What Is the Difference Between a Trust Deed and Bankruptcy?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

A trust deed and bankruptcy are both solutions that can help you if you’re struggling with debt.

Many debtors are confused about how trust deeds and bankruptcy differ, and they’re also unaware of the differences in impacts that both these debt solutions can have on their lives.

In this post, I’ll be comparing a trust deed with bankruptcy and helping you determine which one would be right for you.

What is a Trust Deed?

A trust deed is a voluntary agreement that is made between you and your creditors (the people to whom you owe money).

A trust deed involves you paying a regular amount of money towards your debts in the form of monthly payments for a fixed period of time. When this time ends, any remaining debts you have are written off.

The amount of money which you pay in the form of monthly payments will depend on how much you can afford.

How does a Trust Deed work?

When a trust deed is put in place, all of your belongings as well as property (all of your valuable assets), are passed to a third party. They are responsible for looking after your financial affairs while your trust deed is in place. This third party is known as your trustee.

It’s the aim of the trustee to repay as much of your debt to your creditors as possible. At times, this can involve selling some of your assets in order to raise money to repay your debts.

Trust deeds can only be set up through a licensed Insolvency Practitioner (IP). Your trustee is the one who manages your trust deed from start to finish and helps you through any issues you may have during the course of it.

What is a ‘Protected’ Trust Deed?

A trust deed can be turned into a ‘protected’ trust deed if a majority of your creditors are satisfied with its terms. A protected trust deed would mean that the terms of the trust deed become legally binding for all of your creditors.

This would mean that they can’t take any further legal steps to recover their money from you.

Examples of this could be seeking legal action to:

- Make you bankrupt

- Attempting to seize your assets

It’s important to note that if a trust deed is not ‘protected’ then it’s not legally binding on all of your creditors. This means that they are still allowed to take legal action against you if they aren’t satisfied with your repayments.

A trust deed typically lasts 4 years.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is a Trust Deed the right solution for me?

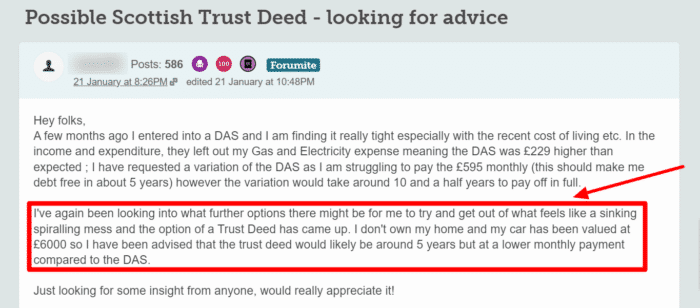

It’s difficult to know whether a Trust Deed is the right choice for your current financial circumstances, as this forum user is experiencing:

A trust deed can be a great option for you if:

- You have unsecured debt that totals up to £5,000 or more

- You have enough surplus income to make significant monthly contributions towards your debts. Please note that you can’t set up a trust deed if your income comes only from benefits.

- You have assets such as savings or a car that can be sold in order to raise money for creditors.

You can only opt for a trust deed if you’re a resident of Scotland.

What is Bankruptcy or Sequestration?

Bankruptcy is known as sequestration in Scotland. It’s a form of insolvency and is suitable for individuals who cannot afford to pay back their debts within a reasonable time.

How does sequestration work?

As a part of sequestration, your assets may be seized and sold off in order to repay your debts.

It’s important to note that if your assets are more valuable than the amount of debt you have or if you can afford to keep up regular monthly payments, then sequestration may not be the right option for you.

In this case, you can look towards other debt solutions such as trust deeds or a debt arrangement schemes (DAS).

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is sequestration the right solution for me?

There are many benefits to sequestration. For example:

- Most unsecured debts are included within a sequestration, and it allows you to become debt-free within a short amount of time rather than 4 years.

- It results in all of your unsecured debt being written off – although there’s a chance that you may be obligated to make a contribution.

- Once sequestration has been done, creditors will stop contacting you. Furthermore, once sequestration starts, your creditors cannot chase you for the money you owe them.

While all of the benefits described above may seem great, there are certainly some risks of sequestration which you also need to be aware of. This includes:

- Any valuable assets that you own, such as your house and/or car, will be sold off in order to raise money for your sequestration. While this can also happen in a trust deed, it’s not always the case.

- Opting for sequestration may also cause you to lose your job. If you’re employed in the financial sector, you will most likely be dismissed once you become formally insolvent.

- You also cannot run for public office or act as a company director.

- Sequestration also has a huge negative effect on your credit rating. Your sequestration will be recorded in your credit file, and it will stay there for six years.

This means that for six years, you will have a lot of difficulty securing any type of credit. Even if you are able to secure credit, it will be offered to you at very high interest rates until you can get your credit rating back to normal.

Long-Term Impacts of Trust Deeds/Sequestration and the Road to Recovery

While both of these options will have a very negative effect on your credit score, there is the possibility for recovery. It is important to focus on:

- Rebuilding your credit score.

- Learning budgeting skills – there are many online courses to help with this, or you can contact a financial advisor.

- Understanding how to avoid future financial pitfalls.

It’s important that you understand what each debt solution offers before you opt for one. If you’re having trouble deciding, you can also get additional debt advice from debt charities such as National Debtline or Payplan.