How to Get a Home Equity Loan During Divorce & Separation

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you wondering how to get a home equity loan during a divorce? You’re not alone in this. In fact, our website is visited each month by more than 6,900 people who are struggling with similar issues.

In this easy-to-read guide, we’ll address the following questions:

- Is a home equity loan during a divorce an option?

- What happens to home equity in a divorce?

- What is a consent order for the transfer of equity?

- What happens to home equity after a divorce?

- Can you use a home equity loan to pay off a divorce?

Trying to understand home equity loans during a divorce can be hard. We know how you feel and are here to help you figure things out.

Is a home equity loan during divorce an option?

You could release some equity on a jointly owned property via a “home equity loan divorce settlement arrangement’.

It means you can continue living in the home by becoming the sole owner while at the same time paying your ex-partner their share.

It could allow them to put money towards a new home or purchase another property outright.

It’s also worth noting that the party who moves out, can also apply for an equity release arrangement.

The funds could help them meet any shortfall between the funds released from the jointly owned property to pay towards a new home.

In short, both you and your ex-partner get to retain their homeowner status after the divorce.

The most popular equity release arrangement is known as a lifetime mortgage.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

What happens to home equity in divorce?

As a jointly owned property is the largest asset in the majority of divorces, it would typically involve a transfer of equity when one person moves out.

Removing a person from the title deeds is a critical step in any divorce.

That said, some couples who divorce or separate may choose to sell a jointly owned property before they divorce or separate.

But if you want to remain in the property, you’d need to remove your partner from the title deeds.

It involves a transfer of ownership to the one person who wants to remain living in the property.

According to property law, equity is the value of a property you own and a transfer of equity is a legal process that ensures sole ownership.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What is a consent order for transfer of equity?

A Court issues a Consent Order as part of your divorce proceedings which transfers a property into sole ownership.

Very often, a Consent Order means the transfer should happen within a specific timeframe.

Most experts advise waiting for the Court Order to be issued before arranging a transfer of equity just in case a District Judge won’t agree to the Order.

It could result in a transfer reversal should this happen.

Moreover, there are some other approvals and check you should do beforehand which include:

- Securing a mortgage

- Making sure you have all the property deed information

What happens to home equity after a divorce?

A court would typically consider a 50/50 split of all matrimonial assets which includes the equity held in a jointly owned property.

However, it’s not set in law and the split could vary depending on several factors.

Home equity loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Can I use a home equity loan to pay off divorce?

As mentioned, yes, you can use the funds to pay off a divorced partner if selling a property isn’t an option.

In short, you could tap into the equity held in your property to pay an ex-partner their share of the asset.

However, before choosing this route, you may want to seek advice from a financial adviser.

They could also propose other options which may be better alternatives to taking out a home equity loan.

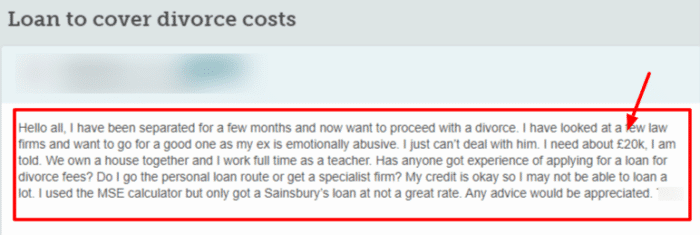

Divorces are often stressful with one party not playing ball as described in the message posted on a popular forum below:

Source: Moneysavingexpert