For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for ways to clear your loan debt? You’ve come to the right place.

We understand how worrying it can be to owe money and feel unsure of your options. This article will help you discover different ways to clear your loan debt. We’ll share information on:

- Things to think about when taking out a loan

- What happens if you miss a loan payment

- The difference between secured and unsecured loans

- How to find extra money to help repay your loan

- Ways to get out of debt and repay your loan

Over 170,000 people visit our website each month seeking advice on debt problems, so you’re not alone. Some of our team have had debt worries too, and we know how tough it can be.

So, whether you’re asking, ‘do everyday loans pay out same day?’ or wondering about the pros and cons of Coop Loans in 2023, we’re here to help. We hope this article gives you a better understanding of your choices and how to move forward with clearing your loan debt.

What should I consider when taking out a loan?

When considering a loan, it’s important to consider how debt repayments affect your finances, as well as having a clear understanding of loan terms. Moreover, it’s also essential to consider how you will manage to keep up with repayments if you face unexpected financial challenges.

Before you apply for a loan, it’s worth using our free loan payoff planner for a full and clear picture of how managing loan debt will affect your monthly finances.

When you use this free resource, remember that the interest rate you’re offered might not be the same as the representative rate advertised by lenders, which is critical when managing loan repayments.

Secured vs. unsecured loans

It is important to understand the differences between secured and unsecured loans. An unsecured loan doesn’t require any asset to be listed as security in the credit agreement, whereas a secured loan does require a security to be used as collateral for loans.

The asset is at risk if you fail to repay secured credit. This is one of the unsecured loan advantages.

What is security on a loan?

A secured loan requires an asset to be used as security. Collateral for loan agreements usually involves the property of the borrower.

What are the different types of loans?

Many different types of loans are available, depending on what you need them for and your financial circumstances. In navigating through your financial journey, understanding the array of loans available in the UK is pivotal. Evaluating each loan type against your repayment capacity, loan duration, and use case can safeguard your financial stability. Understanding different loans is vital to ensure you get the right one and explore the pros and cons of various loans.

- Personal loans – A bank, building society or finance company can give you a personal loan whether or not you’re a customer. You can apply for a loan in person at a branch, by post, by phone, or online.

- Payday loans – A payday loan is a short-term loan intended to tide you over until you next get paid. It’s an expensive way to borrow.

- Student loans – The government authorises student loans through the Student Loans Company (SLC).

- What financial help you can get depends on your course, where you live while studying, and your circumstances. Most full-time students can get a tuition fee loan to cover the full tuition fees and a maintenance loan to cover the cost of living expenses.

- Doorstep loans – Home credit, or doorstep loans, is where you borrow money, and the lender calls your home to collect the repayments. The loans are usually for smaller amounts, and you will be charged a high interest rate for borrowing in this way.

- Credit union loans – A credit union is a self-help cooperative whose members pool their savings to provide each other with credit at a low-interest rate. To be part of a credit union, you must share a common bond with other members.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What can the loan provider do if I don’t pay for my loan?

If you don’t repay a loan, the lender can take action to recover the money owed, forcing you to face the consequences of loan default. How they do this depends on whether you have a secured or unsecured loan.

It’s easier for the lender to recover the money on an unpaid secured loan, but unsecured loan debts can also be recovered through a different process.

What type of debt is a loan?

Unsecured personal loans are non-priority debts, but secured loans against your home – such as a mortgage or home equity loan – are priority debts.

What does this mean?

If you have to make a decision about which of your debts to repay because you cannot afford to repay them all, you must repay priority debts first. Examples include secured loans, council tax, court fines, etc. There is more information to help you with understanding priority debts here.

You should only make monthly payments on non-priority debts, including unsecured personal loans if you can keep up with your priority debts. If you are not managing your debts, it could be time to get professional debt advice.

More on Loan Lenders

MoneyNerd has already taken a long hard look at some of the UK’s most popular loan providers. You can read our findings on different personal loan companies with us and read various loan provider reviews. This will help you with comparing loan companies and choosing a reputable loan lender.

- Good News for Morses Club Loan Holders

- Morses Club in Administration – What does this mean for you?

- What is an Example of an Unsecured Loan? Borrowing Explained

- Arrangement to Pay on Credit File – Why and How to Remove?

- Will an Arrangement to Pay Affect Mortgage Application?

- Average Personal Loan Interest Rate by Credit Score

- What Are the Rights of a Second Charge Holder?

- Loan Payoff Calculator Free Downloadable Spreadsheet

- Can’t afford my loan payments – What Can You Do

- Can You Write Off Unsecured Loan Debt? Complete Guide

- Unsecured Debt Consolidation Loan In-depth Info

- Get a Refund on Your Loan – Irresponsible Lending Letter Templates

- What Happens When You Default On A Loan?

- Ratesetter Loans (Rate Setter) All You Need to Know

- Amigo Loans Refund, Complaints & Claims

- Provident Loans Refund, Complaints & Claims

- QuickQuid & CashEuroNet Information – Refunds & Updates

- Can’t Pay Back Your Loan – What Can You Do?

- Reduce Your Monthly Loan Repayments – Here’s How

- Making Extra Loan Repayments – The Pros and Cons

- Loan Temporary Repayment Plan – What You Need to Know

What happens if you can’t repay a loan for a single instalment?

If you can’t pay a single monthly payment towards your loan, it’s best to inform the loan provider in advance. They might give you a payment holiday, or you could arrange a temporary repayment plan to catch up over the following repayments.

If you miss a loan payment but don’t contact your lender in advance, they will likely ask you to pay immediately. They could also add a missed payment fee to your loan debt. You could still call them to arrange a repayment plan.

How will missing loan payments affect my credit record?

Many borrowers quite rightly worry about the credit impact of missed loan payments. Your loan provider can report a missed payment to credit reference agencies, which will be recorded on your credit file and lower your credit score. They can also report reduced monthly repayments if you agree to a temporary repayment plan.

Engaging with credit reporting agencies like Experian, Equifax, and TransUnion allows you to be proactive in managing your financial health. Each agency in the UK may represent your credit slightly differently, but you possess the right to dispute discrepancies. To dispute an error, initiate a detailed report to the respective agency, providing all relevant documents and ensuring that corrections are reflected in future reports.

» TAKE ACTION NOW: Fill out the short debt form

How long will late payments stay on my credit report?

Missed payments will be recorded on your credit file for six years. They’re automatically deleted from your credit report after six years, which is when you will need to spend time repairing credit after missed payments.

What happens to my loan if I am months in arrears?

If you miss three months of loan repayment, the loan company could decide that you have defaulted. The lender will give you a final chance to catch up with missed payments by sending you a default notice and late loan repayment options.

Prevention is the cornerstone of prudent financial management. Establishing automated payments ensures timely repayment, precluding inadvertent defaults. Proactively communicating with your lender when you foresee financial turbulence, exploring refinancing options, or negotiating revised payment terms can be pivotal in maintaining a healthy financial profile and avoiding default.

What’s a default notice?

A default notice is a letter sent in the post to let you know that your loan will default if you don’t catch up with repayments. You’re usually given two weeks to catch up; otherwise, the loan will default.

The default notice should include bold text telling you to read the letter carefully and the phrase “Default Notice Served Under Section 87(1) Consumer Credit Act 1974”.

A loan default will be recorded on your credit report and cause serious damage to your credit score, making it difficult to be approved for further credit in the future.

Could I be taken to court if I can’t repay a loan?

If you have defaulted on an unsecured loan, the lender will take further action to recover the debt, which may involve being taken to court and legal actions for loan defaults. The lender will apply to the court for a court order to make you pay the money owed. This order is called a County Court Judgment.

Before it reaches this stage, the loan provider might employ a debt collection agency to chase you for the money.

If you’re eventually subject to a court order to pay, you’ll need to pay off the debt or come to an agreement to pay the debt off through monthly instalments. Further fees will be added to the debt if litigation is required to make you pay.

What happens if I can’t repay my loan?

If you’re subject to a court order to pay your personal loan debt but simply cannot repay the loan due to financial difficulty, the lender can look to enforce the debt in other ways. This may involve dealing with loan enforcement.

The loan provider can also consider further action if you agree on a payment plan after the court order and miss one payment.

A judge can give permission for the lender to use other options after a court order, including:

- Using bailiffs to come to your home

- Using an Attachment of Earnings Order, which is when money is taken from your employment income or state benefits

- Using a Charging Order, which is a charge placed on a property you own, stopping you from selling the property without repaying the debt

Could you lose your belongings if you can’t repay a loan?

If the lender is given a warrant to use enforcement agents (bailiffs!), the bailiffs can come to your home to ask for payment. If you cannot pay, the bailiffs could decide to seize possession of belongings to be sold, and the money raised is then used to clear the debt.

The rules on what bailiffs can and cannot do, especially when it comes to loan default and asset seizure, are complex. We have discussed these rules and what to expect in detail in our dedicated bailiff guide. You can find this guide on our debt information page.

Can a lender force someone else to pay my debt for me?

No, only those who took out the loan can be forced to pay their debt and have responsibility for loan debts. Friends and family are never responsible for paying the debt. However, they can offer to pay the debt for you if they wish, but they will not have to accept loan debt liability.

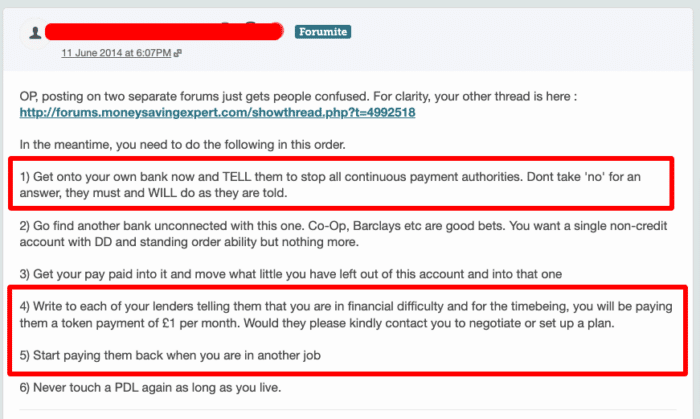

It is important to remember that if you have a joint loan with a partner, you are both liable to pay 100% of the loan – don’t get caught out like the below forum user.

