The Cheapest Car Insurance with a CD10 Conviction

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about finding car insurance after a CD10 conviction? It’s a common concern. In fact, over 9,300 people come to our website each month looking for advice on this very topic. It’s not always easy to find cheap car insurance after a driving conviction, but it’s definitely not impossible.

In this article, we’ll provide clear information and helpful advice about:

- What a CD10 conviction is and why it might lead to a driving ban.

- How a CD10 conviction can impact your car insurance.

- The difference between having your licence taken away and being banned from driving.

- How to find affordable car insurance even with a CD10 conviction.

- Why it’s so important to tell your insurance company about your conviction.

We understand that it’s scary to think about not being able to afford car insurance. And it’s even scarier to think about being unable to get insurance at all. But don’t worry; we’re here to help you navigate this tricky situation.

What is a CD conviction?

A CD conviction is a conviction for careless driving (CD). You’re assumed to be driving carelessly when your standard of driving is lower than an average competent driver.

The types of offences classified as careless driving can differ significantly, from driving without care and attention to causing death by driving.

In total, there are nine different types of careless driving offences: CD10, CD20, CD30, CD40, CD50, CD60, CD70, CD80 and CD90.

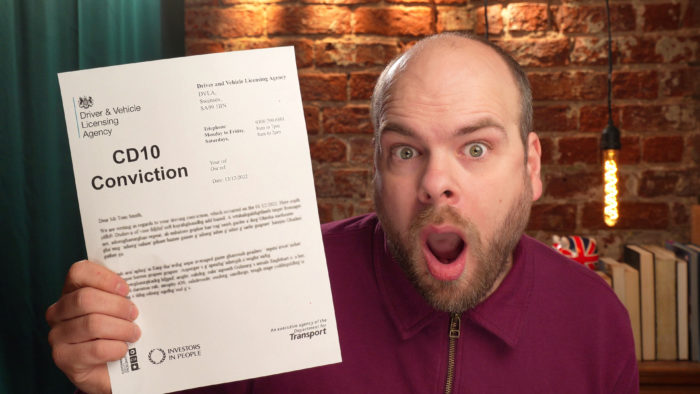

What is a CD10 conviction?

A CD10 conviction is a conviction for driving without due care and attention. The scope for these offences is large, but it doesn’t include driving without care and attention due to substance abuse or using a mobile phone. Both of these offences have separate conviction codes.

Is a CD10 a serious offence?

All careless driving offences are serious.

However, a CD10 is considered one of the lesser serious offences in comparison to other careless driving offences, such as a CD90 for causing death by driving.

Will a CD10 affect my insurance?

Yes, having a CD10 conviction will affect your insurance. It will make getting a competitive insurance quote more difficult, and it will affect the amount you have to pay in premiums.

Increases to your insurance premiums will depend on how many penalty points you received for the CD10 conviction. A minor infringement will only cause your premiums to increase slightly – and vice versa.

The biggest increases occur after a drunk driving ban or similar.

You might need to search for specialist insurance providers (or brokers) to get motor insurance when you have a CD10 conviction, which may be advertised specifically as CD10 insurance or as convicted driver insurance.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How can I get CD10 conviction car insurance?

Convicted driver insurance is vehicle insurance specifically for people with a careless driving conviction on their record. When you have a CD10 conviction, insurance providers consider you a greater risk of being involved in further road incidents compared to someone who doesn’t have any convictions.

The situation is comparable to someone trying to get a personal loan or credit card with a poor credit score. That person can find it more difficult to get approved for credit at a competitive interest rate if they haven’t handled debt repayments well in the past.

If you have a past record of careless driving, insurance providers might not be willing to insure you or offer you a competitive deal.

The good news is there are insurance providers who do offer coverage to people with careless driving convictions. Some brokers specialise in helping people with these convictions find the most competitive insurance policies.

How long does a CD10 stay on your license?

A CD10 conviction remains on your driving record for four years from the date of the offence. This is the case for all careless driving offences that don’t result in the death of another person.

What is the penalty for CD10?

The penalty for a CD10 conviction is between 3 and 9 penalty points, which will remain on your license for four years from the date of the careless driving offence. Moreover, you will have to pay a means-tested fine based on your income up to a maximum of £5,000.

This has been summarised in the table below:

| Conviction code | Offence | Penalty points | Conviction duration | Fine amount |

| CD10 | Driving without due care and attention | Between 3 and 9 points | Four years | Up to £5,000 (means tested) |

There are also additional costs to consider, including legal fees, court costs, and money spent on alternative transport if you are faced with a driving ban.

Can I hide my CD conviction from insurance companies?

No, you must disclose any driving conviction when applying for insurance when asked. If you don’t, your insurance will be invalid. If you’re subsequently stopped by the police, you could be given a long-term driving ban.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What is the cheapest CD10 conviction car insurance?

There are lots of insurance companies offering CD10 insurance policies, and these policies are subject to frequent change. Due to the selection of options and ongoing changes, it’s not possible to state which company has the cheapest option at your time of reading.

For this reason, it’s important to shop around and use car insurance comparison websites or a broker for support.

You may uncover better deals by searching specifically for convicted driver insurance instead of standard policies. Moreover, you could use an insurance broker who specialises in helping people with driving convictions.

The key takeaway is that you will have options. You just have to start searching wisely.

Are there any tips for securing affordable CD10 conviction car insurance?

To secure more affordable insurance with a CD10 conviction, you’ll need to rebuild trust with your motor insurer. To do this, you should focus on maintaining a clean record. This will prove that you are less of a risk on the road.

There is a possibility for convicted drivers to take rehabilitation courses, which may reduce insurance premiums in the future. These are often intended for those who have drunk driving and drugged driving convictions.

For more information on convicted driver insurance, it may be worth contacting Citizens Advice for free and impartial advice.