if a letter or a visit could make your situation worse – this could be the case if you have a mental health problem or a heart condition, for example.

Make a note of what you agree with the bailiffs about future contact. This will make it easier to argue with them if they don’t stick to this new agreement, or if you need to make a complaint.