Where to Get Free Debt Information in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about debt? It’s okay, you’re not alone. Every month, over 170,000 people come to our website for advice on their debt problems. This article is here to help you understand free debt help in the UK. We’ll explain:

- Steps to take if you’re feeling anxious about debt

- Where to find free help and support

- How a debt charity might be able to assist you

- If it’s possible to write off some debt

- What to remember when looking for free debt advice

Our team understands what it’s like to feel overwhelmed by debt. We know how hard it can be to figure out what to do next. But don’t worry, there’s always a way forward. Let’s explore the world of debt management together.

Where can I Get Free Help And Support?

When looking for debt advice, it’s crucial that you seek it from an agency that does not charge you for their services.

Many private debt advisers and debt management companies will charge you for their debt advice. It’s obviously not a good idea to rack up debt advice fees when you’re already struggling to make your debt repayments.

This is why I always advise people to seek debt advice from independent debt charities that are operating in the UK.

They have professionals who are sympathetic, understanding and thorough with their approach. Not to mention, they don’t charge you for their services.

Some independent debt charities that you can seek help from include:

What are Some Aspects that a Debt Charity Could Help Me with?

Seeking debt advice can be beneficial for a number of different aspects.

A debt professional will know what approach to take given your unique financial situation.

Not only will they provide you with a quick way of dealing with your debts but it’ll also be an approach that will cost you the least amount of money.

They might turn you onto a debt solution which you may not have been aware of and could be more suitable.

Additionally, they might help you budget in a way so that you wouldn’t even need a solution to take care of your debts.

Other ways in which debt charities can help you include:

- Helping you prioritise your debts. There are many different types of debt and they vary in terms of severity if you were to miss payments to them. This is why it’s important to prioritise payments to your debt(s) in a way so that the one with the direst consequences gets dealt with first.

- Assisting you in creating a budget for your household. Taking control of your finances should be the first step towards your journey to becoming debt-free. You can get free debt advice from a professional about how to organise your budget and stick to it.

- Helping you decide how you’re going to pay off or write off your debt(s). There are several debt solutions available to you in the UK. Thus, making the right choice about which debt solution to go for can decide whether you become debt-free or stay in debt forever. You can get free debt advice about which solution would be most suitable for you.

- Negotiating with creditors on your behalf. Your creditors are the primary source of stress when it comes to debt management and paying back the money you owe. If you choose to enter into a debt solution with the help of a debt charity, they will do the negotiating for you. Once a solution is put in place, you will have little to no interaction with your creditors.

Note that priority debts have more severe consequences if not paid off and can include things like mortgage arrears, council tax debts, or court fines. Non-priority debts include credit card debts or unsecured loan.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Are Some Things I Should Keep in Mind when Seeking Free Debt Advice?

Obtaining debt advice from a debt charity is definitely the way to go.

That being said, there are certainly some things which you should keep in mind during your first meeting with a debt adviser.

These are:

- Always check that the adviser you’re consulting with is qualified to give you the debt advice you need. All financial advisers must have a level 4 (or above) of the National Qualifications and Credit Framework. They also must have a Statement of Professional Standing (SPS) and must be registered with the Financial Conduct Authority (FCA).

- Note down everything you feel that is important that is said during the meeting. This will give you a clear record of everything that was discussed.

- Don’t be afraid to ask a lot of questions. Make sure you understand everything that is being told to you. Ask the adviser to repeat himself or elaborate if you didn’t understand something he/she said to you.

- Take your time. You don’t have to jump into any decision immediately. You can take time to think it over or even consult with another adviser if you want.

- Be mentally prepared to answer questions about yourself honestly. Always remember to be honest about everything the adviser asks you. If you lie about your situation, the adviser may suggest something that isn’t suited to your actual circumstances. As a result of this, you may end up making your finances even worse.

- Ensure that any personal information you provide to the debt advisor is kept confidential and isn’t used for marketing purposes, etc.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Debt Management Plans and Debt Charities

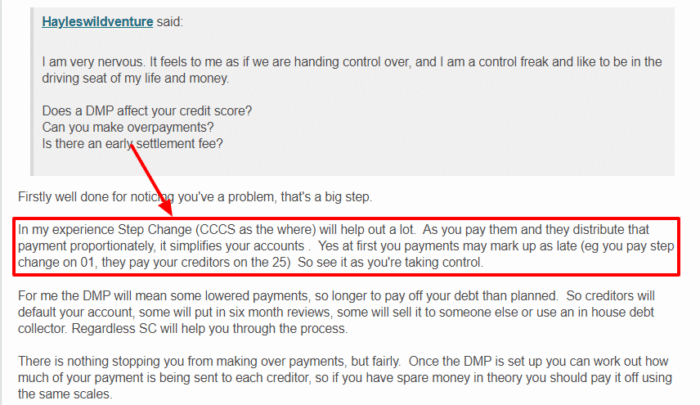

Debt charities such as StepChange Debt Charity and National Debtline can both help you set up a debt management plan for free.

Debt management plans are one of the more flexible debt solutions available in the UK.

A debt management plan would involve you paying back your debt(s) to your creditors in the form of monthly payments until the entirety of it is paid off.

The amount of money you pay as part of your monthly payments will be determined by how much you can afford.

Advisers in debt charities will help you negotiate with your creditor(s) and ensure that you are treated fairly throughout the process.

Once the debt management plan is set up, they will also help you manage it all the way to the end. They will also give you debt advice throughout the process to ensure that the debt solution is a success.