County Court Bailiff Eviction Notice – Know Your Rights!

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a County Court Bailiff? Have they contacted you about a debt? If this sounds like you, this is the right place to get help. Every month, more than 4,600 people use our website for advice on courts and debts.

In this article, we aim to help you understand:

- What a County Court Bailiff really is.

- What steps you should take if contacted by one.

- What duties these officers have.

- How you might lower your debt.

- What to do when these officers visit your home.

We know how scary it can be to face debts and court actions. Our team has been there too. We understand how you feel, and we are here to support you. This can be a tough time, but with the right advice, you’ll be able to navigate it with confidence.

Let’s dive in.

Can a County Court Bailiff Evict You?

Whether you face a mortgage debt or are in rent arrears, it is very much within the powers that bailiffs wield, to physically evict you. However, there is a strict timeline that has to be followed before a bailiff can literally, throw you out of the property.

- The landlord will informally ask you to leave the property.

- If you don’t leave, the landlord will officially notify you that you are being evicted by a certain date.

- If you still don’t leave, the landlord can apply to the local court for a warrant for possession.

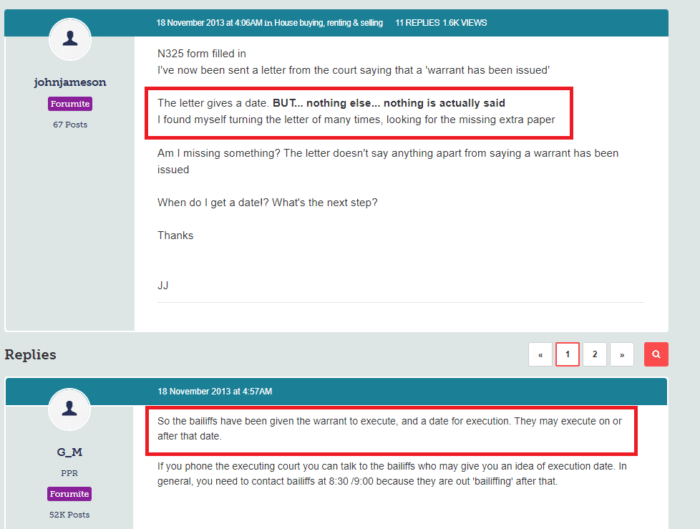

- An official notice of eviction will be sent by the court, setting the date you must leave the property.

- If you don’t leave by this date, the landlord can apply to the court for a warrant for possession. Once this has been issued, a team of bailiffs can come to the property, and physically evict you, by serving the warrant for possession.

» TAKE ACTION NOW: Fill out the short debt form

When Can a County Court Bailiff Enter Your Home?

There are different rules that relate to when a bailiff can force entry into your home and when they cannot. A bailiff cannot force their way into your home in the following circumstances.

- Nobody over the age of 18 is at home.

- They are collecting council tax arrears.

- The debt is related to credit cards or other forms of consumer credit.

- You are being chased for unpaid parking fines.

- The debt is for energy or other utility bills.

In all of these circumstances, the bailiff can only enter your home if you a) let them in, or b) they find an unlocked door to enter through.

In other circumstances, the bailiff may be allowed to force entry into your home (but not cause you physical harm). And these include:

- When serving a warrant for possession to evict you.

- To collect unpaid criminal fines.

- For tax-related debts.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When Do You Have To Speak to a County Court Bailiff?

There are circumstances that mean a bailiff will have to follow additional rules and may have to leave the property. And these include:

- If you are suffering from a serious illness or you are a registered disabled person.

- You are suffering from a diagnosed mental health issue.

- You are pregnant or you have young children in the house.

- You are over 65 years old or under 18 years old.

- You cannot either read or speak English properly.

- You have recently suffered a bereavement or other traumatic experience.

If none of the above applies to you, then you will likely have to face dealing with the bailiff. But you must first check whether everything is above board.

First, you should check that they are a registered bailiff. You can contact the local county court to confirm they are on the bailiff register. You also need to check the details of the warrant they are serving. All details must be 100% correct. Dates, names, amounts, everything. Even a simple spelling mistake would mean that the warrant is invalid and cannot legally be served.

Make sure that the date of execution of the warrant has passed. A warrant cannot be served before this date, as you must be sent notification of the impending bailiff visit at least 7 days before it happens.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Making a Complaint Against a Country Court Bailiff for Eviction

All county court bailiffs are empowered by the same set of rules and regulations. And they must work within these laws. Which are:

- Schedule 12 of the Tribunals, Courts and Enforcement Act 2007.

- The Taking Control of Goods Regulations 2013.

- The Taking Control of Goods (Fees) Regulations 2013.

If you believe that a bailiff has overstepped their boundaries, or acted in an inappropriate manner, you are fully within your rights to report this behaviour to the local county court. Furthermore, a bailiff cannot issue threats or attempt to intimidate you in any way (although many do act in an aggressive manner to try and scare you).