The only exception is if you pass away. In this case, the executor of your will may have to repay debts from the money you left behind – if possible.

In the UK, consumers are shielded against aggressive debt collection practices under The Consumer Credit Act and The Financial Conduct Authority’s (FCA) guidelines. Lenders are restrained from using oppressive tactics and should be lenient, especially amid financial hardship. Understanding your legal rights and obligations in the context of UK debt laws empowers you to deal with debt issues and financial problems.

What happens if I have a secured loan?

If you default on a secured loan, the process is different. The secured loan company doesn’t need to get a court order to make you pay. They can instead force the sale of the asset you used as security within the credit agreement.

For example, your mortgage provider can repossess your home and sell it to clear the debt. Lenders face less risk when offering secured loans because the debt is easier to recover, which is also why secured loans can be bigger with more competitive interest rates.

How can I find money to help repay my loan?

You might not be able to get extra money or financial assistance for loan repayment, but always check to see if you’re entitled to any other state benefits which might improve your finances and ability to pay off the loan quicker.

The only other way to find money to pay off a loan is to borrow more money from another lender. This could be part of a debt consolidation strategy.

What is loan debt consolidation?

Loan debt consolidation is when you take out new credit large enough to pay off multiple loans.

You do this to consolidate all your debt into one place, making monthly payments easier to manage. But you should also do this while securing a lower interest rate on the new credit, saving you some money each month.

Loan consolidation is best used as an early debt mitigation strategy and there can be some benefits of debt consolidation. It’s not ideal if you already have significant arrears. You can achieve debt consolidation using different forms of credit. There are even unsecured debt consolidation loans offered specifically for this reason.

What help can you get if you can’t meet loan repayments?

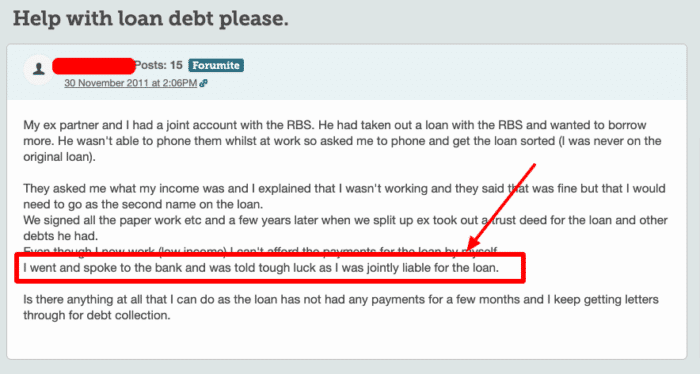

Help and support are available for people struggling to meet loan repayments. Debtors can speak to a UK debt charity like StepChange or National Debtline to get free debt advice on how to deal with their loans.

The free advice takes into account your personal circumstances. The charity could recommend one of many different debt solutions to help you get out of the loan debt. And some will even negotiate with creditors and set the debt solution up on your behalf.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can I get out of debt and repay my loan?

Various debt solutions can help you pay off your loan. Most will reduce your monthly loan payments to make them affordable based on your income and expenses. Some of them will even write off some or all of the loans.

A debt charity could advise that you use:

- The snowball or avalanche method

- Debt consolidation

- A Debt Management Plan

- A Debt Relief Order

- An Individual Voluntary Arrangement

Can I wipe my unpaid loan debt?

Unsecured personal loans can be completely or partly written off using some debt solutions, such as a Debt Relief Order or an Individual Voluntary Arrangement. Loans can also be written off when they become too old to be collected.

After so many years – depending on your location – loan companies can no longer take legal action to recover the unsecured loan debt. Without getting a court order, you’re never forced to repay the loan.

Although this isn’t exactly the same as writing off an unsecured loan, it has the same end result – you don’t have to pay!

Can you get a refund on your loan?

Yes, getting a refund on your loan is possible if the loan was approved when it shouldn’t have been.

Lenders are required by the Financial Conduct Authority (FCA) only to approve loans that are affordable to people. If your loan was approved when it wasn’t affordable, you can request that the loan company refund the loan.

We have made it easier than ever to request a loan refund from your lender. Download our free loan refund letter template to save time and make a formal refund request.

Should you make loan overpayments when possible?

Overpaying on your loan will help you pay your loan off quickly. However, there can be some cons of overpaying, including fees that might be added to your debt for overpaying or paying off the loan early.

This topic has been discussed in more detail in our Making Extra Loan Repayments article.