Hoist Finance Debt Collection – Should You Pay? UK Laws

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Update (03/05/2023):

Hoist Finance has now been sold to Lowell Finance, which may mean your debt is now owned by Lowell. I’ve covered what this means for you if Lowell are contacting you about your Hoist debt or if you have any questions about what happens next.

Handling a surprise debt letter from Hoist Finance can be unsettling, but don’t worry, you’re not alone. Every month, over 170,000 individuals visit our website seeking advice on debt matters.

We understand that you might be feeling confused about where the debt has come from and if you should pay it. Luckily, this article is here to help answer your questions about Hoist Finance Debt Collection.

With the help of expert data on Hoist Finance, we’ll explore:

- Who Hoist Finance is, and why you’re receiving letters or calls from them.

- If you should pay the debt and how UK laws affect your decision.

- Ways to potentially write off some of the debt.

- How to contact Hoist Portfolio Holding 2 Limited.

- How to stop Hoist Finance from contacting you.

Remember, we’re here to guide you, offering you the support you need during this time. Let’s navigate this together, starting with getting to know Hoist Finance.

Have You Received a Letter?

Hoist Finance can use a variety of methods to get in touch claiming you have a debt you owe to them – the most common way that Hoist Finance will get in touch is by sending you a letter.

The letter will often be worded in a way to scare you into paying, referencing legal action and penalties. But before you open your wallet, make sure you read the rest of our guide for a way to fight back.

Why am I getting calls and letters?

If Hoist Finance UK has contacted you about your debts, it is because one of your creditors has a past-due account with you. Unpaid debts are frequently passed on to debt collection agencies, which will contact you on their behalf in order to collect payment.

Make Sure they Prove the Debt

When Hoist Finance tell you that you owe a debt, how do you know they are telling the truth and the amount you owe is correct? You don’t.

The only way to know for certain how much you owe is to request proof of the debt. This means sending them back a letter and asking for the proof, such as a signed agreement.

You can do this easily with our prove the debt letter templates!

The biggest advantage of this is if they don’t give you the proof then you do not have to pay until they do. And they are not allowed to ask for payments in the meantime.

» TAKE ACTION NOW: Fill out the short debt form

Can I Ignore It?

Don’t ignore the Hoist Finance debt letter because you can’t afford to pay. Debt solutions are available even for low earners.

If you ignore a Hoist Finance debt letter, they could take the issue to court and get a CCJ for the debt. If that is successful, you will be forced to pay or bailiffs will come to your home to collect a payment.

If you refuse at this point, they can remove goods to pay off the debt.

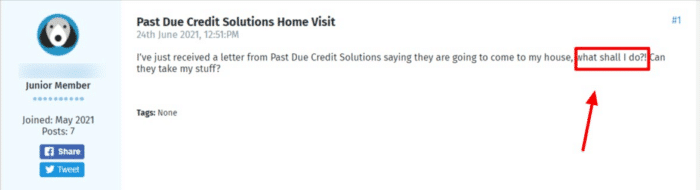

But Hoist aren’t allowed into your home until they have authority from the courts to do so.

Hoist Financial can’t take your belongings unless the courts have said that they can because this person has not keep to the terms of their CCJ. This person should not let Hosit into their property and should request that home visits are stopped immediately.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Available Debt Solutions

So, what happens when Hoist Finance do provide proof? This is the stage when you are going to have to pay.

Hoist Finance and their debt collection agencies try to make it easy for people to pay back over time through repayment plans. This could be an easy way to pay back the debt over time.

But the easy way is not always the best way!

There are other debt solutions available in the UK that may be better for your finances than a Hoist Finance repayment plan.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

UK Personal Debt 2021 Update:

There were 29,291 individual insolvencies in England and Wales in March to May 2021, a fall of 8.6% from 32,047 for the same period in 2020.

(Source: The Money Charity)

Some Debts Don’t Have to be Paid Back!

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for a while.

Stop Calls, Instantly!

We hear a lot of debtors complain that Hoist Finance keep on calling them and asking for money. Most of the time, this excessive calling is illegal and classed as harassment.

Dealing with debt harassment is stressful. One of the best tricks to make them call less is to provide Hoist Finance with your call preferences, i.e. times and days when you can speak with them.

The other is to make a complaint or threaten a complaint to the Financial Ombudsman.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Do I Complain?

If you think that Hoist Finance has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Filing complaints against debt collectors that break the FCA’s guidelines is quite straightforward.

Make your first complaint to Hoist Finance so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Hoist Finance may be fined. You could even be owed compensation.

