How Do Debt Collectors Find You in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering how debt collectors find people in the UK? You’ve come to the right place for answers. Each month, over 170,000 people visit our site seeking advice on money problems.

In this easy guide, we will help you to understand:

- How debt collectors find people in the UK.

- What happens if they find you.

- How they can find out where you live.

- If you can write off some of your debt.

Unfortunately, nearly half of the people who deal with debt collection agencies have experienced harassment or aggression1. Some of us have been there.

We know it can be scary, but we’re here to help you.

How Can They Locate Me?

Debt collection agencies buy billions of debt annually at rock bottom prices, at an average of 10p to £1! 2.

So, debt collectors contact you to request payment for the debt they have bought from a creditor or for the debt they are chasing on behalf of someone else (for a commission).

They can often do this by looking at your debt.

For example, if you have an unpaid electric bill that has escalated into debt, they can simply look at the address where the electric bill is registered.

But you may have moved from this address since the debt collection agency started tracking you down. If they can’t find you at that address, they may start using public databases to see where you moved to.

They could even try to access your credit report to give an indication of your location, but sometimes they don’t do this as it can be costly if they have to keep doing it for lots of untraceable debtors.

Typical Collection Process

Once the debt collectors have found you, they’ll call or send letters requesting payment. This is part of the first stage of the debt collection process.

We’ve put together this table to help you better understand the key stages and actions involved in the debt collector timeline. If you’d like to learn more, please read our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Remember, one of the easiest ways to stop debt collection agencies from contacting you is by talking to them and offering to pay what you can.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Are Some Ways They Can Track You?

Before we get started, we must state that running away from your debts is never a good idea.

We’re putting together this post in order to inform you about the techniques through which debt collection agents can find you, but we do not condone using this information to hide from them.

Not only does hiding from your creditors give them cause to sue you in the high court, but it also won’t make your debt go away.

If anything, your creditors will keep adding interest onto the debt and it will keep increasing. You’ll be in an even worse situation than what you started with.

That being said, here are some ways through which a debt collector can find you:

» TAKE ACTION NOW: Fill out the short debt form

Your Creditor

In most common cases, your creditor is the one who has hired the debt collection agency in the first place to collect what you owe to them.

If that is the case, the agency will definitely get most of its information about you from your creditor.

This will most likely include different types of contact information as well as financial information regarding your debt.

Your Credit Report

Your credit report is not something that anyone can view.

It’s not something that’s available to the general public and it won’t show up as a result of a search engine search.

However, certain organisations and agencies are definitely allowed to look up your credit report in order to collect information about you.

As it turns out, debt collection agencies fall under one of the organisations that are allowed to look up your information via your credit report.

This is a very useful resource for them because not only will they get your contact information such as your phone number but they will also get a lot of financial information about you that would be relevant to their goals.

Your credit report contains information about all debts you’ve had in the past six years as well as your performance in regards to paying those debts back.

Data Brokers

Data brokers are people that collect information about people to later sell it to agencies.

If you’ve ever filled a survey online or checked a license agreement on a piece of software, etc. then there’s a chance you may have agreed to have your data collected such as your contact information.

This information would later be sold to interested parties such as a debt collection agency.

Government Agencies

While most of your personal information is protected under privacy laws, there can certainly be occasions where a collection agency may be able to find you by inquiring about your information from a government agency.

Skip Tracers

Skip tracers are professionals who are hired by organisations in order to trace people that they have been unable to locate.

Skip tracers are typically hired in order to locate individuals whose contact information on public records is not accurate anymore. These people employ a number of different techniques in order to locate you.

For example, if your debt was related to your car, then a simple inquiry with the DVLA would be enough to get your contact information.

They’d just have to look up your registered address in correlation to the index number of your car.

An inquiry like this typically costs £20. If you’re still the owner of the car and residing at the same address that you registered with, the skip tracer would locate you immediately.

If you’ve sold the car to someone else, the skip tracer might contact them and inquire about the whereabouts of the person who sold them the car, i.e., you.

Pretexters

Pretexters are individuals who get your information illegally under false pretences. These individuals normally work alone and collect your information for their own personal gains.

However, there have been cases where these individuals have been hired by agents who are trying to collect debt in order to get information about the debtor.

