How Long Do You Have to Declare Points For Insurance?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about how long you have to declare points for insurance due to the 2023 laws? You’ve come to the right place for answers. Every month, over 9,300 people visit our site for advice on finding insurance as a convicted driver.

In this article, you’ll learn:

- How long you must tell insurance companies about points on your licence.

- How car insurance is worked out in the UK.

- What to do if you forget to tell your insurance about points.

- How points can change your car insurance cost.

- Ways to find cheaper car insurance even if you have points.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

We understand this can be tough, but don’t worry! There are ways to get affordable insurance.

How long do I have to Declare the Points to Insurance Companies?

It depends on the number of endorsements (penalty points) you have on your licence.

Legally, you only need to declare the points for five years. After this period, insurance companies cannot continue with the increased charges.

However, penalty points can stay on record for anywhere between 4 to 11 years.

The validity of the penalty points is for one year less than the total length of the endorsement.

A 5-year endorsement would be valid for four years. This validity period is taken into account if you re-offend within it.Plus, it leads to a higher level of consequence, leading to paying higher insurance rates for longer.

Both employers and insurance companies can obtain this information for varied periods.

Here is an example.

| Endorsement Details | How Long You Have to Declare Them |

| 4 years in duration | You must declare this for the full 4 years |

| 11 years in duration over 18 years old | Must be declared during the first 5 years |

| 11 years in duration under 18 years old | The first 30 months must be declared |

Do you have to tell insurance about points straight away?

It is recommended that you tell your insurance company about any points you have accrued when you renew your insurance.

The majority of insurance companies do not ask that you tell them about your points when you receive them.

The Terms and Conditions of each insurer do vary.

I strongly advise looking at these details to determine your personal agreement’s answer.

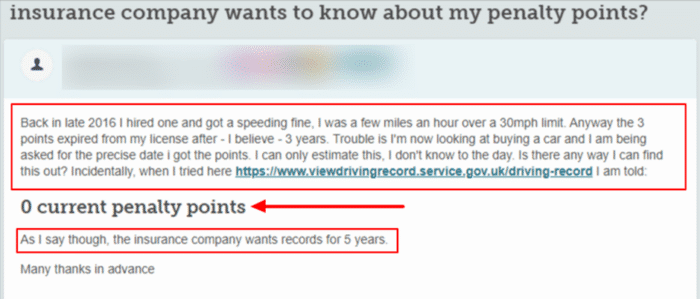

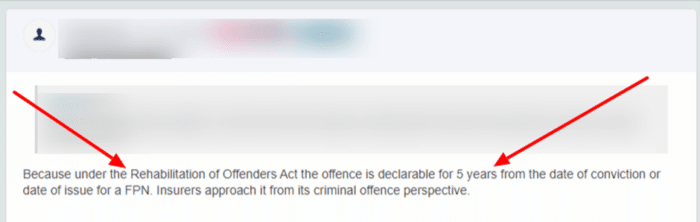

Case study: Insurance wants 5 year record of penalty points

Check out this message posted by a motorist and the reply they received.

Source: Moneysavingexpert

Points expired but not removed

Although penalty points are no longer valid, they remain on your driving licence for another year.

That said, the points don’t count towards a total points tally. But, if you commit another driving offence, the points could be considered.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do I need to tell my insurance company if I get 3 points?

All points you receive through driving convictions must be declared to insurers in the application process.

Any changes to your details that are not on record can invalidate your insurance if it comes to light.

For example, when making a claim.

Do I have to declare an SP30 after 3 years?

Speeding convictions such as this should be declared for 5 years from the incident’s date.

If other offences were committed at the same time, it may increase the duration.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Is it illegal to not declare points?

According to the Road Traffic Act 1998, it is against the law to withhold this information when applying for insurance.

It means that endorsements must be declared during the application process.

That’s the mandatory disclosure period for endorsements.

Suppose you receive the points whilst being insured. In that case, an insurer’s Terms and Conditions will tell you whether non-disclosure will invalidate your insurance.

Do expired points affect insurance?

Expired points only reduce your insurance premium upon renewal.

If the penalty points expire during the period of time that you are insured, no change will take place until the renewal date occurs.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What invalidates your car insurance

Policy breach consequences could see your car insurance annulled.

There is a range of factors that can invalidate your insurance, including:

- Not revealing the truth about the number of penalty points

- Lying about where the car is stored. Saying it is secure in a garage when it is out on the street, for example

- Allowing people to drive your car who are not legally allowed to do so

- Estimating that the number of miles you will do in the year is far below what you end up doing

- Allowing the car to deteriorate below safe levels

Can car insurance companies find out if you are lying?

It depends on the lie, but insurance companies can check what you say using information stored on you from the DVLA.

They could find out if you are lying.

If they find out, it can lead to a range of consequences that will outweigh any short-term benefits.

Some of these consequences include:

- A higher insurance rate, leading to potentially paying more as a result of the lie

- Most lies will invalidate the insurance. They will then be within their rights to cancel your insurance

- If the lie is severe enough, they might take you to court to claim for damage that resulted via the savings you unethically obtained as a result of the withheld information

That said, car insurance providers must respect data protection regulations.