How to Get a Secured Loan – Step-by-Step guide

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Have you been wondering how to get a secured loan in the UK? You’re not alone! Every month, more than 6,900 people visit this website seeking advice on similar matters.

In this easy-to-understand guide, we’ll address the following questions:

- How do secured loans work?

- How to get out of a secured loan?

- What happens if you default on a secured loan?

- What happens if you can’t pay your secured loan?

- Can a secured loan be written off?

- Can you include your secured loan in a debt management plan?

We’ve been in your shoes and understand your worries. This guide aims to help you make sense of secured loans, so you can make an informed decision.

Ready to learn more about secured loans? Let’s get started!

What do you need for a secured loan?

To be approved for a secured loan, you must first meet the eligibility criteria to apply. Each lender will have their own criteria, but most usually ask you to be of a certain age, have a certain asset you are willing to use as collateral and be a UK tax resident. You may also have to take out a minimum loan amount. You shouldn’t overborrow without good reason.

What does a secure loan require?

A secured loan requires you to be prepared to use an asset as collateral. Therefore, you must own the asset in your name and be willing to have it repossessed and sold if you cannot pay the loan back. Most loans of this kind allow you to use property, home equity or vehicles as security. Some other loan providers may allow you to use other assets.

But it’s not just about having an asset. Your application will be subject to an affordability check where the lender calculates how much of your income is needed to pay back the loan and any other debts.

If they believe you would need to use too much of your income on all debts and therefore make essential living expenses difficult, you will be rejected. All applicants’ credit files will be checked to see how finances have been managed in the past.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

How to get a secured loan in the UK

As mentioned previously, you can get a secured loan in the UK from high-street banks, which are advertised on their websites. You can also search for these loans online and find an array of lenders offering these loans.

In general, but not exclusively, the higher interest rates are found with online lenders compared to banks, but they may be easier to get approved for.

You should also be aware that some supermarkets and even the UK Post Office offer secured credit. These loan providers can offer competitive rates. You should always do your own research and engage with a broker if you need support. You may be charged a broker fee or have to pay a commission.

If you decide to look for a loan yourself, then to find the best secured loan for your needs, you should make sure you look at the APRs, read reviews on lenders, and try using comparison tools on financial advice websites.

What documents do I need for a secured loan?

When you apply for secured credit, you will need to provide many documents that prove your identity, your asset and its worth, your income and any existing debts. You may have to provide copies of:

- Your passport and driving license

- Your payslips and employment contract

- Proof of ownership of an asset and proof of its worth (you may need a new appraisal or valuation)

- Proof of your existing debt repayments, possibly existing mortgage payments or the credit agreement for each one

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What credit score do I need to get a secured loan?

Each lender can use its own affordability checks and credit score assessments. Thus, there is no fixed credit score required to get approved across all lenders. To get a competitive interest rate, you’ll need to have a good or excellent credit history. Otherwise, you can expect to pay more interest or be rejected.

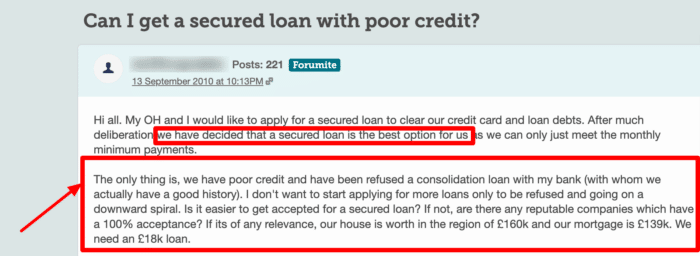

This forum user on MoneySavingExpert is wondering whether it is possible to get a secured loan even with poor credit.

Examples of a secured loan

To illustrate the length and breadth of secured loans, here are some examples:

- Generic secured personal loans – these secured loans use all types of assets as security and can provide a loan amount beyond what is offered through an unsecured loan. The money can be used for any purpose.

- Home equity loans – also known as a homeowner loan or second-charge mortgage, these loans are secured with home equity and can be used for any purpose.

- Secured home improvement loans – usually secured with a property or home equity, these loans are used to make home improvements.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Do banks offer secured loans?

UK banks offer secured loans and usually offer some of the lowest interest rates to people with a good credit score. You can find different types of secured loans through a UK bank.

You don’t have to use a bank to apply for a secured loan; these loans are also offered by online loan providers and some building societies. Whichever lender you consider, make sure they are legitimate and legal. To be a legal lender in the UK, they must be authorised and regulated by the Financial Conduct Authority (FCA).

How to get a loan secured against your house

There are multiple types of secured loans that allow you to use your property or home equity as collateral within the loan agreement, namely home loans, second charges and home equity loans or HELOCs. These types of secured credit can enable homeowners to borrow a significant sum of money that they would not get from any other loan or credit card.

You can work out your home equity by subtracting your remaining mortgage balance from the current market value of your home. Most lenders will allow you to borrow against 80% of your home equity at most. Seek advice before going down this route.

However, you can’t borrow against all of your home equity for your own safety in case the property value decreases over time. The lender’s loan to value ratio (LTV) will explain the maximum you can borrow against it, which at most is usually 80%-85%.