What is an Example of an Unsecured Loan? Borrowing Explained

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering what an unsecured loan is and what’s the process for getting one? Don’t worry! You’re not alone. Every month, over 170,000 people visit our website looking for guidance on similar debt matters.

In this guide, we’ll explain:

- What an Unsecured Loan is.

- What the alternatives to an Unsecured Loan are.

- How lenders are regulated.

- What happens if you don’t pay.

- Whether an Unsecured Loan is right for you.

Our team understands what you’re going through, as many of us have been in similar situations, so we know exactly how to help you make sense of things. Let’s dive in and learn more about Unsecured Loans!

What Is an Unsecured Loan?

When a lender gives you a lump sum as an unsecured loan, the debt is not secured against your property, such as your home. But don’t fool yourself into thinking the loan provider can’t ask the court to enforce repayment. From my experience, this is not the case.

Unsecured loans are helpful for some purposes, but not all. In many cases, other lending products might be more appropriate. In general, unsecured loans are relatively short-term and are ideal for providing funds for the following purposes:

- Buying a new or used car.

- Making repairs, improvements or additions to your home.

- Paying off other debts to consolidate your monthly repayments at a lower interest rate.

- Paying for ad-hoc events such as a wedding, honeymoon or holiday.

In general, you won’t be able to borrow a large amount of money as an unsecured loan. Typically, you can borrow anywhere from £500 up to £25,000. In exceptional cases, if you are seen as a very low risk by lenders, you might be able to borrow as much as £50,000.

What Happens if You Don’t Pay Back Your Unsecured Loan?

This is where things become tricky.

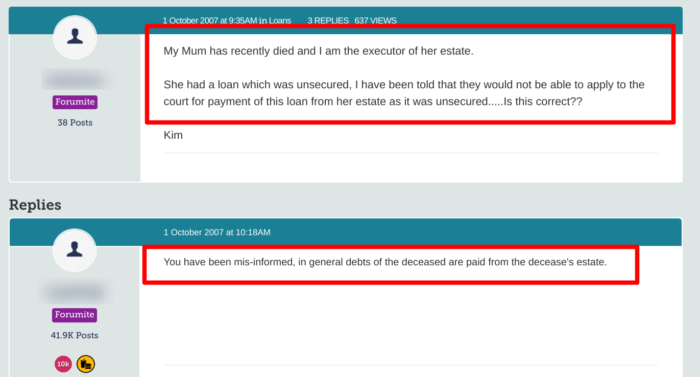

Many wrongly believe that an unsecured debt cannot become the basis of legal proceedings to collect the debt. However, the finance firm can chase the debt through the legal system and this begins with your creditor asking your local county court to issue a County Court Judgement (CCJ) against you for the debt. If this happens, you’ll receive a county court claim form to complete and return.

If the CCJ is granted, you could end up with the county court bailiffs sending you a letter telling you they are coming to your home to collect the debt. The bailiff will visit and ask you to pay up, or they will take goods from your home to sell.

It is important to note that the bailiff can’t break into your home!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is an Unsecured Loan Right for You?

If you need a small amount of short-term funds and have no other credit available to you, then an unsecured loan might be a good option. However, there are potential fees associated with unsecured loans, such as arrangement fees or early repayment fees, that could make this option less favourable in the long run.

If you have access to other forms of credit, such as a bank overdraft or credit card with a high limit, you should carefully consider all options before choosing.

Look at the term you want to repay the debt over and the total amount of interest you will accrue for each of the credit options you have. If an unsecured loan is the cheapest, it could be your best option.

Use my loan payoff calculator

If you have an unsecured loan, you can use my free payoff calculator to get an estimated breakdown – including interest and repayment period.

A loan payoff calculator might be a valuable resource if you have a loan debt in the UK and are struggling to meet repayments or just want to stay on track.

Generally, an unsecured loan is a short-term loan with a term of between one year and seven years. However, some lenders might offer a longer term in certain circumstances.

Remember that the term unsecured doesn’t mean you can simply not repay the debt and get away with it. You will be chased for repayment. If the person who signed the contract dies, their estate will be expected to repay the loan.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Alternatives to an Unsecured Loan?

An unsecured loan is generally a short-term loan for a relatively low amount of money. There are other sources of short-term credit that might be more suitable to your financial needs.

- Credit cards – if your credit limit is high enough, you could pay using the card or take a cash advance instead of taking out an unsecured loan.

- Bank overdraft – if you have an overdraft facility with your bank, this could be a good alternative to an unsecured loan.

- Borrowing from family and friends – if you only need a small amount of money, you might find that you can borrow from people you know.

How Are Lenders Regulated?

All lenders in the UK are regulated by the Financial Conduct Authority (FCA) and must comply with the relevant laws. Companies must be operated by what the law deems as fit and proper people, they must act ethically, and their operations should be based on a sustainable business model.

If you believe you have been treated unfairly or unethically by a company that has provided you with an unsecured loan, you can complain to the FCA. You can do so by contacting the Financial Ombudsmen Service.