MIL Collections Debt Collectors – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from MIL Collections Debt Collectors and are unsure what to do? This is the right guide to help you navigate through the situation.

Every month, more than 170,000 people turn to our website for advice on matters relating to debt, so you’re not alone.

In this article, we will explore:

- Who MIL Collections Debt Collectors are and who they work for.

- Why they are reaching out to you.

- If they can take your home.

- Whether you can write off some of your debt with MIL Collections.

- The options available if you can’t afford to pay your debt today.

We understand that receiving a letter from a debt collector can be worrying and confusing; in fact, research shows that 64% of UK adults find interactions with current debt collectors stressful1. Some of our team members have experienced this as well, so we know how you feel.

Let’s look into how you can handle this situation with MIL Collections Debt Collectors.

Why Are Mil Collections Debt Collectors Chasing You?

» TAKE ACTION NOW: Fill out the short debt form

Get the Debt Collectors to Prove the Debt

The initial letter you received from Mil Collections stating you need to cough up the money is what the industry classifies as a Letter Before Action (LBA). The letter tells you to pay or there will be a Mil Collections CCJ issued.

This means a court could give enforcement officers the right to repossess your items or even your home.

Sounds scary? It is serious, but these letters are there to scare you into paying, especially if you do not know your legal rights.

A CCJ can only be issued if Mil Collections can prove to you that you owe the debt. So before you go looking for your chequebook, you should be requesting proof of the debt. From our experience, too many people don’t go through the debt verification process and pay a debt that they weren’t necessarily legally obligated to pay.

Proof of the debt is usually an agreement between the company that Mil Collections are working for and yourself, such as a signed utility contract or tenancy contract.

If Mil Collections cannot prove the debt, you won’t have to pay.

Lots of people do not realise this and pay instantly out of fear. But there is a chance that Mil Collections and their client cannot prove the debt because they don’t have significant proof anymore.

How to Write a Prove the Debt Letter?

To make things even easier, prove the debt letters have already been made for you online. You can choose from many effective templates and add some of your personal details to make them relevant to your situation and the LBA from Mil Collections.

Prove the debt letter templates are widely available online.

But if you want to write your own letter, you should remember to include:

Keep a copy of the prove the debt letter just in case you do need to report Mil Collections. If they contact you again without proof, you can report them for harassment to the FCA.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should You Pay or Ignore Them?

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Can Mil Collections Take Your Home?

Mil Collections cannot:

They can pay you a visit, but you don’t have to talk to them if you don’t want to. Only a law enforcement team can carry out repossessions after a CCJ has been issued.

This may only happen if you ignore Mil Collections’ debt letters.

What if you can’t afford to pay?

Threats of CCJs can send you into panic mode if you cannot afford to pay the debt that Mil Collections are asking for. If they have proved the debt to you, there are solutions even if you are unemployed or a low earner.

#1: Agree on a Payment Plan

If you cannot afford to pay the debt, then you can agree on a payment plan with Mil Collections. This is not unusual as most people are not able to pay off unexpected debts out of the blue. Before you negotiate a payment plan, you must first calculate what you can afford to pay each month.

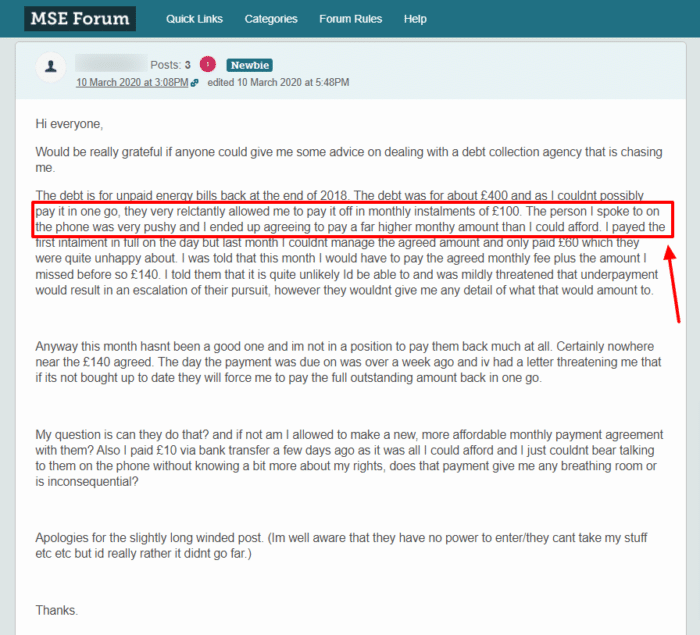

Never commit to an unreasonable and unaffordable payment plan because it can make the debt worse! Take a look at this example.

If you are in a similar situation and feel pressured when speaking to debt collectors or creditors on the phone, you should know that you can request written communication only.

Writing via letter should give you enough breathing space to seriously consider any payment plans and compare them to what you are likely to be able to afford.

We have a number of free letter templates that you can use to guide you through the writing process.

#2: Consider a Debt Solution

If you can’t afford to pay for any of the payment plans that MIL Collections have suggested, you may need to consider a debt solution. We will go through your various options below.

There are several different debt solutions available in the UK, so we recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

You also need to be aware that these debt solutions may have an impact on your credit score and other areas of your life. Speaking to a debt charity will help guarantee that you are as well-informed as possible before starting your debt solution process.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Can You Make a Complaint?

If you think that MIL Collections has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to MIL Collections so that they have the chance to sort out the issue themselves.

If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters. You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, MIL Collections may be fined. You could even be owed compensation.

Know Your Rights

The best way to protect yourself against debt collectors is to know your rights and theirs. Debt collectors are entitled to do certain things, but there are others they can’t do. Please check out our related article on this and take a look at the summarized table below.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |