How to Use a Home Equity Loan for Divorce Settlement

Are you wondering how to use a home equity loan for a divorce settlement? You’re not alone! Every month, more than 6,900 people visit this website looking for advice on home equity loans.

In this article, we’ll answer the following questions:

- What are the criteria for a home equity loan?

- What happens to a home equity loan after divorce?

- Should you seek advice before applying for a home equity loan?

- How can you buy your husband out of the house?

We know that understanding home equity loans can be a bit challenging. But don’t worry; we’re here to help you figure things out.

Let’s dive in!

How to save money on divorce fees

How to save money on divorce fees

Divorces are hard to handle, but the financial repercussions can make a bad situation feel even worse.

The solution? Understanding your next steps and exactly how much they’ll cost.

For only £5, JustAnswer offers a trial chat with an experienced divorce solicitor. They can help you navigate the process and save you from costly face-to-face lawyer fees.

Chat below to get started with JustAnswer

What are the criteria for a home equity loan?

You could apply for a home equity loan if you meet the following criteria:

- You own the property

- There is sufficient equity in the property to meet a lender’s criteria

- You have a good credit history

- Your personal finances meet the lender’s criteria

What happens to a home equity loan after divorce?

If you took out a home equity loan jointly with a partner, you’d both be liable for the payments even after you divorce.

Lenders don’t see a divorce as changing any contract you entered into when taking out the loan.

As such, you’d both still be liable for the repayments even after you divorce.

» TAKE ACTION NOW: Get legal support from JustAnswer

Should I seek advice before applying for a home equity loan?

Yes. It’s always worth seeking expert advice if you’re going through a divorce and need financial advice before taking out a home equity loan.

Plus, a solicitor could offer an idea of the cost of a divorce when you both parties agree on things.

They would also advise against hiding any assets because the consequences could be serious when you do.

A home equity loan is only one solution available, there are others that a financial adviser could go over with you.

Remember, when you take out a home equity loan, the money you receive is secured against your home.

Your home would be at risk if you fail to repay the loan.

Worried About Divorce Finances?

Divorce can be complicated, especially when it comes to navigating the cost. One small error could lead to serious consequences.

But, the support of a good solicitor can help you to understand your next steps.

For a £5 trial, JustAnswer’s online divorce solicitors can help you understand your rights and guide you towards the best financial solution for you.

In partnership with Just Answer.

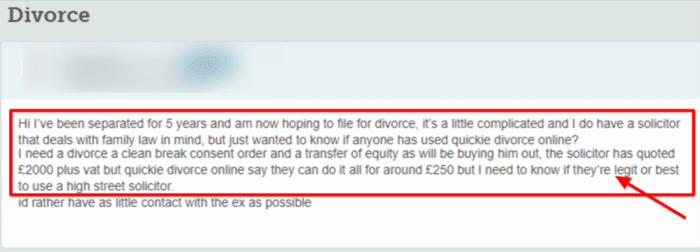

How can I buy my husband out of the house?

You would need to wait till all financial aspects of a divorce are settled before you buy your husband out of a family home. Things need to be officially settled before going down this route.

See the question often asked by people who go through a divorce and want to buy their spouses out.

Source: Moneysavingexpert

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

FAQs

Can I use a home equity loan for divorce settlement?

Yes. You could use a home equity loan for a divorce settlement which could allow you to remain in the property by buying your partner out.

Can I use a home equity loan to pay off divorce?

Yes. As previously mentioned, there are no restrictions on how you use funds you receive from a home equity loan. As such, you can use some or all of a home equity loan during divorce proceedings to pay off your spouse/partner.

Can I use equity release to buy out my partner?

Yes. You can use equity release to buy out your partner when they agree to move out so you can remain in a family home.

Divorce Doesn’t Mean Financial Ruin

Legal advice can make all the difference when navigating the financial aspects of divorce, and affordable help is within reach.

Normally, the cheapest solicitors in the UK will put you back at least £130 per hour.

But, for a £5 trial, a divorce solicitor from JustAnswer can review your situation and provide personalised guidance. It’s a no-brainer!

Try it below.

In partnership with Just Answer.