County Court Letter – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

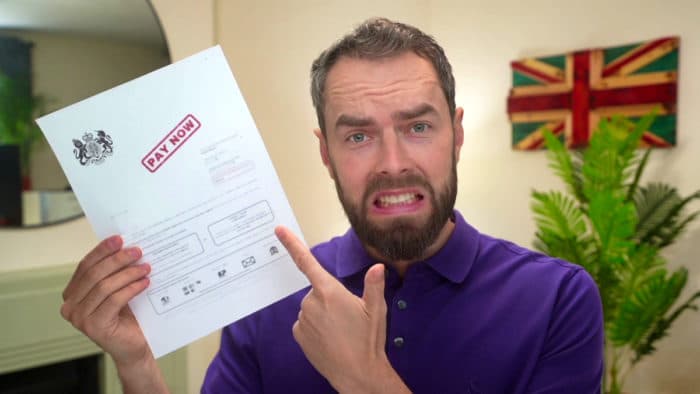

Have you got a county court letter? This is a note from the court asking you to pay a debt. If you’re feeling worried about this letter and what it means, you’re not on your own. Each month, more than 170,000 people come to our website for advice on debt problems.

In this piece, we will:

- Explain what a county court letter is.

- Tell you what steps to take next.

- Show you how to ask for proof of the debt.

- Talk about how you might be able to reduce some of your debt.

- Discuss how a County Court Judgement (CCJ) could affect your credit score.

We understand how scary it can be to get a letter like this, as many of us have been in the same boat. We’re here to help you understand what to do next and give you clear, easy-to-follow advice to help you deal with your debt.

Let’s find out more about how to handle a county court letter.

Ask for Proof of Debt

The first step after receiving a letter of claim is to check that the debt is yours. Use this customisable ‘Prove It’ template to figure out if the debt does actually belong to you.

For example, you might find that the debt belongs to someone else that used to live at your address.

How to Reply to the Letter of Claim?

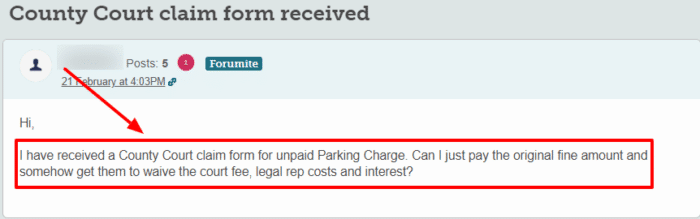

Use the form in the letter of claim to respond to the creditor. If you agree that you owe the debt, the next step is to fill in the details of your income and expenses (financial statement). You have 30 days to respond.

I have created this free budgeting spreadsheet to help you calculate what you can afford to pay.

Once you have your budget, make an offer of payment to your creditor.

Another debt management strategy is to repay the amount in full or lump sum. However, I suggest you offer an instalment plan if you think full payment will leave you in financial hardship.

In addition, let the creditor know that you’re seeking help from a debt charity to clear your debts.

Failure to come up with an agreement with your creditor can lead to court action. The next letter you may receive is a county court letter informing you of the CCJ.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Long Do I Have to Reply to a County Court Letter?

You have a little over two weeks from the date you received the county court claim form to respond. It’s vitally important that you reply within this timeframe.

You will receive a “claim pack” consisting of four forms, namely:

- N1 – Claim form

- N9 – Response pack

- N9A – Admission (specified amount)

- N9B – Defence and counterclaim

If you reply within two weeks with the completed N9A or N9B back to the creditor, you have the opportunity to arrange a repayment plan that is affordable to you. You can also reply online or apply for an extension using the ‘acknowledgement of service’ form.

If you fail to respond, you might have to pay a more expensive rate as decided by the court.

Having unaffordable payments can lead to further problems with the debt and could result in further enforcement action, such as the use of bailiffs.

If you’ve received forms that appear to be from a court, check that it contains a claim form, response park, N9A and N9B. If it does, it means a creditor has applied for a County Court judgment against you. Return the completed forms and make an offer to pay the CCJ to avoid any further court action.

» TAKE ACTION NOW: Fill out the short debt form

What Happens if I Ignore a County Court Letter?

Ignoring the county court letter will not stop court action from going ahead. The court will issue the judgement without taking your circumstances into account.

This is because you won’t have responded to share any information about your finances with the court. As a result, the court may order that you make full payment immediately or pay instalments that you may not afford.

You only have the chance to explain your circumstances and put forward a payment plan if you reply.

What Will Happen if I Get a CCJ?

You will need to repay the debt if you have a CCJ registered against you. You’ll be informed about how you must clear the debt.

The court decides the payment terms, which is why I always encourage people to respond to all county court letters.

If you didn’t return the forms in time or you’ve been ordered to pay more than you can afford, you still have two options available:

- Apply to change the payment terms if you can’t afford them.

- Apply to have the CCJ set aside or cancelled if you don’t admit the debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will a CCJ Affect My Credit Rating?

Your credit score can be negatively affected by a CCJ. When the CCJ is entered, it’s added to the Register of Judgment, Orders and Fines (operated by Regisry Trust).

Credit reference agencies, told of the CCJ, will add the details to your credit file. Lenders then use the credit file when you apply for credit and will likely see that you have a CCJ. This might affect your ability to obtain credit, like a mortgage or car finance.

In addition, some real estate agents and energy providers may deny you services because of your poor credit history.

As I see it, seek help from reputable charities like StepChange or Citizens Advice for debt advice on how to manage your payments. Once you’re back in control, you can take steps to repair your credit file.