These people normally operate by calling you and posing to be a legitimate business. They may be able to elicit basic personal information from you under this guise.

Once they have ample information, they will contact your financial institution and pretend to be you in order to get your financial information. As you can probably imagine, this is a serious offence and of course, illegal in the UK.

If you suspect that a debt collections agent got your information through the use of a pretexter, you have every right to sue them in court.

Keep in mind, however, that for this, you’re going to need ample, concrete evidence.

How Likely Is It That They Will Discover Your Location?

In short, likely.

As you’ve seen above, debt collection agencies and creditors have a huge number of tools at their disposal that they can use in order to locate where you are.

The world is becoming increasingly connected and it will be hard for you to live a normal life if you’re trying to “stay off the grid”. You can try but it will lead to a severely decreased quality of life and there’s no guarantee that they won’t locate you anyway.

Here are some things to consider before you take this step:

- An increasing number of types of payments are now being included in your credit report. It’s quite common now for utility bills to be included.

Agencies such as Experian are expanding their system to include rent payments as well. Thus, if you decide to move, you’ll be very easy to locate by your creditors since your utility and rent payments will show up on your credit report.

- It will be extremely hard for you to get any place to rent if you do not appear to have a credit report.

- If you change your job, employers will most definitely need to see identification in most cases. The only way for you to not show up in an online system would be if your employer were to pay you in cash.

You can definitely request your employer to do this but it would be an extremely bad idea. There’s a chance you may end up being paid less than the minimum wage and there would be no way for you to prove it.

- To get any type of benefits, you would need a bank account into which these benefits would be deposited. However, it would be near impossible to open a bank account without any proof of identity or relevant documentation.

Running away from your debts is never a good idea. It will only lead to your debts increasing as well as, possibly, court action.

If you are struggling with your debts, then we suggest that you contact an independent charity such as the StepChange Debt Charity or Payplan. They’re doing a wonderful job of providing debtors with the proper guidance they need in order to get themselves out of debt.

They will discuss your situation with you in detail and provide you with the advice you need in order to set up a viable debt solution with your creditor.

Also, since they are a charity, they provide this service free of charge.

Always remember that being unable to pay a debt is not a criminal offence. You will never be forced to pay more than you can afford as long as you cooperate and follow the correct procedure.

There are several laws and practices in place in the UK that protect you, the debtor, during the debt collections process.

As long as you are aware of these guidelines and practices, you will be able to navigate yourself out of debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can You Go Abroad to Avoid It?

If you go and live abroad to avoid debt collectors in the UK, you do increase your chances of remaining undetected.

But again, this is not a sensible option.

For one, going abroad to live is not so easy in light of Brexit, and even if you did, trying to earn a living abroad without fluency in another language may be tough.

You may not have a better quality of life abroad compared to paying back your debts in the UK. Naturally, this will depend on personal circumstances and skills.

Moreover, going abroad is not bulletproof in stopping your debts from following you.

Some debt collectors will sell debts to international companies.

For example, if you immigrate to Australia with a debt in the UK, that debt could be sold to debt collection groups in Australia – and the nightmare continues.

Do They Struggle to Find Debtors?

Yes, it is not easy trying to locate one person in a population of over 65 million.

People change address frequently and even change their names. Therefore, debt collection agencies have a difficult job trying to find people.

Some people with debt do not have a lot of financial commitments. They may not have records to trace if they don’t pay household bills or are couch surfing.

What Are the Consequences?

The consequence is that debt collection agencies use a technique known as the scatter-gun approach.

This is where they send a debt letter requesting payment from the person they are looking for at all possible addresses where they may be. This is a cheap way of trying to locate the right person, hoping they will reply via letter or phone and maybe even make a payment.

The other consequence is that lots of innocent people who do not owe the debt also get contacted.

These letters can be threatening and cause a lot of anxiety and stress to people who are not responsible for the debt.

What If Your Debt Already Has a CCJ?

If your debt already has a CCJ and is legally enforceable, you will have been requested by the courts to make repayments to the creditor.

If you try to go hiding at this point, the creditor can then choose to take enforceable action by employing a bailiff to come to your home.

But what if they don’t know where you live and you have gone hiding? Well, there is something the creditor can do.

