Can I Change from IVA to DRO? Your Options Explained

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to understand how to clear your debt and want to know if you can change from an IVA to a DRO? This can be a tricky thing to understand.

We are here to help you make sense of it all. Every month, over 170,000 people visit our website for guidance on debt solutions.

In this easy-to-understand guide, we’ll explain:

- What an IVA is and how it works.

- What a DRO is and how it helps with debt.

- If you can change from an IVA to a DRO.

- The good and bad points of changing to a DRO.

- How to deal with debt that is too much to handle.

We understand that dealing with debt can be hard. But don’t worry, we’re here to help you.

By understanding your debt and knowing how to manage it, you will be taking steps towards a better financial future.

Eligibility comparison

Below, I’ve added an IVA and DRO comparison table.

| DRO vs IVA | |

| DRO eligibility | IVA eligibility |

| Value of debts less than £30,000 (total) | Value of unsecured debt over £6,000 (total) |

| Value of savings or valuable items less than £2,000 in total | Have regular income |

| Own a vehicle worth less than £2,000 if sold today (exceptions apply) | Owe money to more than one creditor |

| Not enough money left at the end of the month to pay debt | Creditors must agree to IVA |

| Have lived or worked in England and Wales in the last 3 years | Must be based in either England, Wales, or Northern Ireland |

| Not currently bankrupt, have interim order, or individual voluntary arrangement | Must be set up by an Insolvency Practitioner |

| Not had a DRO in the last 6 years | IVAs are published on the Individual Insolvency register |

Can I switch from one to the other?

Yes, but this isn’t always the best solution if you’re finding it difficult to continue your IVA payments.

The IVA to DRO process will further hurt your credit profile and make it challenging to get credit, loans, or insurance in the future.

You may want to try other options before settling for a DRO. Plus, I suggest you seek professional advice before choosing this option if the IVA agrees to it.

The wrong debt solution could make your financial situation worse.

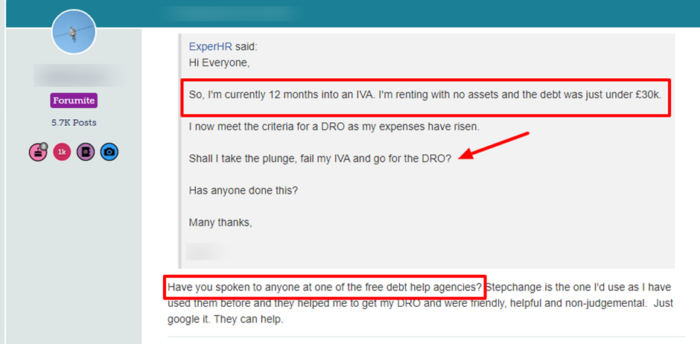

It’s a question many people ask, just take a look at this message and response posted on an online forum.

Source: Moneysavingexpert

Is switching a good idea?

Both IVA and DRO have their pros and cons when it comes to debt management. If you’ve started with an IVA and are considering switching to DRO, time is the core factor that determines whether switching is a good idea or not.

As such, when researching IVA vs DRO for debt management, you should seek professional advice first.

» TAKE ACTION NOW: Fill out the short debt form

Changing early in your agreement

If you cannot keep up with your instalments in the first half of your IVA and want to switch to DRO, this could be a good idea.

Since an IVA will last for five to six years, it’s better to take action early and switch to DRO if you cannot continue your payments.

Doing this will save you the stress and pressure of keeping up with payments, as being on a DRO means you wouldn’t make any payment toward the debt for one year.

And if your financial situation doesn’t improve, the debt could be written off. But you need to check that you qualify for a DRO first.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Changing in the second half

If you’ve reached the second half of your IVA, you want to explore other options before considering a DRO.

This is because switching to a DRO will mean another blow to your credit history, which will remain for another six years.

Thus, you want to explore other options that will not further impact your credit profile or sit on your credit history for another six years.

