NewDay Debt Collection – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a surprise letter from NewDay Debt Collection and are unsure about what to do next? Don’t worry; you’re in the right place.

Our website helps over 170,000 people each month to understand and deal with debt situations. You’re not alone, and we’re here to guide you.

This article will provide simple and clear information on:

- Who NewDay Debt Collection is.

- If their claim is lawful and if you must pay.

- How to respond to their letter.

- Ways to handle debt collectors.

- What happens if you ignore their letter.

We know that getting a debt collection letter can be worrying. It can be confusing to understand where the debt came from or if it’s real. You might be wondering how to pay if you can’t afford it. But there’s no need to panic; we have lots of helpful advice and examples to make things easier for you.

Let’s get started.

Why did I get a Letter?

If you have received a letter from NewDay Then it is likely because you have unpaid debts with a company that has hired them out for retrieval purposes. It is the job of NewDay Attempt at getting the money back that companies feel that they are owed by debtors.

You will usually receive some type of communication after one missed payment after multiple it will then be handed off to a debt collection company such as a new day. How long it takes for this debt to be handed over depends on how much you are and for how long you haven’t paid.

How do you respond?

How you choose to respond depends on your personal situation. For some, more research might be the right choice. For others, replying straight away and asking them to prove that the debt is yours might be the way to go. Someone else might decide bankruptcy or an IVA best fit their situation.

The effect bankruptcy has on wages and similar questions might lead some people to look at how they choose to respond initially. If they had that particular resolution fixed in their mind from the offset, then studying what other avenues of exploration might be available that better fit their situation might be prudent.

» TAKE ACTION NOW: Fill out the short debt form

What is a Prove the Debt Letter?

A Prove the debt letter is where you can respond to a communication that you have received from NewDay. This response from you is to ask them to prove that the debt is yours if they cannot do this then you are not inclined to pay.

This is a great step to take if you believe that you were not the person who should be paying. Sometimes, errors do happen, so asking them to produce evidence that you are the one who owes the money allows for certainty about this on all sides.

Should I Pay?

The direct answer to this question is that it depends on your personal circumstances. For example, if you were to look into whether or not an IVA is worth it before paying the requested total, the result might lead to the amount you end up paying to be a different number entirely.

However, someone else might decide to ignore the messages entirely. This might then lead to an escalation to court sooner than it might have been if communication had been open from the start.

You are under no obligation to respond and pay the second that you receive the communication. This means that you have time to look at what options might be available to you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if I Ignore It?

The result might be very similar to the situation that occurred above. It might just spur them into taking action against you in court. NewDay is paid by companies to collect money, so it is in their best interest to get at least something out of you.

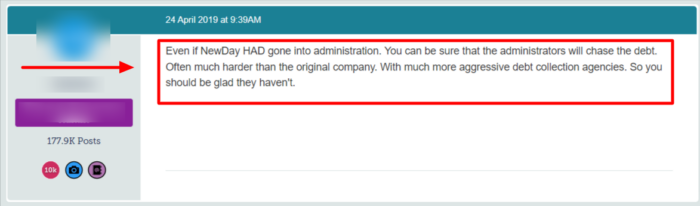

Image src: The Money Saving Expert Forum

If you are giving them nothing at all, by avoiding even talking to them, then they will likely do the only thing they legally can at that stage.

Potentially, if you go ahead and communicate with them that you are willing to negotiate, then at the very least, you are buying yourself some time.

The downside is that you will need to talk with them, which many understandably want to avoid due to the stress of the whole situation.

At this point, you might be wondering if a debt is written off after 6 years. There are various things to consider around this topic. There are some pre-conditions for this to happen, the technical term for this being “Statute Barred”. These include some of the following:

- The debt should be at the very least six years old

- Over that six-year period, no part of the debt should have been paid

- No acknowledgement of the debt should have been put forward during those 6 years

- If the debt was issued to you by a CCJ, then the 6-year rule becomes obsolete

How Long Before a Debt is Unenforceable?

As mentioned above, the two most important factors here are:

- Was the repayment order issued via a CCJ? If so, it is never usually written off.

- Does it meet the three other criteria to become a “Statute Barred” status?

The answer is that it depends on your answer to the above 2 questions. Whilst there is potential for your debt to be written off in those 6 years, there are boxes to tick before it becomes available.

Reviews

This NewDay review listing found on Trustpilot currently rates this company with a 3.5 out of 5. 50% of these are 5-star reviews, and 33% of these are 1-star.

Some of the 1-star reviews are around the lack of customer service over the weekends. As well as their customer service in general. Of course, this is all based on reviews and no data is available to verify this.

One of the 5-star reviews is about the use of NewDay’s credit card. The comment said that they keep it within 25% of its max limit to help increase their credit score.

Why is it on my bank statement?

If you have made a purchase from Amazon, Debenhams, Topman, Burton or a range of other mainstream retailers in the UK, then NewDay is the company that collects and chases up money owed for goods and services that you have purchased from them.

Which bank owns them?

There is no immediate evidence to suggest that NewDay is owned by a bank. However, Wikipedia has an entry explaining that there are two private equity firms that are the primary investment partners of NewDay. Both of which have reps on the “board of directors”

- Cinven

- CVC Capital Partners

Who are Cinven and CVC Capital Partners

These are two of the world’s most prominent private equity firms. They have a combination of over $40 billion in assets, These two organisations acquired NewDay to be a part of their portfolio.

Is Newday part of Amazon?

The Money Saving Expert explains that although NewDay did collect payments for Amazon up until late this year, it has now been announced that they will be ending their partnership together. NewDay was in partnership with Amazon, but was never a part of the company.

Before the partnership officially ends, 800,000 of their cardholders have been told that they can use the card they have up until January 2023. They will automatically be moved over onto the new card named “Pulse”.

What is Pulse?

Pulse is the name of NewDay’s new cashback credit and debit cards. The invite-only Mastercards’ are only available for customers that are already their clients. They will automatically be moved over, as stated above.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are they a UK company?

Yes, NewDay Debt Collection is one of the UK’s leading credit providers for the consumers of many high street brands. The following table lists some of their attributes:

| Approx number of customers | 5.6 million customers |

| The 2 specialist actors that they serve in the UK’s credit market | Co-brands Near-prime |

| NewDays brand statement is | “to help people be better with credit.” |

Are they the same as Aqua?

Aqua is one of the credit cards that the company named NewDay offers to their customers. The Aqua card is designed to be used by those who have bad credit, it currently has a 37.9% APR, so they have offered a higher interest rate for “higher-risk” debtors.

What they consider to be high risk comes from your credit score and your past behaviour. Some of the things they might look at to assess this risk are not limited to the following:

- How many debts you have in total

- How recently you applied for another loan

- How many loan companies have turned you down

- How much you owe, relative to your earnings

- Whether you are a homeowner or have a mortgage

Are Marbles owned by them?

Yes, Marbles is the brand name of one of NewDay’s cards. They offer some credit limit that they state is easy to manage from £250 to £1,200. It has no annual fee and the APR is 34.9%.

They allow you the ability to check your eligibility with an instant response without your credit score being impacted. The downside is that it is likely just an estimate at how likely the acceptance is. They can only go on the limited information provided to them.

Once they have a greater amount of information, the outcome might be different. This final outcome may in turn have a negative effect on your credit rating. This is something you might want to investigate more.

The assistance of a professional will also be of great use to many at this stage too.

Is Bip owned by them?

Yes, Bip is trademarked by NewDay Ltd. More specifically, “NewDay Cards Limited” is the company that has directly trademarked the brand. Only those who are above the age of 18 years old can apply.

Bip is 100% digital and you do not receive a card. From your mobile, you operate within mutually agreed spending limits.

What credit cards are owned by them?

NewDay Limited have a range of branded cards named:

- Aqua

- Marbles

- Opus

- Fluid

- Pulse

Some of these cards, such as the ones for Argos and AO are Buy Now Pay Later. This enables those who are unable to pay upfront to spread the costs.

The interest rates will likely increase the total amount you end up paying. Unless you are with a 0% interest period. This varies from card to card.

How do I make a complaint?

NewDay states that they have a number dedicated to complaints. You can call this department directly on 0333 220 2532.

They are open to calls from 9 am to 7 pm from Monday to Friday.

10 am to 5 pm on Saturdays, and 10 am to 4 pm on Sundays.

If you require additional assistance in the complaints process, there are Debt charities you can approach who might be able to work with you on this.

If you feel like you are being harassed by NewDay Ltd in any way then citizens’ advice has information that might assist you.

You essentially have two main phases you go through when making a complaint. These are:

- Complain directly to NewDay themselves. You can make a complaint in any one of the following ways:

- To complain by phone, call 0330 175 6825

- To complain by Post, send your written letter to: Customer Services Department, NewDay Ltd, PO Box 700, Leeds, LS99 2BD

- You can also complain through your login portal through the messaging section

- If complaining to the company does not resolve your issue, you can take it to the Financial Ombudsman Service, where you can have your complaint looked at by a 3rd party.

- This complaint will need to be made within six months of the final decision letter from NewDay

- You can call them on 8088 0 234 567

- You can write to them at Financial Ombudsman Service, Exchange Tower, London, E14 9SR

- Email them at [email protected]

- Lately, you can visit the Financial Ombudsman Service’s website to get all the details you need to try and reach a resolution.

With the above in mind, knowing that your options are not limited to one might be a comfort. Knowing that you aren’t necessarily trapped is a better place to be.