How to Stop a Deduction of Earnings Order

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a Deductions of Earnings Order (DEO)? It’s a way of paying back money you owe from your wages.

You’re not alone. Each month, over 170,000 people visit our website looking for guidance on money problems. We are here to help you understand what a DEO is and what it means for you.

In this guide, we’ll explain:

- What a DEO is and why you might have one.

- How much money can be taken from your pay.

- Steps to take if your DEO isn’t working as it should.

- What happens if you can’t afford to pay.

- Ways to stop a DEO if it’s causing you problems.

We know it’s hard when you’re worried about money; many of us have been in the same place before. We’re here to help you.

Let’s start making things clearer for you.

Can you stop a deduction from earnings order?

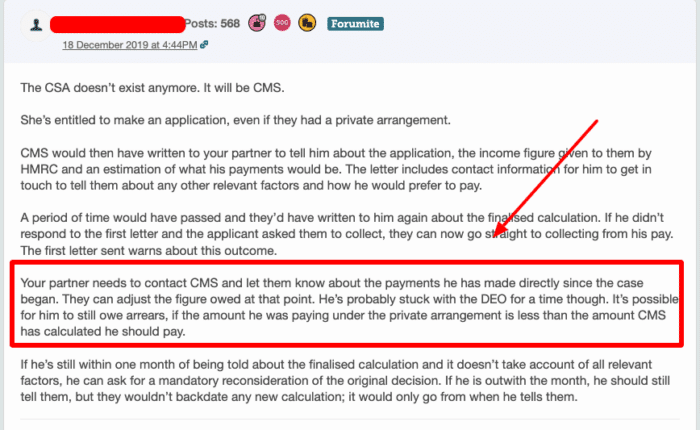

Yes, you can ask CMS for the order to be cancelled if it is not working. You may not be earning enough for it to have an effect. Or you may be able to stop it if you come to a different arrangement to send payments. You’ll have to contact them and outline your case.

The only other way to stop paying towards the deduction of earnings is if the CMS writes to you and informs you that any arrears are being wiped. This will typically happen if:

- The other parent asks for the arrears not to be collected in this direct way

- The other parent dies

- CMS come to this decision for another reason

You then may be able to continue any future payments using another method until you no longer have to make these payments (see below).

How much can be taken out of my wages?

The amount that can be paid from your net wage is the same as what you would be legally required to pay. This depends on several factors, including how much money you earn, how many children are included, how much time you spend with them, or what the AEO (Attachment of Earnings Order) specifies.

It cannot cause you to lose more than 40% of your net income! Although there are fixed rates, there is no one-size-fits-all approach because all factors must be considered together. For a detailed breakdown, consider reading this guide.

Protected earnings rate

Everyone receives a protected earnings rate, a set figure you must receive in your net pay each payday. Your place of work cannot withhold any money below this figure to ensure you have enough for essential living, such as rent and food.

It may be that the full amount owed cannot be deducted because it would send your net pay below the protected rate.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can my employer charge me for the deduction from earnings order?

Technically they can, yes. A further £1 can be deducted from your wage by your employer. This is an administration cost for following their employer obligation and sprocessing the deduction from earnings order. They may or may not choose to deduct this payment. If they do, the cost is nominal.

» TAKE ACTION NOW: Fill out the short debt form

What happens if you can’t afford to pay?

If you can’t afford to pay or pay the full amount from your wages, your place of work is required to record the shortfall each week. They must then try to recover the shortfall in future wage payments. For example, if you were off sick for a period and didn’t receive your usual wage, you may be asked to pay more than usual when you return to work – i.e., your wage returns to normal.

If you cannot pay for consecutive weeks, the courts or the CMS Child Maintenance Service may review what you have been asked to pay. The amount may be reduced.

You should send the CMS Child Maintenance Service details of your income and expenses and explain how much you can afford to pay. Remember that you’ll need to keep paying maintenance at the same time as paying off the arrears in a reasonable time.

You can write to the CMS Child Maintenance Service or call them.

Child Maintenance Service

Child Maintenance Service 21

Mail Handling Site A

Wolverhampton

WV98 2BU

Telephone: 0800 171 2345

Request a reduced amount.

You can successfully request that the amount paid each payday be reduced if it is causing you financial difficulty. If you can prove that the payments are so high that you cannot pay the transport costs to visit the child or any other child you are responsible for; CMS are more likely to agree to a reduced amount.

You must tell CMS if your salary is reduced by 25% or if you have a new child with a partner. These other events could reduce the child support payments taken from your wages. If you don’t tell CMS, they will never know or implement any adjustments.

Further action

If you are still unable to pay, the CMS could ask the courts for a liability order, which is used to enforce the debt with bailiffs who will take control of goods and sell them to pay off what is owed as part of child maintenance enforcment. Or they could force you to sell a property and use some of the money from the sale to clear your arrears.

If these methods are not possible, the CMS may ask the court to either:

- Repossess your driving licence

- Repossess your UK passport

- Send you to prison

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Alternatives to a deduction from earnings order

If you don’t want a deduction from earnings order, you can arrange with the other parent to pay them directly or through the CMS Collect and Pay Service.