Some of your options before looking into a DRO are:

1. Reducing your payment

If you can’t meet the initial instalment payment, you can negotiate a payment reduction of up to 15 per cent, and your IVA firm should be able to approve this. However, if you propose a larger deduction, you would need approval from your creditors.

2. Finishing on a “funds paid to date” basis

If you are in the second half, especially in your last year, you can propose to finish “based on funds paid to date” instead of cancelling your IVA.

With this, you wouldn’t have to pay the remaining balance, even though you haven’t reached the end of your IVA.

The closer you are to the end of your IVA, the higher your chance of getting creditors’ approval.

That’s why individuals who have reached the final year often get approval when they apply to finish on a “funds paid to date” basis.

What are the downsides of a Debt Relief Order?

I’ve listed the DRO disadvantages below:

· The DRO will show on your credit history for six years, making it difficult to get credit.

· You might still have to repay your creditors if your financial situation improves.

· You can’t set up, promote, manage, or a limited company except with court permission during the DRO.

· You can’t act as a director for a company without court permission while the order is in place

· There are tight asset and debt restrictions on who can apply for a DRO.

What are the benefits of going with it?

Despite the downsides of a DRO, it can be a better way to get out of debt and avoid bankruptcy. Some DRO advantages include:

· It stops your creditors from taking court action against you

· It does not require court approval to proceed

· It helps to write off your debts after one year if your financial situation remains unchanged, thus making you live debt-free again.

· All debt repayments and charges or interest will remain frozen for a year.

How do I qualify?

There are strict DRO requirements which I’ve listed here:

· not have had a DRO in the last six years.

· be unable to pay your debts.

· have debts of £30,000 or less.

· have assets worth less than £2,000.

· have £75 or less spare income after your household expenses.

· not own a motorbike or car worth more than £2,000.

· live in or have a business registered in England or Wales

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Tips for managing debt

First, work out your budget which allows you to see how much you have left every month after paying essential things. This is known as ‘available income’.

Keep a copy which you can refer to when needed. Plus, creditors will ask for a copy if you ask them to let you make lower payments.

Try to be as accurate about your budget as you can.

I suggest you deal with your most important debts first which are known as ‘priority debts’.

These are:

- Rent/mortgage

- Energy supply

- Council tax

- Court fines

These are important debts because failing to keep up with payments could have far-reaching consequences.

Next, deal with non-priority debts which include:

- Overdrafts

- Catalogue debts

- Credit card debts

- Store card debts

- Unsecured personal loans

- Payday loans

Contact your creditors to tell them you’re working on sorting out your debts. You can ask them to:

- Cease contacting you for payments until you sort things out

- Stop adding charges and interest to the debt

Consider alternatives to an IVA or DRO. For example, with the right debt management plan in place, you could see your situation improve. A debt advisor could tell you about your options.

Do you have to talk to your creditors?

No. One of the advantages of debt solutions is that it saves you the headache of talking to your creditors or getting calls from them.

The Insolvency Practitioner (IP) handling your debt will be the middle person between you and your creditors in case there’s any information.

What is the impact on employment?

It depends. If your “contract of employment” states that you can’t have a DRO, then your job will be affected if you take a DRO.

Also, certain positions are automatically restricted for people with a DRO, such as becoming a company CEO, manager, or director.

What can’t you do?

There are restrictions attached to a DRO. These ‘rules’ mean you can’t borrow £500 or more without letting a creditor know about the DRO.

Plus you can’t promote, manage or set up a limited company. You can’t be a company director either without first receiving permission from the court.

Does an advisor check your bank account?

A DRO advisor may ask for bank statements as proof of income. Or they may accept benefit letters or pay slips. The Insolvency Service won’t need to see bank statements.

What debts Cannot be included?

Certain debts can’t be written off by a Debt Relief Order. It means you’d have to keep paying them. It includes:

- Criminal fines

- Child Maintenance Service arrears or CSA

- Student loans

- Social Fund loans

- TV Licence arrears

- Court ordered damages for personal injury