Elliott Davies Bailiffs – Should You Pay Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re dealing with Elliott Davies Bailiffs and wondering whether or not you should pay your debt, you’re in the right place for answers.

Many people feel the same way as you do. In fact, over 170,000 people visit our website each month for guidance on similar debt issues.

In this guide, we will:

- Help you understand if the debt Elliott Davies claims you owe is really yours.

- Explain the difference between a debt collector and a bailiff.

- Show you how to deal with Elliott Davies and stop them from bothering you.

- Discuss your options for setting up payment plans or even writing off some of your debt.

- Prepare you for a visit from Elliott Davies Bailiffs.

We understand how worrying it can be when a bailiff company is threatening to take your things. Many of our team members have been in your shoes, dealing with debt collectors and bailiffs. We know what it’s like, and we’re here to help you through it.

So, let’s dive in and find out how you can deal with Elliott Davies Bailiffs.

What Is The Reason for the Calls?

Why am I getting debt collection calls, and are they legitimate? It’s a question you may be asking yourself.

Elliott Davies is a legitimate company with the right to contact you about outstanding debt.

These are some possible reasons why they may be trying to track you down, which I have listed here:

- You failed to pay back a debt to businesses, organisations or other individuals

- You have unpaid tax due to HMRC

- There are credit cards or payday loans you failed to pay back

- You defaulted on court fines

The bailiffs have contacted you because the original creditor passed your unpaid account over to Elliott Davies.

They can do this when they could not get hold of you to settle the debt.

It means that although the debt is not with Elliott Davies directly, they have the right to collect the money.

Some of the companies they may work on behalf of include:

- Utility companies which may include NPower and other similar organisations

- Mobile and broadband companies, including well-known providers such as O2, Virgin Media and EE

- Local council, for council tax debts and similar

Elliott Davies may not buy debts individually, they may purchase them in bulk, as it is more worth their while.

They make a profit on the debt when they start to receive payment, and since they buy the debt at a fraction of its value, it can be a profitable business.

Responding to Contact from Elliott Davies

If Elliott Davies has contacted you, there are some things you should (and shouldn’t do) to deal with the situation.

Negotiating with bailiffs can be stressful, so I suggest you seek advice from one of the leading UK charities if you’re at all concerned.

» TAKE ACTION NOW: Fill out the short debt form

Don’t hide from your problems

You should never ignore contact from Elliott Davies. They won’t just disappear.

They will keep trying to reach you and may even cause you a great deal of hassle in the process.

In some cases, you may end up being charged more, depending on the action they need to take.

For instance, you could be charged the following:

- Compliance – £75. This is the cost for sending an enforcement notice with a request for payment.

- Enforcement – £235 (or 7.5% over £1500). A charge for visiting your home and taking goods.

- Sale of goods – £110 (or 7.5% over £1500). The cost if they need to sell your goods to cover the debt.

You should always respond to any correspondence you receive, even if you are not responsible for the debt.

Make sure you know if you are liable for the debt payments, and then take the most appropriate action.

Is this even your debt?

If you have received correspondence from Elliott Davies saying you owe money, you should always seek confirmation on the debt.

It could be the case that the debt is someone else’s and they have contacted you in error.

You may even have paid the debt previously, but they have not updated their records.

You may not need to pay the debt if:

- You have failed to make a payment within the last six years, or

- You have not spoken to the creditor in this time

If you were pressured into signing the agreement or there were no checks carried out to check you could pay it back, you may not be required to pay the debt.

Clear your debt

If Elliott Davies proves it’s your debt, you must pay it.

You should clear the debt quickly so the company doesn’t contact you again.

Ask Elliott Davies to give you a receipt to confirm the payment has been made.

If you can’t afford to pay the debt in one go, you should come to an arrangement to repay it via an affordable repayment plan.

You can contact Elliott Davies and discuss your income and expenditure, and they should develop a suitable plan.

They should put a hold on any further charges.

Have Elliott Davies Already Taken Your Goods?

If you have already allowed access to Elliott Davies into your property, you may be worried that all is lost and you’ll never recover your goods.

