County Court Business Centre Claim Form – What To Do Next

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a County Court Business Centre Claim Form? Are you worried about what to do next? You’ve come to the right place. This article will help you understand what steps to take and whether you should admit guilt, dispute, or ask for more time to think about your situation.

Each month, over 170,000 people visit our website seeking advice on problems just like this one. You’re not alone.

In this article, we’ll cover:

- What a County Court Business Centre Claim Form is.

- What to do when you get one.

- How to respond to it, whether you owe the money or want to challenge the debt.

- What happens if you ignore the form.

- How to get help and advice if you’re finding your debt hard to manage.

Our team has dealt with many forms like this one, so we know how you might be feeling. We’re here to help you understand how to handle your County Court Business Centre Claim Form.

Why have I received a form?

When you get a claim form from County Court Business Centre, it means you’re being sued by someone.

Typically, it’s a Court form N1 that you’re sent. This is because CCBC takes on unpaid debts, including parking fines for car park management companies and other organisations.

Before you pay anything to County Court Business Centre, I suggest you contact a debt charity for advice on dealing with debt collection agencies.

I got a CCBC form. What should I do?

Never ignore a claim form. Always respond within the time limit to prevent matters from escalating.

Seek independent advice before you sign or pay A CCBC claim. Plus, you can ask County Court Business Centre to prove the debt. A court could strike out the claim if they can’t prove the debt is yours!

» TAKE ACTION NOW: Fill out the short debt form

What to do when you receive one

Respond to the claim form. Do NOT ignore it. You want to avoid the legal consequences of ignoring a claim form.

For example, a judgement could be entered against you if you do. Moreover, CCBC could pursue you for the money through the courts, and employ enforcement methods like bailiffs.

Plus, you could receive a CCJ, which stays on your credit record for up to six years. In short, a CCJ will impact your credit rating.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What steps should I take?

You should take specific steps when you’re sent a County Court Business Centre claim form.

- First, was the claim form served correctly? It needs to have been served correctly, which means it should have included a ‘Response Pack’. If this is missing, the claim form was not served properly. Therefore, you could ask to cancel the claim form.

- Next, does the claim form explain what the ‘claim’ concerns? You can file an application with the court to stop things from progressing when it does not include an explanation.

- Ask CCBC to prove the debt: Every debt collection agency legally must prove that the debt is legitimate and is actually yours. They should be able to send you a “prove the debt” letter showing the details of a specific debt, what you owe, who you owe it to, and when they need you to pay. Proving the legitimacy of debt is crucial. Otherwise, CCBC will be forced to mark the debt as settled.

- Lastly, was the claim form issued on time? There is only a specific amount of time for CCBC to begin a claim against you. The claim is time-barred if the debt is over six years old. You can ask the court to ‘strike out’ the claim when the time limit has expired. (In Scotland, the time limit is five years).

How do I respond?

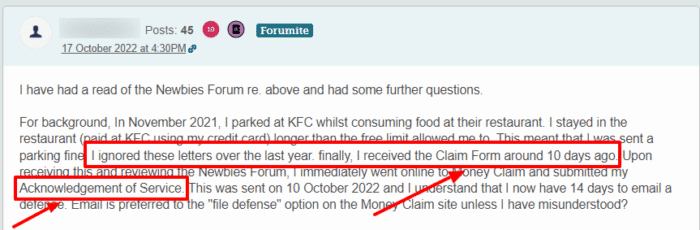

The claim form you receive should include a Response Pack which in turn should contain an ‘Acknowledgement of Service’. This is called form N9 (CC).

You have 14 days to respond, which begins from the day you get the claim form. In short, the court must receive the Acknowledgement of Service form no later than two weeks after you were served the claim form.

Again, a reputable debt charity can help you with filing an Acknowledgment of Service and other legal documents to the court.

It’s unwise to ignore a County Court Business Centre claim. They do not give up. If you choose to keep ignoring them, they might take you to court, which can escalate the situation.

I owe the money. How do I pay?

You can admit the debt when filling out the Acknowledgement of Service form. Plus, you can make an offer to pay back the money when admitting the full amount of the claim using the documents included in the Response Pack.

However, the payment itself would be arranged with the claimant, not through the court.

You have two options to pay back the debt to the claimant:

- Settle the debt in a lump sum payment.

- Ask for a repayment plan that allows you to pay it back in affordable instalments.

What if I want to challenge the debt?

You can tick the box in the Acknowledgement of Service form indicating you don’t accept you owe any money. In short, this states that you want to defend a debt claim, either in part or as a whole.

You effectively stop the clock from ticking as soon as you file a defence. County Court Business Centre cannot take the matter further until a ruling is made.

Note: The timeframe for presenting a defence against the CCBC form claim is two weeks. So you have at least 14 days to gather your documents and evidence and present them to court and CCBC.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when I ignore it?

Things escalate fast when you ignore a claim form you get from County Court Business Centre. You’ll get a CCJ on your credit history, and bailiffs could turn up at your door.

A CCJ could hurt your ability to obtain credit in the future (e.g. mortgage), while bailiffs’ enforcement actions involve repossessing your goods/items to recover the money.

You could also have to deal with the following:

- An attachment on your earnings to recover the debt

- Dealing charging orders

- Bankruptcy

Plus, things get expensive when you don’t respond to a CCBC claim form. You’ll have to pay bailiffs fees, solicitors fees and other associated costs.

So the risk of ignoring a debt claim can be costly in the long run.

I received a CCJ – What happens next?

You’d get a CCJ If you ignored calls and correspondence from County Court Business Centre. Once a CCJ is levied against you, it goes on your credit history.

If you can pay the total amount claimed by CCBC within 30 days of receiving a CCJ, you have the right to ask the court to remove it. This means the CCJ is “satisfied’.

What advice and help is there?

You should seek advice if you are confused or worried about getting a County Court Business Centre claim form. Some charities provide support and advice to people in debt. This includes:

Don’t try to cope on your own or sign things without first talking to an expert. Of course, you have to respond when things have escalated and you receive a County Court Business Centre claim form. But you can get confidential advice and support by speaking with a professional advisor.

County Court Business Centre Contact Details

| Post: | St. Katharine’s House, 21-27 St. Katharine’s Street, Northampton, NN1 2LH |

| Phone: | 0300 123 1056 (County Court Business Centre (CCBC) 0300 123 1057 (Money Claim Online (MCOL) 0300 123 1059 (Traffic Enforcement Centre (TEC) 0300 123 1058 (Centralised Attachment of Earnings (CAPS) 03003035174(for welsh-speakers) |

| Email: |

[email protected](Fee paid applications) [email protected](Centralised Attachment of Earnings (CAPS) [email protected](Traffic Enforcement Centre (TEC) [email protected](County Court Business Centre (CCBC) |

| Website: | https://www.find-court-tribunal.service.gov.uk/courts/county-court-business-centre-ccbc |