How to Use Equity Release for a Divorce Settlement

Getting divorced is stressful at the best of times and having to sort out mortgage and living arrangements is never easy.

I look at the various options available and whether releasing equity in your home is the best solution in my post.

How to save money on divorce fees

How to save money on divorce fees

Divorces are hard to handle, but the financial repercussions can make a bad situation feel even worse.

The solution? Understanding your next steps and exactly how much they’ll cost.

For only £5, JustAnswer offers a trial chat with an experienced divorce solicitor. They can help you navigate the process and save you from costly face-to-face lawyer fees.

Chat below to get started with JustAnswer

Equity release divorce settlement option

An equity release arrangement could allow one divorcing party to remain in a marital home.

In short, once a transfer of ownership is complete, they become the sole owner of the home.

It can also provide funds to pay for a new property to live in for the party who leaves the home.

How do I take the equity out of my house in a divorce?

Most people opt for a lifetime mortgage when they want to release equity from a home they own.

In effect, you take out a loan that’s secured against a property you own. However, you don’t have to make any monthly repayments.

As previously mentioned, you can choose to take a lump sum or you can opt for a regular stream income over a set period.

Worried About Divorce Finances?

Divorce can be complicated, especially when it comes to navigating the cost. One small error could lead to serious consequences.

But, the support of a good solicitor can help you to understand your next steps.

For a £5 trial, JustAnswer’s online divorce solicitors can help you understand your rights and guide you towards the best financial solution for you.

In partnership with Just Answer.

Can I use equity release to buy out my partner?

Yes. An equity release plan could be used to buy out your partner when you divorce.

In short, some equity release companies will let you use this type of plan to buy your spouse out which allows you to pay them their percentage of equity in the home.

You can use my divorce settlement calculator to see how equity release can affect how your marital assets are divided.

This is a guidance tool only and not an assessment. For accurate divorce settlement assessment, consult a solicitor. Do not rely solely on this calculator’s results.

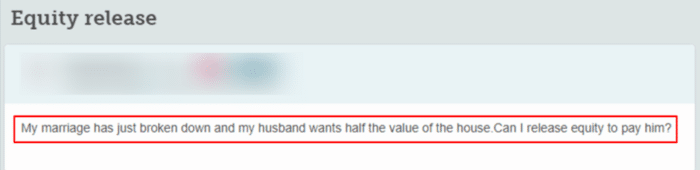

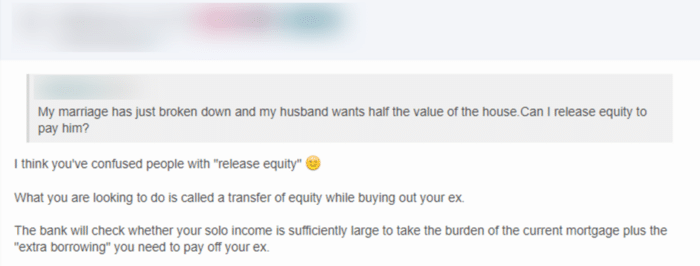

Check out this message and answer posted on a popular forum.

Source: Moneysavingexpert

» TAKE ACTION NOW: Get legal support from JustAnswer

How does the transfer of equity divorce work?

Transfer of equity in a divorce means removing one person’s name from a home’s title deed.

In short, the transfer confirms new ownership of a property in a sole name. It’s a legal step that’s required to legally gain sole ownership of a home.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

Should I get advice before releasing equity in a divorce?

You should always discuss your situation with an independent financial adviser before committing to any sort of equity release arrangement.

This is especially true when you’re going through a divorce. A financial expert could explain the various options which could be better alternatives for your situation.

Divorce Doesn’t Mean Financial Ruin

Legal advice can make all the difference when navigating the financial aspects of divorce, and affordable help is within reach.

Normally, the cheapest solicitors in the UK will put you back at least £130 per hour.

But, for a £5 trial, a divorce solicitor from JustAnswer can review your situation and provide personalised guidance. It’s a no-brainer!

Try it below.

In partnership with Just Answer.