Joint Council Tax Debt – Who Is Responsible & Your Options

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When you’re worried about council tax debt, understanding your options can be a big relief. This guide will give you clear, simple answers to your key questions.

Each month, over 170,000 people just like you visit our website seeking advice on their debt worries, so you’re not alone. We’re here to share our knowledge so you can feel more confident about dealing with your debt.

In this guide, we’ll help you understand:

- Who is responsible for council tax debt when two people’s names are on the bill.

- What steps you can take if you can’t pay your council tax.

- What happens if you don’t pay your council tax in seven days.

- How council tax debt can affect your credit score.

- If you can move house when you have council tax arrears.

We understand that dealing with debt can be tough, but you can rest easy now. Together, we can work through your concerns and find a way forward.

Let’s discuss your options.

Joint names on a council tax bill

If two people live in a property and both of them are considered qualifying adults in terms of council tax, the council tax bill will be put in both names.

This may include:

- A married couple living together

- De facto partners living together

- Housemates (full-time students are exempt)

- A homeowner who has accepted a lodger or tenant to occupy part of the property

When does council tax have to be in joint names?

A council tax bill should be put into two names when two adults permanently and habitually reside at the same property.

A standard council tax bill is calculated based on two adults living together, so if two qualifying adults don’t live at the property, the sole bill payer can apply for a single occupier council tax reduction.

There are serious consequences if you claim to live alone at a property to get the council tax reduction but live with another qualifying adult.

Is council tax a joint debt?

Council tax is a joint debt if there are two people named on the council tax bill. If there is just one qualifying adult living in the property, the council tax will be a single debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are you jointly liable for the council tax?

Yes, both people named on a joint council tax bill are jointly and equally responsible for all of the council tax owed.

This doesn’t mean you’re each responsible for 50% of the bill, although this is how you may choose to split it if you don’t have joint finances. Both individuals are responsible for 100% of the bill.

This is comparable to a pair taking out a joint loan. Both people are responsible for repaying all of the loans. You never just have an individual responsibility to pay back just 50% of the loan.

Who is responsible for joint council tax arrears?

Joint council tax arrears are the responsibility of both people named on the council tax bill. As discussed earlier, this doesn’t mean each person is responsible for 50% of the arrears. Both people are considered responsible for all of the council tax debt.

What if one person leaves the property?

Council tax arrears are owed by people regardless of where they now live, so the arrears will still be a joint debt between the people who accumulated the debt.

However, when one person no longer lives at the property they will not be liable for any future council tax payments or arrears accumulated.

The person still living at the property should make the council aware and apply for a single occupier discount to make their future payments cheaper – if applicable.

What happens if you cannot pay your council tax?

If you cannot pay your council tax you will fall into council tax arrears. You’ll need to pay off these arrears as soon as possible while continuing to meet your ongoing payments (to prevent more arrears!).

The council will follow a strict process to collect council tax arrears…

» TAKE ACTION NOW: Fill out the short debt form

Can you move with council tax arrears?

Yes, you could potentially move with council tax arrears because the debt is tied to you rather than a property. You’ll still owe the debt if you move.

Moving property with council tax arrears can be troublesome for a few reasons. These have been discussed in our Moving Home with Council Tax Arrears post.

How many years can a council chase a debt?

A council can only ask for a liability order to force you to pay council tax arrears if the council tax was owed within the previous six years and you haven’t made a payment towards the arrears in that time.

This is known as a statute-barred debt because it’s not legally enforceable. Many debts become statute-barred after six years, but there are some exceptions.

Unfortunately, your local authority is highly unlikely to not take legal action within six years. It’s almost unheard of that a council won’t apply for a liability order as soon as it’s able to, so it’s therefore unlikely that the council tax debt will become too old to be collected.

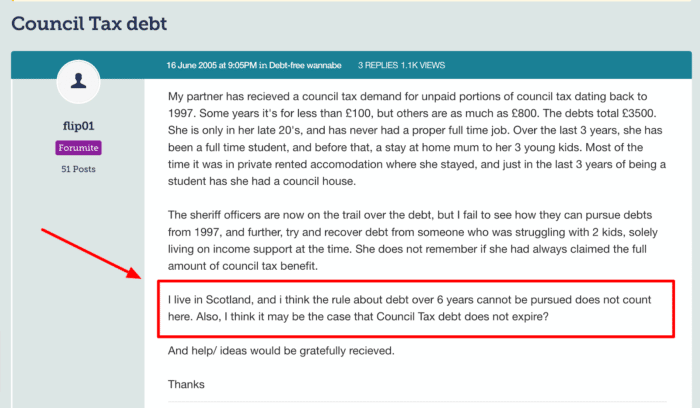

Statute-barred council tax debt in Scotland

Scotland debtors usually face different rules and processes compared to debtors in England, Wales and Northern Ireland.

This is why some people with council tax arrears have asked if the six-year rule also applies to them, just like this forum user asked:

Source: https://forums.moneysavingexpert.com/discussion/64907/council-tax-debt

In Scotland, most debts become statute-barred after five years. And in Scotland, they get written off, whereas in the rest of the UK, they just become legally unenforceable.

But there are some exceptions to the five-year rule, and it just so happens that council tax arrears are one of those exceptions. The forum user is mistaken because council tax debts in Scotland do “expire”, but they only do so after 20 years.

Your Scotland council tax arrears could end up benign too old and be written off, but as 20 years would need to pass with no payment towards the debt or acknowledgement of it, it’s highly unlikely that this would happen.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can council tax debt be written off?

Council tax debt could potentially be written off using the statute-barred loophole (unlikely), but it could also be written off in part or in full through a debt solution.

There are debt solutions you might be able to use that write off council tax arrears at the end of the process.

Debt solutions that could write off council tax debt

Here are some of the debt solutions that could write off some or all of your council tax debt:

- Debt Relief Order

- Individual Voluntary Arrangement

- Bankruptcy

- Scottish debt solution equivalents

For further information on these debt solutions, you can search our own explanation guides or speak with a reputable debt charity like National Debtline or StepChange.

Further help tackling council tax arrears

MoneyNerd has set up a main council tax debt page to help people deal with council tax debts and the process they could be involved in. Head there if you’re struggling with these debts now.

If you are dealing with council tax debts or just struggling to manage your money, I recommend speaking to a debt charity.

There are several charities and organisations in the UK that offer free debt counselling services and free financial advice. Their advisors will be able to walk you through your options and find the best solution for you.