Could this be a Scam?

You have every reason to be cautious when you receive a demand for money from a company you’ve never heard of before. Verifying legitimate debt collectors is very important!

You should be informed about the debt and the initial creditor with whom your account was opened. You could also check the company’s legitimacy by looking them up on the FCA registry or the CSA members list.

Hoist Finance Contact Information

| Website: | https://www.hoistfinance.com/ |

| Phone: | +46 (0)8 55 51 77 90 |

| Address: | Bryggargatan 4, 111 21 Stockholm, Sweden |

| Post: | P.O. Box 7848, 103 99 Stockholm, Sweden |

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

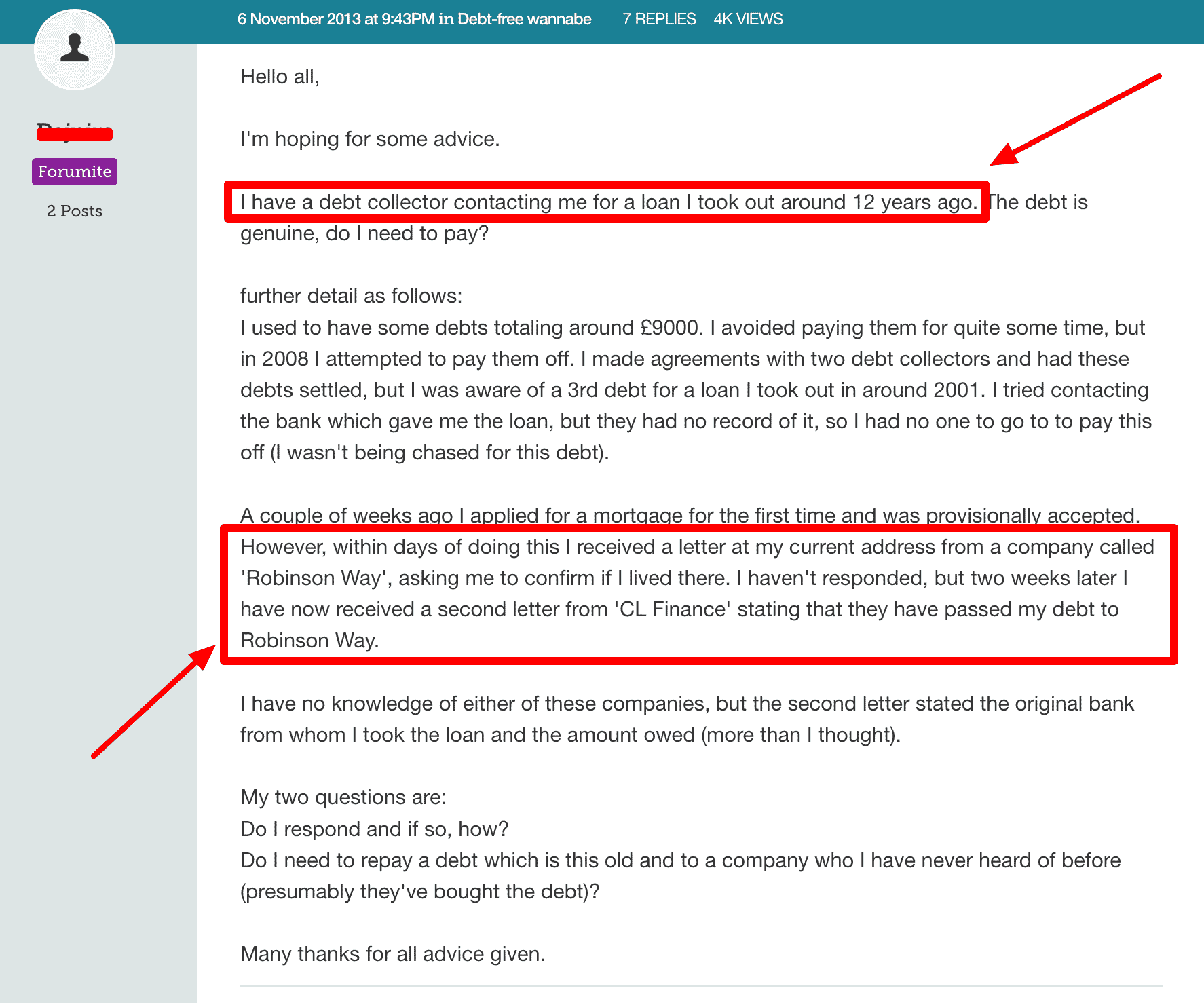

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.