They can make a request for you to go back to court and face a judge.

The purpose of this is to get information about any assets you have before deciding whether to employ bailiffs. The process is known as an ‘Order to Obtain’ because the creditor is wanting to obtain information about your circumstances.

You will then be responsible for disclosing your information to a judge, including your whereabouts.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

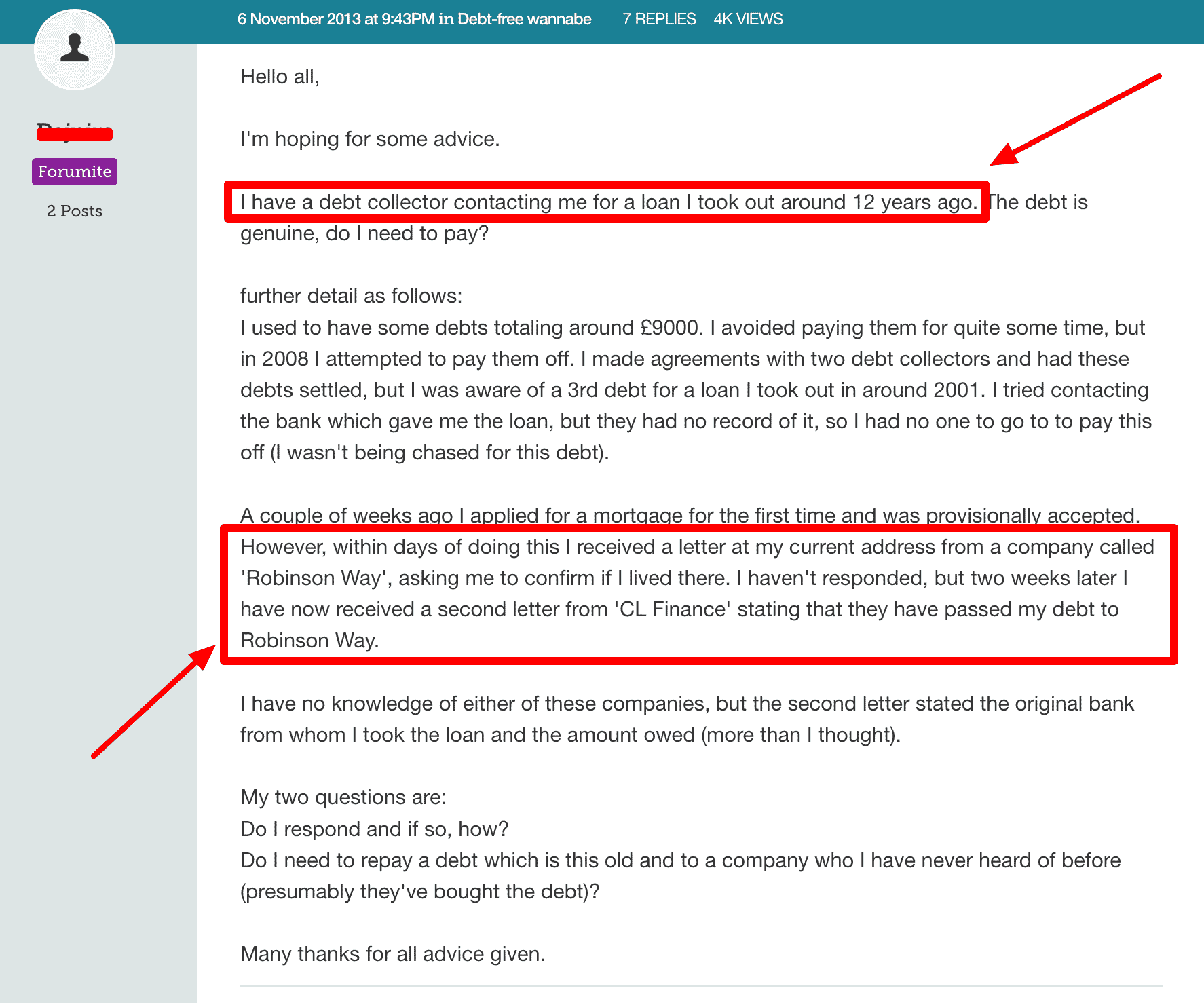

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.