What Does Discharged Mean on a CCJ?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you dealing with a bailiff company and want to know about County Court Judgments (CCJs)? Are you confused about what “discharged” means on a CCJ? Don’t worry, we’re here to help.

Over 170,000 people come to our website each month to find answers to their debt questions. We’re ready to help you too.

We will talk about:

- What a CCJ is and what it means for you.

- What to do if a bailiff comes to your home.

- How to handle a CCJ and what happens if you ignore it.

- What “discharged” means on a CCJ and how it affects your credit report.

- Ways to deal with too much debt, including how to legally write off some of it.

Remember, you’re not alone in this. Many people face the same worries and fears. Our team has a lot of experience in dealing with these issues. We understand how tough it can be, so we’ll guide you through every step of the way.

Here are your options when it comes to dealing with CCJs and debt.

What is a CCJ?

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

What does discharged mean on a CCJ?

A discharged CCJ is when you are no longer subject to the CCJ. In other words, the CCJ is no longer applied because you have paid off your debt in full.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you get a CCJ discharged?

To get a CCJ discharged you must have paid off the debt within one calendar month of receiving it.

Once the debt has been repaid, it’s your job to contact the court and inform them that the debt was repaid within one month. You will need to provide evidence of this.

Once the evidence has been received, the court will communicate with the Registry Trust to have the CCJ discharged.

» TAKE ACTION NOW: Fill out the short debt form

What if you pay off the debt after one month?

You can still pay off a debt subject to a CCJ after one month has passed. If you clear the debt after one month, the CCJ is known as satisfied rather than discharged.

What does satisfied CCJ mean on a credit report?

A satisfied CCJ on a credit report means you have paid off the debt but you paid it off after one month of receiving the CCJ, so it isn’t classified as “discharged”.

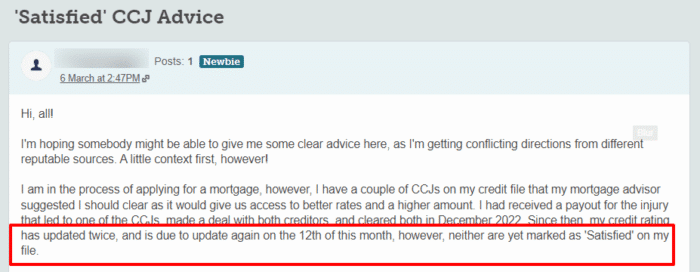

But keep in mind that it can take some time for your credit report to show that your CCJ has been satisfied.

Courts won’t send updated CCJ lists daily or even weekly. This means that it can take a while for your credit file to show the correct status of your CCJ.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long does a discharged CCJ stay on your credit file?

A discharged CCJ will stay on your credit file until the credit reference agency has been instructed to remove it by the court via the public register. This can take weeks.

Remember, this is unlike an existing or satisfied CCJ, which will remain on your credit file for six years.

Will a bailiff charge me fees?

If you don’t pay your CCJ and you end up with bailiffs chasing you, you need to be aware that they can and will charge you fees. These fees will be added to your debt.

These fees are generally quite similar, and some bailiff charges are even standardised. County Court bailiffs, for example, have set fees of £75 for a Notice of Enforcement and £235 if they have to actually enforce the debt.

Keep in mind that the enforcement fee can be a bit higher. Usually, they will charge an extra 7.5% of your debt if that debt is over £1,000.

This means that if you have a debt of £1,500 that you don’t pay, you will be charged:

- £75 for Notice of Enforcement

- £235 for Enforcement

- £112.50 for the 7.5% over £1,000.

- Total: £422.50.

Can I get a discharged CCJ removed?

Yes, you can apply to have a discharged CCJ removed from your credit file. To do this you’ll first need to apply for a Certificate of Satisfaction from the court.

To apply for the Certificate of Satisfaction, you will need to download, complete and send off claim form N443, which can be found on the government’s website here.

Once the court has evidence that the debt was repaid within one month, it should notify credit reference agencies as well as the public register. However, it usually takes longer for credit reference agencies to catch up and remove the CCJ from your file.

The only other way to get a CCJ removed from your credit file is to have the CCJ set aside. To get a CCJ set aside, you’ll need to prove that you don’t owe the money and the CCJ shouldn’t have been issued in the first place. There could be fees as part of this application.

Can I get a satisfied discharge removed?

No, a satisfied CCJ cannot be removed from your credit history. It will remain on your credit file for six years from the date the CCJ was issued before automatically being erased.

Having a CCJ on your credit file will make it much more difficult to get approved for credit cards, loans or a mortgage. Additionally, the payment defaults that led to the CCJ are also likely to be visible on your report.

What happens if you ignore a CCJ?

Ignoring a CCJ, even if you think there’s been a mistake, is not a good idea.

If you just ignore a CCJ, fail to respond to the CCJ letter, or fail to make a CCJ payment plan will result in further action.

The court might send a bailiff to enforce the CCJ and collect the debt. Baillifs will inform you that they are going to visit 7 days in advance, but they will add fees to your debt. You might be able to make a repayment plan with the bailif but if you don’t or you don’t stick to the plan, they can take your belongings.

If you don’t let the bailiff in, they can’t force entry but they might be able to take things that are outside, like your car.

But the court might not send a bailiff and might take money from your monthly earnings. They could also make you bankrupt if you owe more than £5,000, or take money from the sale of property.

The court can also compel you to go to a hearing. There you will discuss your income and how you can pay off the debt. You must go to this hearing or you can be imprisoned.