But there are things you can do.

The key here is to act as quickly as possible. You should aim to settle your debt, if possible.

The other option is to speak to Elliott Davies and ask them to set up a suitable repayment plan for you.

You may even be able to buy the goods they have taken to clear the debt.

Reclaiming possessions from bailiffs can be challenging, so I suggest you seek advice from one of the not-for-profit organisations first.

Elliott Davies is responsible for following specific legal procedures, and if they fail, you could be entitled to get your goods back.

I suggest you contact Citizens Advice for more information on this.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Preparing for a visit from Elliott Davies Visits?

Knowing how to handle bailiff visits can be challenging if you’re unaware of your rights.

You are only required to permit access to bailiffs in exceptional circumstances, such as tax debts or court fines.

They will probably try and insist that you allow them permission, but under normal circumstances, you should not let them in.

If you have serious debts, you should insist they provide you with the necessary paperwork to prove this.

They may decide to get a locksmith to gain entry, but they cannot break the door down.

If Elliott Davies turns up at your door, you should request they provide identification.

These are some of the typical types of ID they should provide you with:

- Identification that shows who they are, such as an ID badge

- Evidence showing the company they are contacting you for

- Proof of what you owe with a clear breakdown

- A warrant or writ, if they plan to force entry

You don’t need to allow them entry to your home to provide these documents.

You can ask them just to put these through your door. Some key things to check on the documents are that they are in date and the information is correct.

If you have checked the documents and there are any details you need clarification on, you should tell the agent from Elliott Davies to leave.

You should then contact their head office instead. In short, if the details on the debt are incorrect, such as the name, you should speak to the head office.

Elliott Davies will keep trying to get the debt from you, so it is worth contacting the head office either way – even if you don’t believe you owe it.

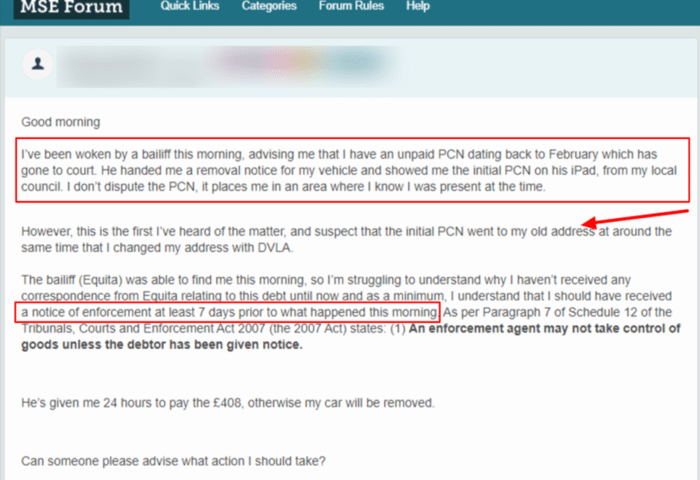

Case study: bailiff visit

Check out how one person was woken up by a bailiff visiting their home. They posted this message on a popular forum.

Source: Moneysavingexpert

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is There Any Way to get Elliott Davies Off Your Back?

If agents from Elliott Davies have contacted you, they will be ‘eager’ to get you to pay your debt.

Handling debt collection agencies can be stressful.

They may come across as quite brash when you speak to them, and they may even insist that you pay the debt right then and there!

If you ignore them, they will continue to contact you.

If you want to ensure they don’t come to your door, you should clear your debt or make arrangements to repay it.

Although Elliott Davies has a lot of powers, they must also treat you fairly.

Elliott Davies Bailiffs Contact Details

| Website: | https://www.elliottdavies.com/ |

| Phone number: | 0343 504 1606 |

| Email address: |

[email protected] (General Enquiries) [email protected] (Debtors) |

| Post: | PO Box 396, Loughton, Essex, IG10 9GL |

References

Schedule 12, Tribunals, Courts and Enforcements Act, 2007

Part 1, Regulation 10, Certification of enforcement agents, 2014.