Court Fine Enforcement Team – Can You Go To Jail?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a court fine? Are you scared that a bailiff may come to your home or take your things? You’re not alone. In fact, just like you, over 170,000 people use our website each month to find answers to their debt problems.

In this article, we will explain:

- What the magistrates’ court does.

- How court fines work.

- What to do if you’re fined.

- How to handle a court fine enforcement notice.

- If not paying a fine can lead to jail in the UK.

We at MoneyNerd know how scary it is to deal with court fines and bailiffs. Some of our team members have been in the same boat. We are here to help you understand the process and your rights. We will also share tips on how you might be able to write off some debt.

Let’s dive into finding a way through your worries about court fines and bailiffs.

What is a court fine?

A fine is a form of monetary punishment for minor crimes or “low-level” offences given by the courts.

The court determines how much you should be fined and stipulates the payment deadline.

After the fine, the court sends you a notice and collection order containing details about the following:

· The amount you have to pay

· The deadline for paying the fine

· How to pay

· Who you should contact if paying is challenging

· The next line of action if you don’t pay

What can you be fined for?

The Magistrates Court can fine you for various minor offences.

These can be in the form of:

You could be issued a charge for:

· Overspeeding and traffic violations

· Minor theft

· Driving without a valid licence

· Driving without insurance

· Failing to wear a seatbelt

· Drunk and disorderly behaviour

· Unpaid TV Licences/Civil offences

The role of the magistrates’ court

Criminal cases and some civil proceedings begin in a magistrates’ court and are either heard by:

- Two or three magistrates, or

- One district judge

Notably, juries are not part of a magistrates’ court involving legal proceedings.

Magistrates have the power to issue search and arrest warrants and to grant or refuse bail.

They can also impose fines and refer serious cases to a higher court.

Does a Court fine mean a criminal record?

No, court fines do not appear on your criminal record unless you are convicted of an offence.

That’s the end once you pay the court fine before the deadline.

The liability for your offence is immediately discharged, and it will not mean you have a conviction history.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you challenge a court fine?

As previously mentioned, if the fine amount is excessive or exceeds the statutory maximum, you may be able to appeal the fine.

The same could be true if the court failed to consider any mitigating circumstances that may have led to receiving a lower fine which could lead to a judicial review.

What if I don’t respond to the reminder?

It’s important to fill out the means enquiry form to help the collection officer determine the best course to collect the money.

Failure to respond to the reminder within ten days could lead to being summoned for an interview by the collection officer.

Here, the officer will take all the personal and financial information needed to decide how to make you pay the court fine.

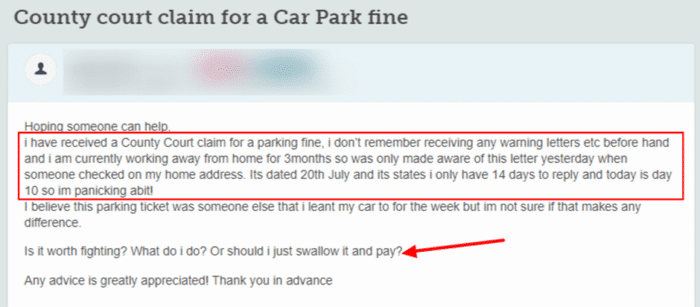

Check out what happened to one motorist who failed to respond to court papers.

Source: Moneysavingexpert

If the deadline for your Court fine passes

The court will transfer your case to the Fine Collection and Enforcement Team. That’s one of the repercussions of missing the deadline.

A collection officer will contact you (often via text) to remind you about the payment if you miss the deadline or you refuse to pay.

You are given a grace period of ten days, during which you must pay the fine.

As part of the reminder, you will receive a means enquiry form by post. The means enquiry form should be filled and returned within 10 days.

The form contains questions about your personal and financial situation to help the collection officer determine how best to collect the court fine.

It’s usually better to negotiate with the court and devise an affordable repayment plan before the case goes to the Fine Collection and Enforcement Team for debt recovery.

This is because collection officers will want to set a shorter repayment duration to collect the money quickly, making it difficult to pay your fine.

