Phoenix Commercial – Should You Pay Them?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Phoenix Commercial may be asking you for money. You may not know why or if you should pay. Don’t worry, you’re at the right place to find answers. Every month, over 170,000 people come here for help with money worries, just like you.

In this guide, we will help you understand:

- Who is Phoenix Commercial, and why they might be asking you for money.

- How to check if the debt is really yours.

- What can happen if you don’t pay.

- Ways to talk with Phoenix Commercial about your debt.

- How you might be able to write off some of your debt.

We know how hard it can be to deal with debt collectors, as many of us here at MoneyNerd have been in your shoes. We’re here to make things clearer and a little less scary. Read on to find out how you can take control of this situation.

Do You Have To Pay Phoenix Commercial?

The first thing we need to talk about in this section, is whether you are actually in debt. In some circumstances, it could be that you are not liable to pay a debt. For example, if you are under the age of 18, or if you were an additional cardholder on a credit card, but not the signatory of the credit agreement.

Additionally, if there are any irregularities with the original credit agreement, it could be that you are not liable for the debt. Therefore, it may pay you to get some debt counselling and go through the original credit agreement with an expert.

What Happens if You Don’t Settle Your Debt?

Even though most debt is written off after 6 years, it is very unlikely that Phoenix Commerical would let matters go for this long, without taking action to have the debt settled. In general, an escalating series of events will take place, if you just try to ignore the debt. We have listed some below.

- You will be sent letters, demanding payment of the debt. Phoenix Commerical may try to send letters to any address they can find that is associated with you.

- Phone calls will be made by the firm, to try and contact you and arrange for payment of the debt. These calls could be received late at night, as the firm tries to catch you at home.

- If Phoenix Commerical believes it is applicable, you might be visited at home by a debt collection agent. Once again, these visits could come at out-of-hours times, such as in the evening or at weekends to try and catch you at home.

- You may find that you are issued with a default notice. This would become a record on your credit history, and lower your credit store.

- Phoenix Commercial may take legal action, which could result in you facing a County Court Judgement (CCJ), which will stay on your credit report for 6 years.

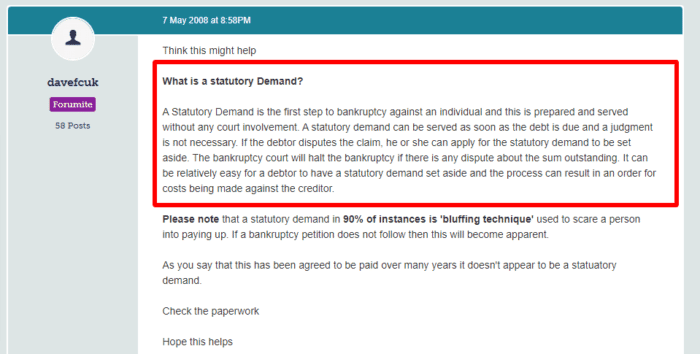

- A statutory demand might be issued for debt over £5000. This is the first stage of the process of attempting to have you declared bankrupt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will You Be Taken to Court by Phoenix Commercial?

Unfortunately, you will likely face some level of legal action if you a) are actually liable for the debt, and b) don’t take any action to resolve the problem. But there is some good news here. Every debt collection company wants to collect the debt in the cheapest way possible, to make the most profit.

This means that as long as you contact Phoenix Commercial and arrange to make regular payments that you can afford, this will generally keep the firm at bay. It will not start legal action against you.

» TAKE ACTION NOW: Fill out the short debt form

Can Phoenix Commercial Have You Declared Bankrupt?

Ultimately, if you don’t do anything and just try and ignore the debt, Phoenix Commerical might aim to have you made bankrupt. This is done to enable the firm to seek settlement of the debt by having it deducted directly from your wages when you are bankrupt.

Obviously, you want to avoid bankruptcy if you can. There are a number of options that you can explore to help in such a situation. For example, an Individual Voluntary Arangment (IVA) could be worth exploring. You definitely should speak to a debt counsellor if you are facing bankrpotcy, to try and find a way to head this off.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Getting in Touch With Phoenix Commercial

CDER Group offers a number of ways to make contact, depending on what kind of debt you wish to settle. However, the easiest way to get in touch with the company is to call the unified enquiry line. This covers all forms of debts and payments. The number is 0330 460 5295 and it is open 24 hours a day.