Court Fine Enforcement Number

You can pay a court fine or charge online or by phone. I’ve listed the phone numbers in the table below.

| Telephone: | 0300 790 9901 | England |

| Telephone: | 0300 790 9980 | Wales |

What steps will the Fine Collection and Enforcement Team take to make you pay?

With your financial and personal information collected, the collection officer can consider the following options to make you pay.

Note: Asset repossession is one of them.

Paying by instalments or extra time to pay

The collection officer will allow you the opportunity to pay in instalments or ask for extra time to pay your debts.

Your request must be in writing or given verbally, and the officer will work out a suitable payment plan for you.

Deductions from benefits

If you cannot pay in instalments or before the extra time elapses, the collection officer can look into your benefits and deduct the fine with or without your consent.

The maximum that can be taken weekly is £5.00, which can be deducted from benefits like your:

· Jobseeker’s Allowance

· Pension credit

· Income Support

· Employment and Support Allowance

Deductions from your income

If any of the above-mentioned options fail, the collection officer can take the fine from your income with or without your consent if you are employed.

They may ask your employer for a signed statement of earnings and decide how to remove the fine from your wages or salary.

Although the amount deducted depends on how much you earn and your situation, collections will not take more than 40 percent of your net income, leaving you with at least 60 per cent.

Here’s a table showing how much income garnishment can be taken from your weekly or monthly earnings.

| Net Weekly Income | Deductions (percentage) |

| £100 or less | Zero deduction |

| More than £100 up to £160 | 3% |

| More than 160 up to £220 | 5% |

| More than £220 up to £270 | 7% |

| More than £270 up to £375 | 11% |

| More than £375 up to £520 | 15% |

| More than £520 | 20% |

| Net Monthly Income | Deductions (percentage) |

| £430 or less | No deduction |

| More than £430 up to £690 | 3% |

| More than £690 up to to £950 | 5% |

| More than £950 up to £1160 | 7% |

| More than £1160 up to £1615 | 11% |

| More than £1615 up to £2240 | 15% |

| More than £2240 | 20% |

Bank account orders

Suppose the previous payment options fail or prove difficult. In that case, a collection officer can take another step by contacting your bank for your account information if there any are in your sole name.

If you have enough money in the account, the officer can direct the bank to freeze what you owe by issuing an interim bank order.

The court will likely summon you for a hearing before issuing an order to deduct the fine.

Vehicle seizure order

If the officer still can’t get you to pay the fine and you own a vehicle, they may ask the court to issue a vehicle seizure order.

It’s important to note that your car can only be seized with an order, so make sure you see the necessary papers before allowing them to take your vehicle away.

A notification should ideally come 28 days before the actual vehicle seizure date. It allows you to pay your fines and cancel the seizure order.

If you fail to pay after 28 days, your vehicle will be seized.

You have another 28 days grace from the seizure date to pay your financial penalty and reclaim your vehicle before further action is taken.

If you don’t pay, your car may be sold, and the fine is recovered from the sale proceeds.

Returning to court

If none of the fine collection options succeeds, your case returns to court, and you will get a summons for a court hearing.

The judge will look into your case a second time and consider the next line of action during this Judicial reassessment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you go to jail for not paying a fine UK?

Yes, but only in extreme cases could you face incarceration.

If the court finds out that you’re deliberately refusing to pay after looking into your case and considering your personal and financial situation, you could face imprisonment.

» TAKE ACTION NOW: Fill out the short debt form

Glossary of terms

Magistrates court – criminal and some civil proceedings begin in a magistrates’ court.

Collection order – a court issues the order that provides details on paying a fine.

Fixed penalty notice – a conditional offer to deal with a matter that prevents a case from going to court.

Penalty charge notice – a fine for a parking violation you can pay, appeal or challenge.

Parking charge notice – is issued by a private parking operator or landowner for a parking violation on private land, notifying a person they will be taken to court if the invoice goes unpaid.

Collection officer – a bailiff is responsible for debt enforcement once a court order to pay is issued.

Means enquiry form – is a Statement of Means questionnaire issued by the courts to determine a person’s income and outgoings.

Interim bank order – an order instructing a bank or building society to freeze a person’s account.